Latest business news

Aviation boom: Indian budget airlines to expand fleet by 900 aircraft by 2024

Data made available by Union ministry of civil aviation states IndiGo, SpiceJet, GoAir and AirAsia planning massive expansion of fleet

As India’s domestic travel industry looks at a revival, private airline operators are planning to expand their fleet to make the most of this imminent increase in passenger traffic. According to the Union ministry of civil aviation, low cost airlines are planning a huge expansion of their fleet over the next few years, with IndiGo alone expected to purchase 448 new aircraft.

Data made available by the civil aviation ministry to Parliament as part of a Lok Sabha written reply shows that the fleet of India’s private carriers is expected to collectively expand by as many as 900 aircraft in coming years. The expansion of the fleet by low-cost airline operators comes at a time when India is emerging as a fast growing aviation market with Prime Minister Narendra Modi’s government also placing a premium on hitherto non-profitable regional routes through schemes like UDAN.

Besides IndiGo, airline operators like SpiceJet, GoAir and AirAsia are also planning an expansion of their respective fleets.

IndiGo already has an existing fleet of 150 planes which over the next eight years is expected to go up significantly and touch the 600-mark. The low-cost carrier which has emerged as one of the most profit-making private carriers has placed purchase orders of 448 aircraft — 399 A320s and 49 ATRs — which would join its fleet by 2024.

SpiceJet is in the process of expanding its current fleet of 57 aircraft with a purchase order of 107 Boeing 737-800s and another 50 Bombardier Q400s. These purchases are lined up in the 2018-2023 period, according to the ministry.

Budget carrier GoAir, which hasn’t yet started overseas operations, has proposed to expand its presently miniscule fleet of 34 planes by inducting 119 A320 aircraft by 2022. Similarly, AirAsia India would also induct 60 planes in the next five years.

Jet Airways — which already has a robust fleet of 107 aircraft — will add another 81 Boeing 737-8 MAX planes during 2018-2024 period while it has also proposed to buy five B737-800s during the fiscal ending March 2018. Full service carrier Vistara would also induct five aircraft next year.

Disinvestment-bound Air India would induct three B777- 300ER and 16 A320 planes between December this year and March 2019. The heavily-in-debt national carrier has 155 aircraft at present with several of them grounded due to their poor condition.

With Agency Inputs

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

India News22 hours ago

India News22 hours agoLandslide hits Arunachal Pradesh, highway linking Indo-China border affected

-

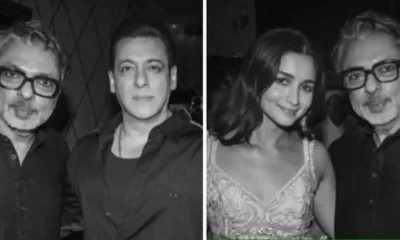

Entertainment21 hours ago

Entertainment21 hours agoBollywood stars Salman Khan, Alia Bhatt, Rekha, Sonakshi Sinha, Aditi Rao Hydari attend Sanjay Leela Bhansali’s Heeramandi premiere

-

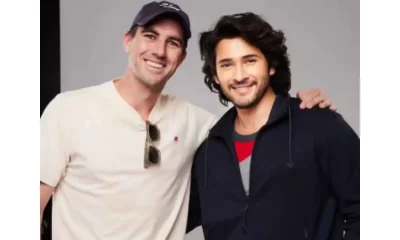

Cricket news15 hours ago

Cricket news15 hours agoTelugu superstar Mahesh Babu meets SRH captain Pat Cummins, says it is an absolute honour

-

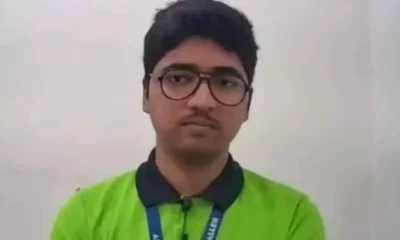

Education20 hours ago

Education20 hours agoFarmer’s son Nilkrishna Gajare Nirmalkumar from Maharashtra scores 100 NTA score in IIT-JEE Mains 2024

-

India News22 hours ago

India News22 hours agoTamannaah Bhatia summoned in illegal IPL streaming app case, to appear before cyber cell on April 29

-

Cricket news22 hours ago

Cricket news22 hours agoIPL 2024: Rishabh Pant, Axar Patel score half centuries as Delhi Capitals beat Gujarat Titans by 4 runs

-

2024 Lok Sabha Elections21 hours ago

2024 Lok Sabha Elections21 hours agoBihar: Election Commission extends voting timings for 4 Lok Sabha seats due to heatwave

-

Entertainment18 hours ago

Entertainment18 hours agoAamir Khan to begin shooting in Delhi for Sitaare Zameen Par next month