India News

PNB fraud: ED expands probe; writes to 16 more banks

If the ED finds out ‘bending of norms’ in cases of other banks, the quantum of losses to banks caused by Modi & Choksi will swell up to nearly Rs 20,000 crore

Expanding its probe in the Rs 11,400-crore Punjab National Bank (PNB) fraud against diamantaires Nirav Modi and Mehul Choksi, the Enforcement Directorate (ED) has now raised questions over the credibility about these public sector banks to keep the public money safe.

Reportedly, the ED has written to 16 banks, other than PNB, seeking information of all loans offered to the two businessmen – including present status of the loans, the form & nature of the loans, and collateral offered against these loans. According to sources, if ED finds out ‘bending of norms’ in cases of other banks too, the quantum of alleged losses caused by them to banks will swell up to nearly Rs 20,000 crore.

Stating that ED Director Karnal Singh has written to the banks for details of the loans, an official said, “We are at present seeking information from banks which have given bigger loans. We have learnt that these loans have been granted at collaterals which are just 12 per cent of the total value of the loans. We want to see on what basis these loans were granted and whether these are still recoverable. However, we have not asked any bank to file a complaint with us.”

Sources have further stated that the CBI and ED probe into the case of fraud – which was perpetrated by Modi and Choksi on PNB – shows that more than two dozen banks may have been exposed to loans ranging between Rs 5,000 crore and Rs 10,000 crore.

While the two prime accused have left the country just before PNB lodged a complaint against them, both Modi and Choksi haven’t yet replied to any official summons – whereas the two defaulters are unlikely to be in a position to pay back the loans, with the authorities having attached their properties.

Earlier on February 16, seeking response within a week on to why their passports should not be impounded or revoked, the Ministry of External Affairs suspended the validity of Modi and Choksi’s passports with immediate effect for a period of four weeks.

According to sources, Mehul Choksi and his companies Geetanjali Gems, Gili India and Nakshatra Brand owed close to Rs 3,000 crore in the form of 37 bank loans till March 31, 2007. On the other hand, the total outstanding loans taken by Nirav Modi’s firms amounts to Rs 3000 crore from 17 banks – Central Bank of India (Rs 194 crore), Dena Bank (Rs 153.25 crore), Vijaya Bank (Rs 150.15 crore), Bank of India (Rs 127 crore), Syndicate Bank (Rs 125 crore), Oriental Bank of Commerce (Rs 120 crore), Union Bank of India (Rs 110 crore), IDBI Bank and Allahabad Bank (Rs 100 crore each).

A former Price Waterhouse Coopers auditor said, “It is perplexing how banks kept advancing loans on such low profits and without probing who these sundry debtors were. It is normal practice to check each and every sundry debtor, particularly in this case where the amounts were so huge, before advancing fresh loans.”

2024 Lok Sabha Elections

Bollywood actor Neha Sharma campaigns for her father Ajit Sharma in Bhagalpur, Bihar

The Bollywood actor posted a video on her Instagram handle which showed her journey through various districts of Bihar, including Kishanganj, Banka, Purnea and Katihar. She was dressed in a traditional salwar kameez and was seen greeting and encouraging the public to cast their votes.

Bollywood actor Neha Sharma’s recent participation in a roadshow in Bihar has taken the internet by storm. Sharma, known for her roles in films like Tum Bin 2 and Crook, was seen supporting her father, Ajit Sharma, who is contesting from Bhagalpur Lok Sabha seat on a Congress ticket. The roadshow came amid speculations that the actor might enter politics. But, it is now clear that she was just campaigning for her father.

The Bollywood actor posted a video on her Instagram handle which showed her journey through various districts of Bihar, including Kishanganj, Banka, Purnea and Katihar. She was dressed in a traditional salwar kameez and was seen greeting and encouraging the public to cast their votes.

The actor received a warm reception and love from a large crowd in Pirpainti and Kahalgaon during her roadshow. She wrote on Instagram that it is said when someone gives one a place in their heart, then they live there forever. She said her heart is full of all the love and support she was receiving from the people. She thanked the people for the warm welcome she got in Pirpainti and Kahalgaon. Aapka pyar sar ankhon par.

Another video, circulating on social media showed the actor actively participating in her father’s election campaign in Bhagalpur. The election to the Bhagalpur Lok Sabha seat is set to take place in the 2nd phase on April 26. Ajit Sharma is representing the Congress and is up against JDU’s Ajay Kumar Mandal in this seat.

Earlier, there had been rumours and speculations that Neha Sharma might join politics. But many reports have clarified that she is not making her political debut yet. The Bollywood actor had been offered the opportunity to join politics by her father Ajjit Sharma but she is currently focusing on her acting career.

Education

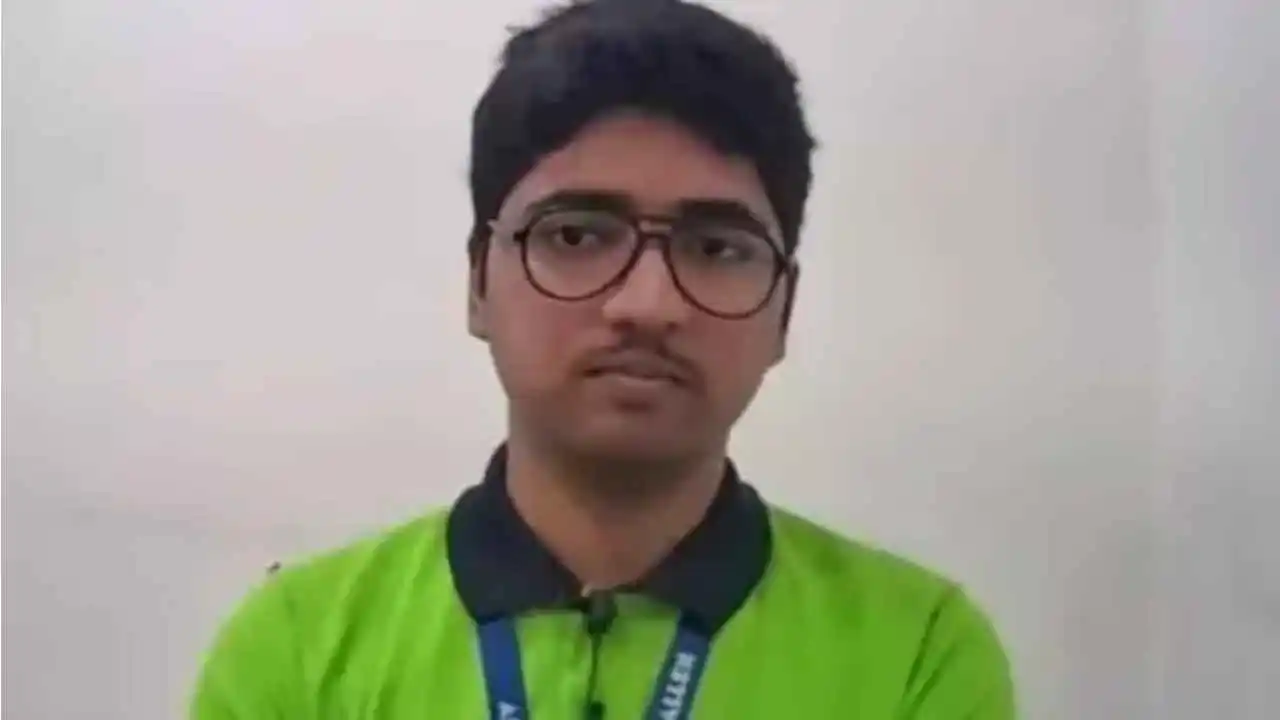

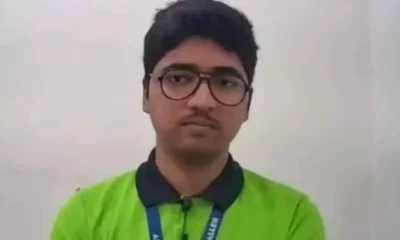

Farmer’s son Nilkrishna Gajare Nirmalkumar from Maharashtra scores 100 NTA score in IIT-JEE Mains 2024

Nilkrishna Gajare’s father is a farmer and had to discontinue his own education after Class 12 as he faced financial difficulties. Gajare faced financial challenges growing up. However, his unwavering dedication and strategic approach to preparation set him apart from the crowd.

Nilkrishna Gajare, who hails from Maharashtra’s Washim, achieved an extraordinary feat by securing a perfect score of 100 in the JEE Main 2024 examination. His journey from humble beginnings to the pinnacle of success is a source of inspiration for many people.

Nilkrishna Gajare’s father is a farmer and had to discontinue his own education after Class 12 as he faced financial difficulties. Gajare faced financial challenges growing up. However, his unwavering dedication and strategic approach to preparation set him apart from the crowd, which resulted in his remarkable achievement of emerging as topper of one of India’s toughest Engineering entrance exams.

Nilkrishna Gajare had a strategic plan that helped him succeed in IIT-JEE 2024. According to Nilkrishna persistence is important and one should never stop trying until they understand a topic. He said being curious and asking questions are important traits of a good student. He said one should not be ashamed of asking questions.

Nilkrishna spent around 10-15 hours every day studying on his own for the JEE Main exam. He mentioned that he used his class notes for Physics and Physical Chemistry. For organic chemistry and inorganic chemistry, he relied on both notes and practice questions.

As for Mathematics, he believed that practicing regularly was the most important thing for him. Other interests of Nilkrishna include archery. He has participated at both state and national levels, and he finds joy in the sport. He said archery helps him understand the importance of focusing his attention on his goals. Nilkrishna likes watching movies and said they are a great source of enjoyment and relaxation.

He likes to watch a movie after exams and occasionally treats himself to one each week too. Gajare aims to keep up the pace for the JEE-Advanced exam and hopes to get into the IITs. He said he wants to secure admission in IIT-Bombay in the computer science branch.

2024 Lok Sabha Elections

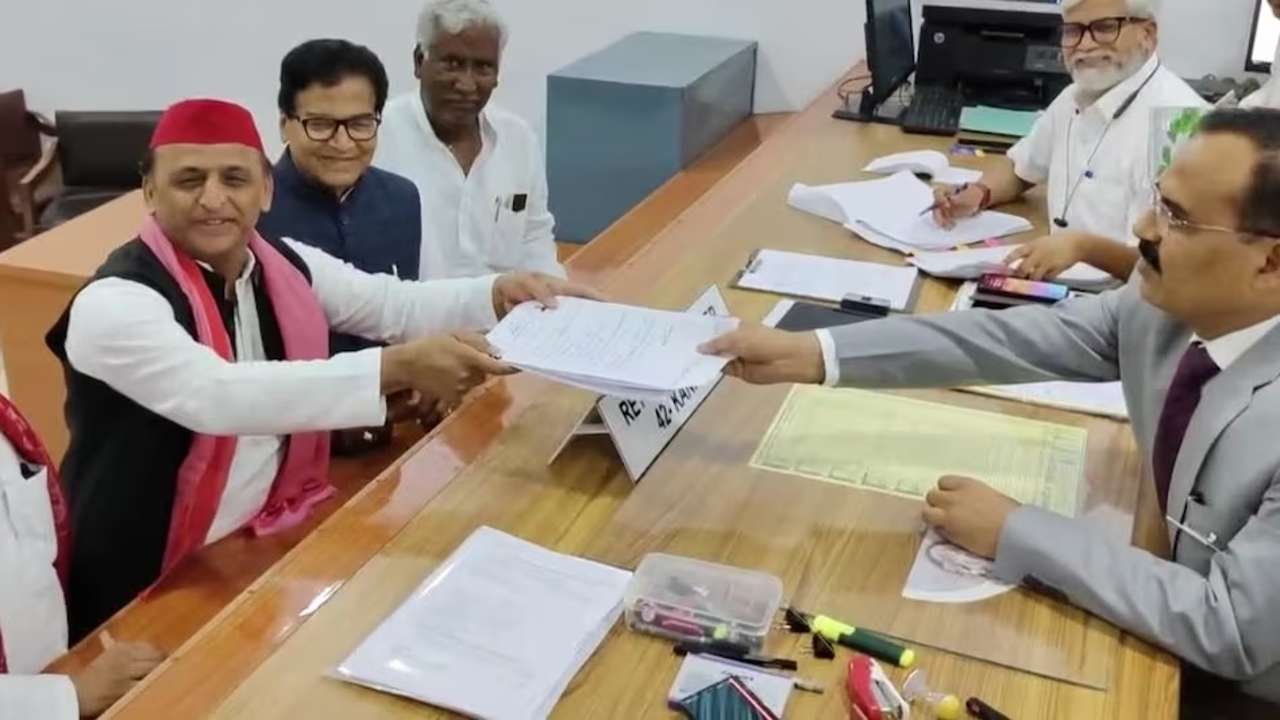

Lok Sabha elections: Samajwadi Party chief Akhilesh Yadav files nomination from Kannauj

The Samajwadi Party has announced Akhilesh Yadav as its official candidate for the Kannauj Lok Sabha seat today

Samajwadi Party (SP) chief Akhilesh Yadav, submitted his nomination for the Kannauj Lok Sabha constituency ahead of tomorrow’s second round of voting. In front of Ram Gopal Yadav and other party leaders, the chief of the SP, who had previously contested the seat in 2000, 2004 and 2009, submitted the nomination.

Speaking with media, Ram Gopal Yadav said that SP would win the seat by a huge margin. The BJP candidate might lose his deposit in the seat, he said.

The Samajwadi Party has completely reversed its earlier plan to field former Mainpuri MP Tej Pratap Singh Yadav as their candidate, which is a significant political development.

Earlier, Akhilesh Yadav told reporters, people will find out when the nomination takes place, in reference to the speculations that he will contest for the seat. The historic victory of Kannauj is the subject of inquiry.

The former chief minister continued, the people have decided that the India bloc is coming as the future and the BJP will be history in this election.

Notably, elections for the Kannauj seat are scheduled for May 13, which would intensify the political drama that is now playing out in Uttar Pradesh. Previously regarded as the Samajwadi Party’s stronghold, the seat was lost by the party in the 2019 election when Subrat Pathak of the BJP won with a resounding victory.

The candidates competing for the following Uttar Pradesh seats will find out their destiny in the second round of voting, which is scheduled for tomorrow, Amroha, Meerut, Mathura, Baghpat, Aligarh, Ghaziabad, Gautam Buddh Nagar, and Bulandshahar.

Notably, two Bollywood celebrities running as BJP candidates in the second round are Hema Malini from Mathura and Arun Govil from Meerut. There are 91 contestants from UP competing in the second phase.

The seats in Gautam Buddha Nagar and Mathura are up for grabs, with a maximum of 15 applicants per seat. In Bulandshahr, six candidates are vying for the presidency. There are twelve contenders running in Amroha, eight in Meerut, seven in Baghpat, and fourteen in Ghaziabad and Aligarh.

1,67,77,198 votes will decide these candidates’ fates.

-

India News18 hours ago

India News18 hours agoLandslide hits Arunachal Pradesh, highway linking Indo-China border affected

-

Cricket news11 hours ago

Cricket news11 hours agoTelugu superstar Mahesh Babu meets SRH captain Pat Cummins, says it is an absolute honour

-

Entertainment17 hours ago

Entertainment17 hours agoBollywood stars Salman Khan, Alia Bhatt, Rekha, Sonakshi Sinha, Aditi Rao Hydari attend Sanjay Leela Bhansali’s Heeramandi premiere

-

Education16 hours ago

Education16 hours agoFarmer’s son Nilkrishna Gajare Nirmalkumar from Maharashtra scores 100 NTA score in IIT-JEE Mains 2024

-

India News19 hours ago

India News19 hours agoTamannaah Bhatia summoned in illegal IPL streaming app case, to appear before cyber cell on April 29

-

Cricket news18 hours ago

Cricket news18 hours agoIPL 2024: Rishabh Pant, Axar Patel score half centuries as Delhi Capitals beat Gujarat Titans by 4 runs

-

2024 Lok Sabha Elections17 hours ago

2024 Lok Sabha Elections17 hours agoBihar: Election Commission extends voting timings for 4 Lok Sabha seats due to heatwave

-

Entertainment14 hours ago

Entertainment14 hours agoAamir Khan to begin shooting in Delhi for Sitaare Zameen Par next month