Latest world news

Swiss Banks at the Losing End with Flight of Offshore Accounts

[vc_row][vc_column][vc_column_text]~Rashme Sehgal

There has been a large flight of capital from Swiss banks even prior to the introduction of the Automatic Exchange of Common Information (AECI) from 2018 signed by over 50 countries who are members of the Organisation for Economic Co-operation and Developments (OECD).

The Swiss banking system has paid a heavy price for handling these unaccounted for offshore deposits especially since several of the smaller Swiss banks had specialised in handling such deposits. The blanket of secrecy surrounding Swiss banking transactions had ensured could they look after deposits of largely unaccounted wealth from well-heeled clients across the globe including India. But this is not going to be the case any longer.

Pressure on the Swiss government to provide details of all account holders has resulted in the outflow of millions of dollars of deposits from these banks thereby causing many of the smaller Swiss banks to shut shop. One such high profile Swiss bank that was forced to file for bankruptcy was Hottinger and Cie which was founded in 1786.

A KPMG study showed that 30 per cent of private banks had recorded losses in 2014-15 which resulted in several thousand bankers being laid off from their jobs.

“The smaller private banks dealing with off shore accounts posted huge losses and the result was that bankers handling these account lost their jobs under the restructuring process,” pointed out Louis Tari, a Geneva-based banking and tax advisor.

“With the introduction of the AECI, information of all non-Swiss residents belonging to the OECD countries will be automatically sent to the federal tax authorities in Berne who in turn will despatch this information to the relevant countries. The authorities in these countries can in turn check if the account holder has declared his income or not,” Tari added.

Zurich based banker Hanspeter Baumgartner pointed out, “What is very significant is that Swiss banks have frozen all accounts of account holders with ‘black’ money informing these holders that they should either regularise their account in their country or else their asset will be frozen. The flip side is that Swiss nationals who had accounts in the Bahamas or in Panama have had to declare their accounts.”

“This has seen an influx of francs into Switzerland but the amount is not very large,” Baumgartner added.

The amount of money of Indian national in Swiss banks has been steadily declining and in 2016 amounted to a mere Rs 4482 crore according to data released by Switzerland’s central bank, the Swiss National Bank. In 2015, the money deposed was Rs 8135 crore while in 2014 it was Rs 12,350 crore.

The figures being projected by the Indian government that billions of dollars had been stashed in Swiss banks by Indian citizens was largely overstated, analysts believe, as Switzerland never saw such massive deposits from any country.

Nathalie Bersier, a lawyer who works as a consultant for Swiss investments in India, said, “From 2009, the Indian government has been highlighting the issue of black money without realising that the easiest thing to do is for a client to close a bank account and transfer the money out. Such a flight of capital has already occurred.”

Bersier believes, “In Switzerland, two years ago the perception was that Indian assets were between $ 900 million to $4 billion. Today I would say, the amount would be less than even $900 million.”

“More than half the undeclared money from India that was stashed in Swiss banks has been moved to Dubai and Singapore from where it would have been invested in real estate, gold or re-entered India through the hawala route,” Bersier maintains.

Former Swiss state secretary for International Financial Matters Jacques de Watteville who had visited India in 2016 to negotiate with his counterparts in the Ministry of Finance had refused to hazard a guess about just how much money has been moved out of Swiss banks to be invested in Dubai or Singapore. “There are no official figures on the assets transferred out of Switzerland,” says Watteville.

While in India he had emphasised that, “Combating the menace of black money and tax evasion is also our shared priority. We discussed the need for an early and expeditious exchange of information to bring to justice the tax offenders.”

Many Indian analysts believe some of this money has been routed to the US with the US government actively encouraging foreigners to deposit money in US banks, no questions asked. Some US states and cities have emerged as veritable tax havens.

South Dakota, to cite an example, has been described by some analysts as the ‘new Switzerland’ and mention of its role as a tax haven was emphasised in the Panama Papers which highlighted that US offshore assets remain anonymous.

The city of Delaware is also said to be another tax haven with over one million registered entities claiming to operate from there.

The fact is that while international disclosure rules comprising the AECI have been accepted by the OECD countries, thhe US has refused to accept them and is not a signatory to it. The US NGO Tax Justice Network has pointed out how the US does not practise what it preaches.

In fact, a Swiss financial analyst on condition of anonymity, has accused the US of having crushed Swiss banks. Since trusts can operate as shell companies in some US states, it is ironical that a Swiss trust company has gone ahead and opened an office in South Dakota. The analyst feels that some of the flight of capital from Switzerland has ended up in the US.

This is because while non-US banks and financial institutions across the world have to reveal American account details, this is not the case with US deposits by offshore account holders.

Bersier does not see too much emerging from the Federal Council consultations with the Indian government on the need to detect, recover and repatriate illegal deposits.

“The key issue is what pressure the Indian government can exert on the Swiss government,” says Bersier. “The US threatened to close all Swiss banks operating in the US which led to the Swiss immediately signing a treaty with the US and UK. There are no Swiss banks operating in India.”

On the subject of the AEOI Information between the Swiss and Indian governments expected to be operationalised by 2018, she remains equally cynical.

Erecting the AEOI platform is all very well, she feels, but it is too little too late. Berseir believes that by the time it becomes operational, all the illegal deposits will have been moved out. There are any number of countries where this money can be moved to.

While some signatories of the AEOI are committed to sharing information from 2017, others will start providing information from 2018. Till then, we have to wait and watch.[/vc_column_text][/vc_column][/vc_row]

Latest world news

World Earth Day 2024: Google Doodle showcases aerial view of planet’s natural beauty

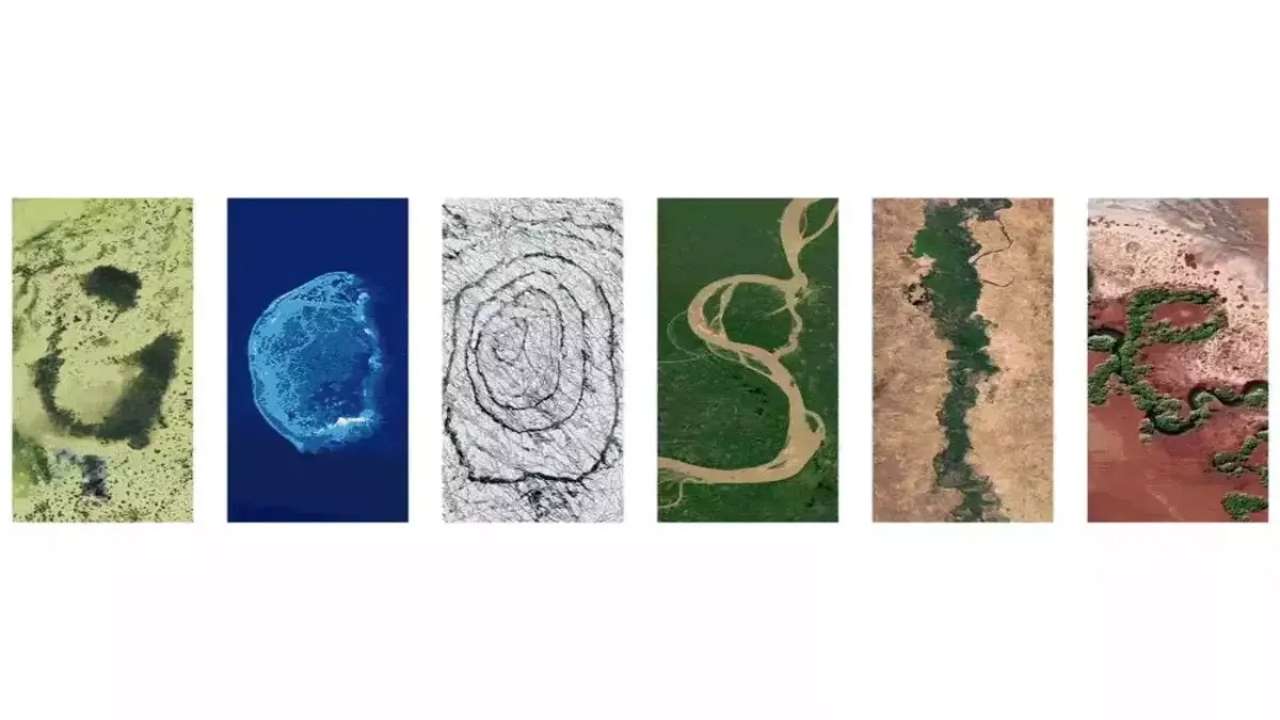

Google celebrated Earth Day 2024 with a special doodle featuring an aerial view of our planet’s biodiversity.

Google shared a doodle today to celebrate World Earth Day 2024, which showcased aerial photos of the planet’s biodiversity and natural beauty. Google reminded us of the importance of protecting planet earth for future generations with the help of this doodle.

The Google letters depict specific locations across the globe where people, communities, and governments work every day to help protect the planet’s natural beauty, biodiversity, and resources, according to the explanation of the annual Earth Day 2024 doodle on their website.

It said, these examples remind us that there’s much more to do to address the climate crisis and biodiversity loss, but also offer the promise of hope and optimism.

The islands of Turks and Caicos are represented by the letter “G.” The islands’ conservation efforts are concentrated on protecting important regions for biodiversity and addressing persistent environmental problems.

The largest reef in the southern Gulf of Mexico and a UNESCO biosphere reserve, Scorpion Reef National Park, is represented by the letter “O” in the Mexican flag.

The letter “O” features Iceland’s Vatnajokull National Park, which was designated as a national park in 2008 following decades of advocacy. The ecology within and surrounding the biggest glacier in Europe is safeguarded by this UNESCO World Heritage Site.

The letter “G” has the Jau National Park in Brazil on it. It is a UNESCO World Heritage Site and one of the biggest forest reserves in South America.

The Great Green Wall of Nigeria is represented by the letter “L,” and the Pilbara Islands Nature Reserves of Australia are represented by the letter “E.”

Meanwhile, Earth Day is a worldwide event that promotes protection of the environment every year. April 22 serves as a reminder of the importance of conservation efforts and sustainable practices to guarantee a healthier world and a brighter future.

The occasion inspires people across the world to come together and take action to protect the environment, strengthening our bonds with nature and promoting good change.

Latest world news

Bigg Boss 14 contestant Rahul Vaidya struggles walking in knee deep water, compares Dubai rains with Mumbai floods

Singer and TV personality Rahul Vaidya was recently stranded in the Dubai rains.

Rahul Vaidya, who was in Dubai ahead of his show which was scheduled to take place today, left the country due to heavy rains and reached Kolkata. The artist shared on social media his encounters in the UAE city, including challenges like walking through knee-deep water. Rahul provided an update regarding the heavy rainfall in Dubai on his Instagram profile.

The Bigg Boss 14 contestant revealed that he was in Kolkata and prepared to do an evening performance. Recalling the terrifying period he went through, Vaidya said there was a lot of confusion and panic in Dubai. The situation was similar to that when heavy floods hit Mumbai in 2005.

Vaiday also posted seval other images and videos of cars that were underwater and flooded roadways. The Bigg Boss 14 contestant, who shared his ordeal, claimed that even though it had just rained for two hours, the situation was dire.

In one of the video, which went viral he can be seen struggling in walking in knee-deep water. He can be also seen holding his sneakers in one hand and with other hand he was seen managing other things.

This is the result of the two hours of rain that it had, he can be heard saying in the video. Vidya also said he dosen’t believe Dubai is accustomed to a lot of rain. Everything had stopped working, he remarked.

After taking part in the first season of the singing reality show Indian Idol, Rahul Vaidya gained widespread recognition. In addition to Bigg Boss, he took part in Khatron Ke Khiladi 11.

Meanwhile, heavy rains that triggered flooding in the UAE and Bahrain, which left 18 people dead in Oman on Sunday and Monday, have paralyzed the financial hub of the Middle East, Dubai.

A lot of incoming flights were diverted from Dubai’s international airport because of the rain. At 7:26 p.m., the busiest airport in the world for foreign visitors stopped accepting new arrivals; a gradual resumption was announced for more than two hours later.

Images of planes navigating flooded tarmacs are making the rounds on social media.

According to pictures shared on social media, the flagship malls Dubai Mall and Mall of the Emirates both experienced heavy floods, while at least one Dubai Metro station had water up to the ankles.

There were several road collapses, severe flooding in residential areas, and numerous reports of leaks from windows, doors, and roofs.

Due to the unfavourable weather, schools around the United Arab Emirates were forced to close, and as more storms are predicted, the closures are anticipated to last until Wednesday. The government of Dubai allowed its staff to work remotely till this Wednesday.

Latest world news

Dubai sky turns green during storm in UAE, video goes viral

The UAE witnessed record-breaking rainfall on Tuesday and the National Centre of Meteorology recorded 254 mm of rainfall in less than 24 hrs in the Khatm Al Shakla area in Al Ain.

1 person was killed in UAE as it witnessed heavy rainfall on Tuesday, stranding commuters, flooding roads, disrupting trains and flights and resulting in water leakage from mall ceilings. The UAE witnessed record-breaking rainfall on Tuesday and the National Centre of Meteorology recorded 254 mm of rainfall in less than 24 hrs in the Khatm Al Shakla area in Al Ain. It is being said that the rainfall was the highest documented since the start of data collection in 1949.

The heavy rainfall in UAE came days after a similar situation in neighbouring Oman, where 13 people were killed in flash floods. Many parts of Oman saw torrential rains, which caused students to be trapped in buses and swept away motorists and trapped people in their homes.

Videos from Dubai circulating on social media showed widespread waterlogging on roads in Abu Dhabi, Dubai and other important cities. This left daily commuters in cars and other vehicles struggling to get back home. Dubai metro station too was seen flooded and closed.

One such video circulating on social media shows the aerial view of the city of Dubai from the top of a building. In the video the stormy winds are seen blowing over the city of Dubai. As the storm intensifies the Dubai sky turns green and ultimately gets covered by heavy rainfall. The video has gone viral on social media with more than 1.1 million views.

Another video showed water leakage from the ceilings of shopping malls, flooding the floors and destroying goods. A video which was shot in the famous Mall of the Emirates, showed pieces of ceiling falling as the rainwater gushed inside. Videos from many outlets of the Deira City Centre mall chain showed escalators being rendered unusable. Majid Al Futtaim, the company which owns the Mall of Emirates, said that the shopping complexes have been kept open and the customers are being sent away from the flooded areas.

-

Cricket news19 hours ago

Cricket news19 hours agoTelugu superstar Mahesh Babu meets SRH captain Pat Cummins, says it is an absolute honour

-

Education24 hours ago

Education24 hours agoFarmer’s son Nilkrishna Gajare Nirmalkumar from Maharashtra scores 100 NTA score in IIT-JEE Mains 2024

-

Entertainment22 hours ago

Entertainment22 hours agoAamir Khan to begin shooting in Delhi for Sitaare Zameen Par next month

-

2024 Lok Sabha Elections22 hours ago

2024 Lok Sabha Elections22 hours agoBollywood actor Neha Sharma campaigns for her father Ajit Sharma in Bhagalpur, Bihar

-

Cricket news20 hours ago

Cricket news20 hours agoAB De Villiers criticizes RCB’s decision to let go Yuzvendra Chahal, says it was a hearbreaking moment

-

2024 Lok Sabha Elections19 hours ago

2024 Lok Sabha Elections19 hours agoMallikarjun Kharge writes to PM Modi seeks time to explain Congress’s Nyay Patra

-

Trending18 hours ago

Trending18 hours agoSocial media user shares video of Air India ground staff throwing expensive musical instruments, video goes viral

-

2024 Lok Sabha Elections2 hours ago

2024 Lok Sabha Elections2 hours agoPM Modi calls for high voter turnout in second phase of Lok Sabha elections 2024, says your vote is your voice