If the goods and services tax (GST) system and rates have got you reaching out for pills to quell a headache, you will derive satisfaction from a World Bank report that agrees with you.

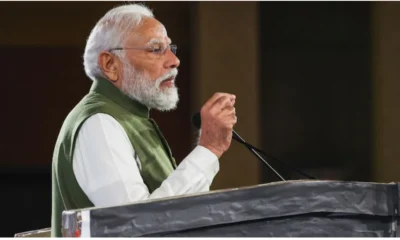

The GST system introduced by Narendra Modi government in India on July 1 last year is among the most complex in the world and is the second highest in tax rate, said the World Bank in a report covering 115 countries with similar indirect tax system.

The World Bank, in its bi-annual India Development Update released on Wednesday, March 14, said the complexity of India’s GST, was due to “higher tax rates and large number of tax slabs” compared with similar systems in other countries. GST has multiple tax rates of 0, 5, 12, 18, and 28%. Separately, gold is taxed at 3 percent, precious stones at 0.25 percent.

Further, there are several exempted sales and exports are zero rated, which allows exporters to claim refund for taxes paid on inputs that go into production process.

Alcohol, petroleum products, stamp duties on real estate and electricity duties are excluded from the GST and continue to be taxed by the state governments at state-specific rates.

This compares unfavourably with other regimes across the world as most countries have a single rate of GST. For example, the report said, India’s highest slab of 28% is the second-highest among 115 sampled countries and the highest in Asia.

The report said that 49 countries use a single rate, 28 use two rates, and only five including India use four non-zero slabs. The countries that use four or more rates of GST include Italy, Luxembourg, Pakistan and Ghana. Thus, India has among the highest number of different GST rates in the world.

The threshold of Rs 1.5 crore of annual turnover under GST for companies to opt for a simpler compliance regime with a flat tax rate called ‘composition scheme’ is also highest among 31 countries, the report said.

The World Bank report also argued against exemptions provided in the GST structure as these reduced the tax base and compromised on the logic of the GST by reintroducing cascading of taxes. “While exemptions allow easing the tax burden on items with high social value, such as healthcare… it creates incentives for vertical integration to keep the exempt status and raise compliance costs by making it necessary to allocate input taxes between exempt and non-exempt output when manufactured or traded together,” the report said.

The World Bank report said the introduction of GST has been accompanied by state administrations experiencing disruptions in initial days after GST’s introduction. This included lack of clarity on discontinuation of local taxes, for example, in Tamil Nadu where the state government devolved an entertainment tax to local governments in order to impose it over and above a 28% GST. To preserve revenue collections, Maharashtra has also increased motor vehicles tax to compensate for losses due to GST.

There also have been reports of an increased administrative tax compliance burden on firms and a locking-up of working capital due to slow tax refund processing, the World Bank said. “High compliance costs are also arising because the prevalence of multiple tax rates implies a need to classify inputs and outputs based on the applicable tax rate. Along with the need to apply the correct rate, firms are required to match invoices between their outputs and inputs to be eligible for full input tax credit, which increases compliance costs further,” it added.

“While international experience suggests that the adjustment process can affect economic activity for multiple months, the benefits of the GST are likely to outweigh its costs in the long run. It added that the key to success of GST was a policy design that minimises compliance burden by cutting number of rate slabs and limiting exemptions with simple laws and procedures, an appropriately structured and resourced administration,” the report said.

The GST was intended to replaced multiple tariffs and levies imposed by the centre and states and bring a uniform system. While the GST Council — the decision-making body for GST — had put well over 200 items in the highest bracket of 28% at the time of roll-out, it has since reduced the items under the slab to 50.

Finance minister Arun Jaitley has said there’s scope to merge 12 percent and 18 percent slabs in order to make it more transparent, efficient and tax payer-friendly.

While the government assured that GST will help curb black or untaxed money and steadily expand the base of taxpayers, complicated tax slabs and lack of proper IT infrastructure have become a problem for businesses.

But there is “positive impulse” expected from GST system as it is likely to improve the domestic flow of goods and services, contribute to the formalization of the economy and sustainably enhance growth, the World Bank observed.

However, notwithstanding the recent momentum, India will have to address several structural challenges to attain a growth rate of 8 percent and higher on a sustained basis, the World Bank said.

India would need to boost private investments and exports – its two lagging engines of growth – while maintaining its hard-won macroeconomic stability to boost growth.

“This will require continued impetus for structural reforms. Resorting to countercyclical policies will not help spur sustained growth and India should not compromise its hard-earned fiscal discipline in order to accelerate growth,” said Poonam Gupta, lead economist and the main author of the report.