Latest business news

How to Buy an iPhone with the Bajaj Finserv EMI Card

iPhones are on the wishlist of many Apple enthusiasts and gadget lovers. These smartphones, manufactured by Apple, one of the leading companies in the world, come with a wide range of cutting edge features

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

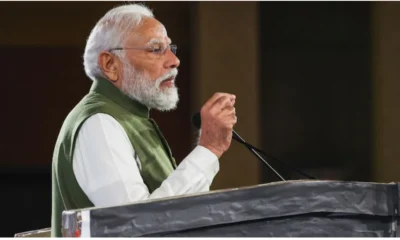

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

Latest world news23 hours ago

Latest world news23 hours agoTrump says tariffs will replace income tax, criticises Supreme Court setback in key address

-

Latest world news23 hours ago

Latest world news23 hours agoTrump repeats claim of averting India-Pakistan nuclear war during Operation Sindoor

-

Latest world news23 hours ago

Latest world news23 hours agoPM Modi to begin two-day Israel visit, defence and trade in focus

-

India News23 hours ago

India News23 hours agoShashi Tharoor questions Centre over Kerala name change to Keralam

-

India News14 hours ago

India News14 hours agoMK Stalin predicts frequent PM Modi visits to Tamil Nadu before assembly election

-

Latest world news14 hours ago

Latest world news14 hours agoIndia eyes Rs 8,000 crore mid-air refuelling aircraft deal as PM Modi begins Israel visit