Latest business news

Post Office MIS Scheme: Earn Rs 3,300 per year by depositing just Rs 50,000, check interest rate

Post Office are one of the greatest options for secure investments with decent returns. The MIS Scheme is one such post office scheme that provides both security and good returns.

Life is uncertain and no one knows when you need money. It’s always good to save some amount of money for future emergencies. There are various schemes in the market but how do you know that it is beneficial for you?

Risk and profit are the key aspects when making any investment. Savings plans offered by the Post Office are one of the greatest options for secure investments with decent returns. The MIS Scheme is one such post office scheme that provides both security and good returns.

To take advantage of the plan’s benefits, you must make a one-time investment and then earn monthly interest on the money, similar to a pension. Furthermore, when the plan matures, the one-time deposit is repaid to the investor.

Post Office MIS Scheme Interest Rate

The PO MIS program currently has a 6.6 percent annual interest rate that is paid on a monthly basis. A single account can hold a maximum of Rs 4.5 lakh in this scheme. The maximum amount for a joint account is Rs 9 lakh. The MIS plan has a 5-year duration.

How to Make a Post Office MIS deposit

Read Also: Assam Flood: New Haflong railway station destroyed in landslide fury

An account can be opened with a minimum deposit of Rs 1,000 and multiple deposits of Rs 100.

The single account maximum deposit is Rs 4.5 lakh; the joint account maximum deposit is Rs 9 lakh.

In an MIS joint account, all joint holders get an equal portion of the investment.

A person’s total deposits/shares in all MIS accounts cannot exceed Rs 4.50 lakh.

A guardian’s account formed on behalf of a minor will have a different limit.

Eligibility Criteria for Post Office MIS account

Single adult

A joint account can be opened with up to 3 adults

A guardian can open on behalf of a minor or person of unsound mind

A minor above 10 years of age can open an account in his own name.

Monthly Income Scheme Calculator:

A five-year deposit of Rs 50,000 will give Rs 275 per month or Rs 3300 per year. This takes the 5-year total return to Rs 16,500.

When depositing Rs 1 lakh, the monthly income is Rs 550, or Rs 6,600 per year, for a total of Rs 33,000 in 5 years.

A five-year investment of Rs 4.5 lakh gives Rs 2,475 per month, Rs 29,700 per year, and Rs 1,48,500 in interest.

LIC IPO: Should investors sell or retain shares after company’s weak listing? Know here

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

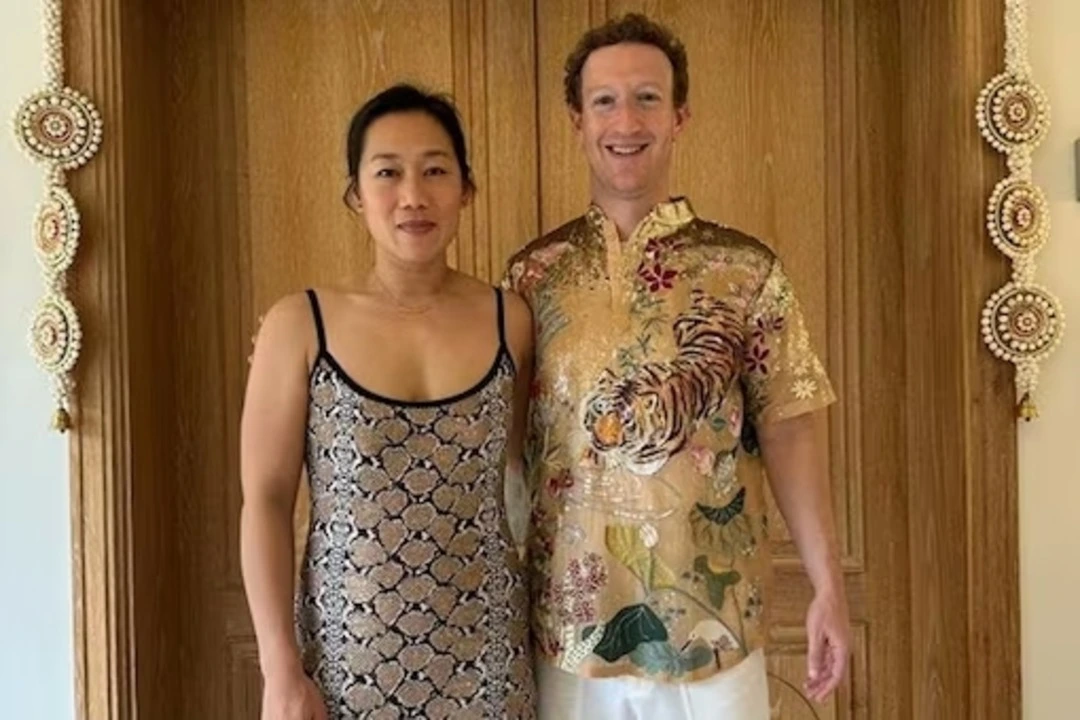

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections15 hours ago

2024 Lok Sabha Elections15 hours agoPrime Minister Narendra Modi says RJD is responsible for destroying Bihar, slams Lalu’s party over various corruption cases

-

Cricket news17 hours ago

Cricket news17 hours agoIPL 2024: Travis Head smashes brilliant century, Pat Cummins takes 3 wickets as Sunrisers Hyderabad defeat Royal Challengers Bengaluru by 25 runs

-

Entertainment14 hours ago

Entertainment14 hours agoAmul pays tribute to Diljit Dosanjh, Parineeti Chopra starrer Amar Singh Chamkila

-

India News17 hours ago

India News17 hours ago2 shooters arrested from Gujarat for firing outside Salman Khan’s house

-

India News16 hours ago

India News16 hours agoMy name is Arvind Kejriwal and I am not terrorist: Sanjay Singh reads Delhi CM’s message from Tihar Jail

-

2024 Lok Sabha Elections15 hours ago

2024 Lok Sabha Elections15 hours agoLok Sabha elections 2024: BJP releases 12th list of candidates, Udayanraje Bhonsle to contest from Satara

-

Entertainment12 hours ago

Entertainment12 hours agoVikrant Massey’s 12th Fail to release in over 20,000 screens in China

-

Food12 hours ago

Food12 hours agoBengaluru outlet selling gold and silver panipuri goes viral