Latest business news

RBI hikes repo rate by 25 basis points as inflation rises, interest on loans to go up

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

India News11 hours ago

India News11 hours agoDMK leader’s son arrested after car rams family in Krishnagiri, one dead

-

India News10 hours ago

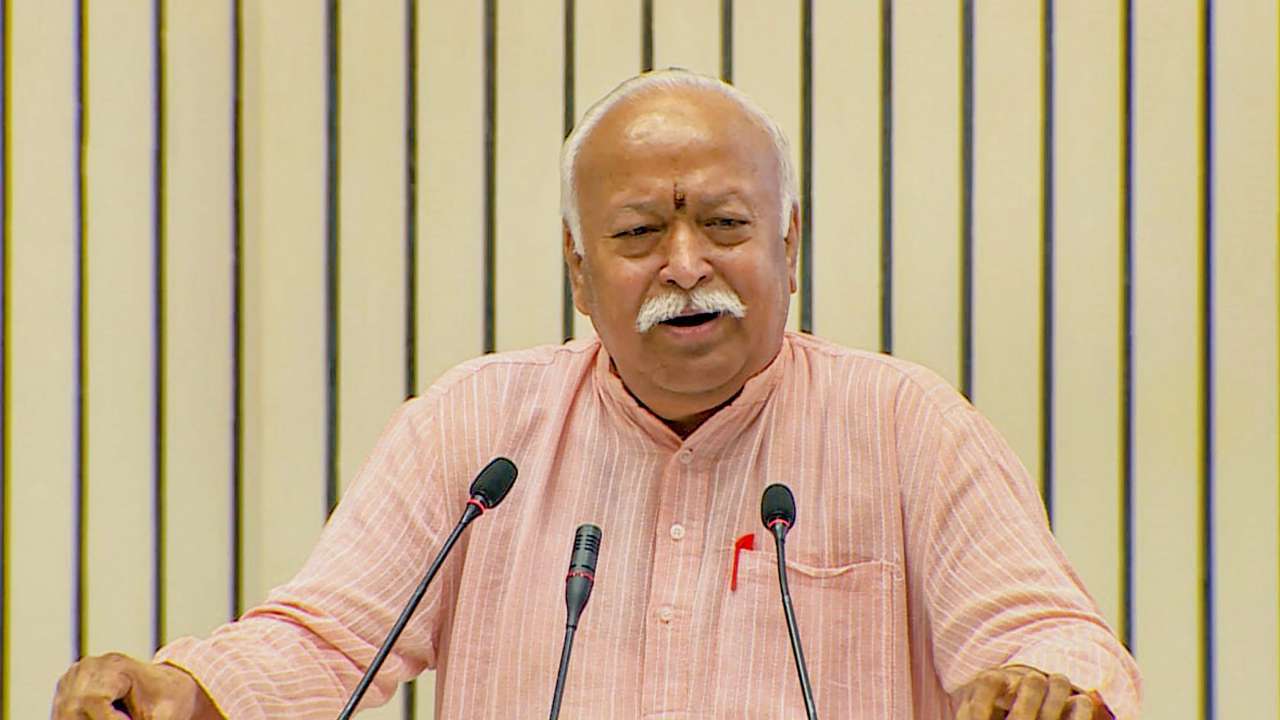

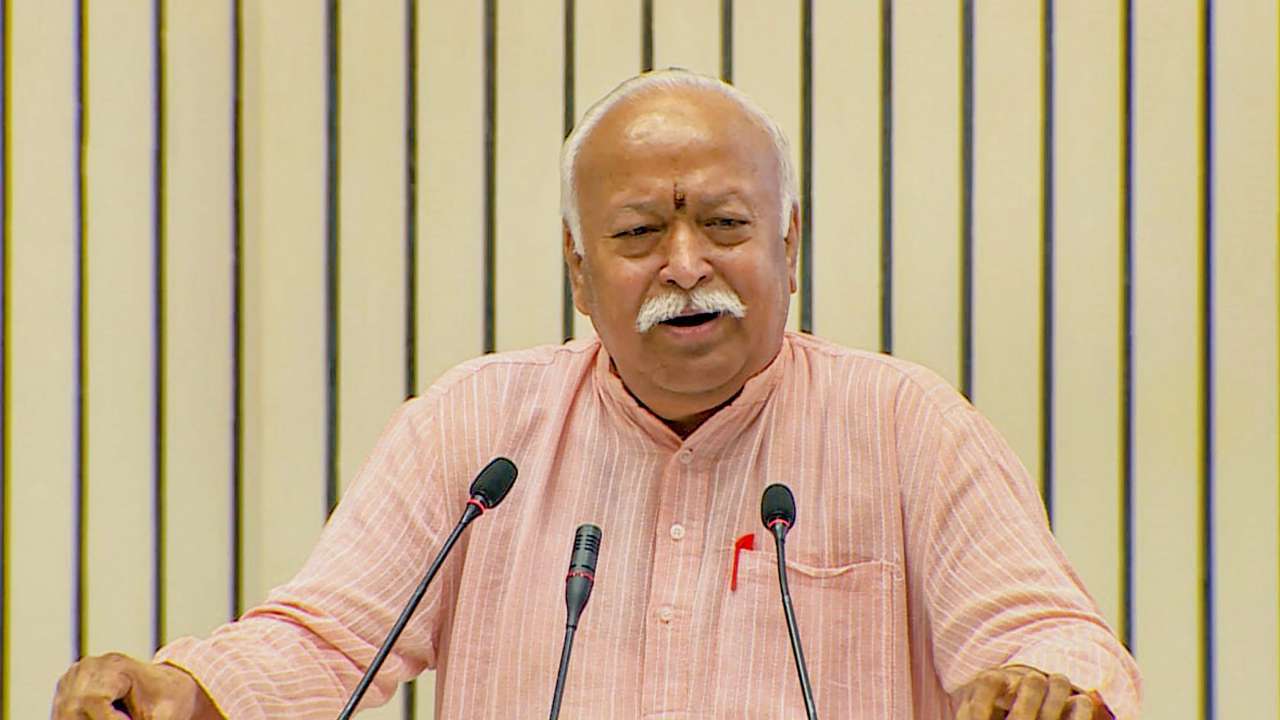

India News10 hours agoRSS chief backs nationwide rollout of Uniform Civil Code, cites Uttarakhand model

-

India News1 hour ago

India News1 hour agoAs stealth reshapes air combat, India weighs induction of Sukhoi Su-57 jets

-

Cricket news46 mins ago

Cricket news46 mins agoRinku Singh returns home from T20 World Cup camp due to family emergency