Latest business news

Videocon, Jaiprakash Associates among RBI’s second list of 26 loan defaulters?

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

India News23 hours ago

India News23 hours agoRahul Gandhi, Centre clash over Ladakh deepens as eight Congress MPs suspended

-

India News23 hours ago

India News23 hours agoMamata Banerjee alleges mass voter deletions in Bengal, targets Election Commission

-

India News7 hours ago

India News7 hours agoThree sisters die after jumping from ninth floor in Ghaziabad

-

India News7 hours ago

India News7 hours agoBJP spokesperson Shehzad Poonawalla’s mother injured in hit-and-run incident in Pune

-

Latest world news7 hours ago

Latest world news7 hours agoMoscow says no word from India on stopping Russian oil purchases

-

India News7 hours ago

India News7 hours agoUS tariff cut to 18% is positive signal for Indian exporters, says Sitharaman

-

Entertainment3 hours ago

Entertainment3 hours agoBorder 2 box office collection day 12 crosses Rs 286 crore, eyes Rs 300 crore milestone

-

India News4 mins ago

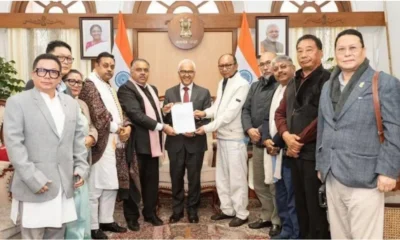

India News4 mins agoPresident’s Rule revoked in Manipur as NDA set to form new government