Latest business news

Punjab National Bank, ICICI Bank, Bank of Baroda increase fixed deposit interest rates, check new rates here

Bandhan Bank, Jana Small Finance Bank, Kotak Mahindra Bank, Bank of Baroda, Punjab National Bank, and ICICI Bank have increased their fixed deposit interest rates for retail customers across multiple tenor baskets.

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

Latest world news19 hours ago

Latest world news19 hours agoPakistan faces domestic backlash after India secures lower tariffs in US trade deal

-

Cricket news19 hours ago

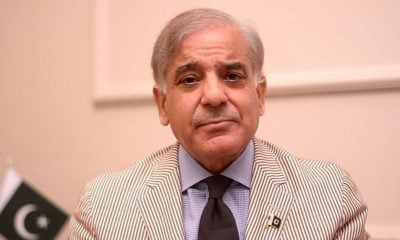

Cricket news19 hours agoPakistan PM Shehbaz Sharif confirms boycott of India match at T20 World Cup

-

Latest world news20 hours ago

Latest world news20 hours agoNew Delhi free to buy oil from any source, Russia says amid US deal claims

-

India News15 hours ago

India News15 hours agoManipur Assembly to meet at 4 pm today, floor test likely under new chief minister

-

India News10 hours ago

India News10 hours agoPM Modi accuses Congress of anti-Sikh bias over Rahul Gandhi’s ‘traitor’ remark