India News

Relief for borrowers as RBI slashes repo rate by 50 basis points

The Reserve Bank of India has cut the repo rate by 50 basis points to 5.5%, promising relief for borrowers and boosting optimism in the real estate market.

India News

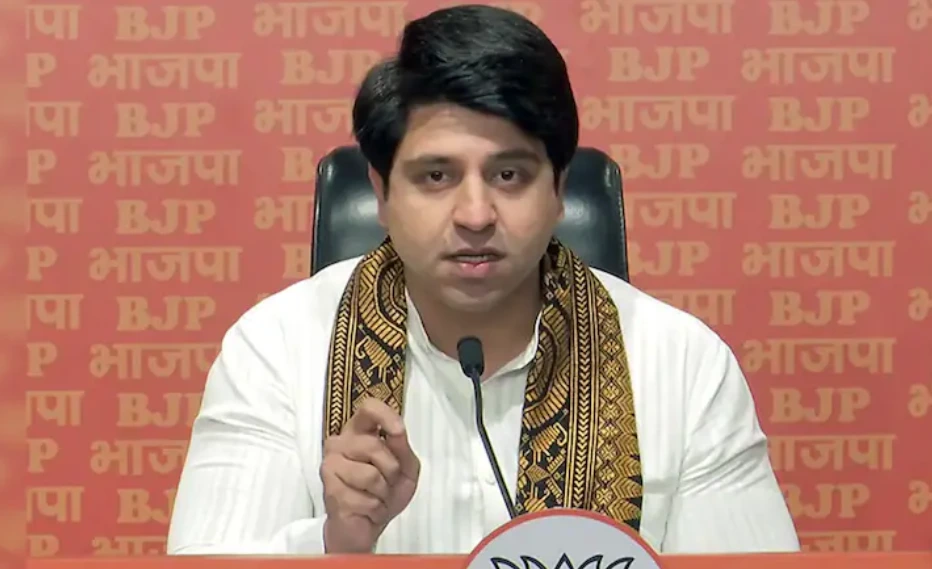

BJP spokesperson Shehzad Poonawalla’s mother injured in hit-and-run incident in Pune

BJP spokesperson Shehzad Poonawalla has alleged that his mother was deliberately hit by a car in Pune and left critically injured. She is scheduled to undergo surgery.

India News

Three sisters die after jumping from ninth floor in Ghaziabad

Three minor sisters died after jumping from the ninth floor of their Ghaziabad apartment, allegedly following a dispute over online gaming, police said.

India News

US tariff cut to 18% is positive signal for Indian exporters, says Sitharaman

Nirmala Sitharaman says India’s exports could recover after the US reduced tariffs on Indian goods to 18%, restoring competitiveness in key sectors.

-

India News22 hours ago

India News22 hours agoRahul Gandhi, Centre clash over Ladakh deepens as eight Congress MPs suspended

-

India News22 hours ago

India News22 hours agoMamata Banerjee alleges mass voter deletions in Bengal, targets Election Commission

-

India News6 hours ago

India News6 hours agoThree sisters die after jumping from ninth floor in Ghaziabad

-

India News6 hours ago

India News6 hours agoBJP spokesperson Shehzad Poonawalla’s mother injured in hit-and-run incident in Pune

-

India News6 hours ago

India News6 hours agoUS tariff cut to 18% is positive signal for Indian exporters, says Sitharaman

-

Latest world news6 hours ago

Latest world news6 hours agoMoscow says no word from India on stopping Russian oil purchases

-

Entertainment2 hours ago

Entertainment2 hours agoBorder 2 box office collection day 12 crosses Rs 286 crore, eyes Rs 300 crore milestone