Economy news

Finance Minister Nirmala Sitharaman announces leave travel voucher, festival advance to boost consumer demand

The FM announced proposals regarding consumer spending and capital expenditure. She said the coronavirus pandemic has adversely affected the economy but the government’s Atmanirbhar Bharat package has addressed the needs of poor and weak sections of society.

Economy news

ITR filing last date today: What taxpayers must know about penalties and delays

The deadline for ITR filing ends today, September 15. Missing it may lead to penalties, interest charges, refund delays, and loss of tax benefits.

Economy news

India’s GDP surges 7.8% in Q1, outpaces estimates and China

India’s GDP surged 7.8% in Q1 2025-26, the highest in five quarters, driven by strong services and agriculture sector growth, according to NSO data.

Economy news

Sensex falls 600 points, nifty slips 180 as US tariffs hit Indian markets

Indian equity markets witnessed sharp declines as US tariffs on Indian imports took effect. Sensex dropped over 600 points, while Nifty fell nearly 180 points in early trade.

-

Latest world news21 hours ago

Latest world news21 hours agoPakistan faces domestic backlash after India secures lower tariffs in US trade deal

-

Latest world news22 hours ago

Latest world news22 hours agoNew Delhi free to buy oil from any source, Russia says amid US deal claims

-

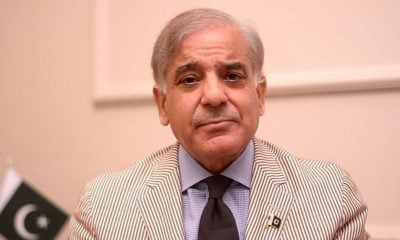

Cricket news21 hours ago

Cricket news21 hours agoPakistan PM Shehbaz Sharif confirms boycott of India match at T20 World Cup

-

India News17 hours ago

India News17 hours agoManipur Assembly to meet at 4 pm today, floor test likely under new chief minister

-

India News13 hours ago

India News13 hours agoPM Modi accuses Congress of anti-Sikh bias over Rahul Gandhi’s ‘traitor’ remark