Economy news

Best Investment Plan|Investment Option in india

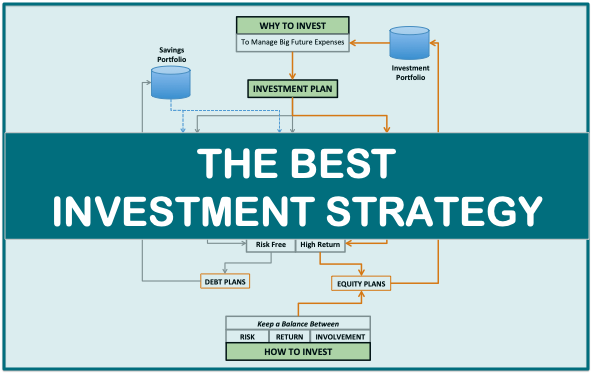

An investment plan is a basic piece of abundance creation, which encourages you to beat expansion to satisfy your budgetary objectives and furthermore settle your money related future. Rather than letting cash lie inert in your ledgers, you can put resources into various roads like stocks.

The Best investment plan is a basic piece of wealth creation, which encourages you to beat expansion to satisfy your budgetary objectives and furthermore settle your money related future. Rather than letting cash lie inert in your ledgers, you can put resources into various roads like stocks, values, shared assets, fixed store, or more.

The speculation roads you should pick, rely upon your investment plan, liquidity needs, investments skyline and danger craving. Out of these, hazard craving is a main consideration to consider, particularly in the present occasions. To assist you with choosing the correct alternative, here’s an overview on the best investment for you, in light of your danger craving.

How hazard craving influences your investment decisions?

Most investments convey a specific degree of danger and instability, which likewise influences the profits. Ordinarily, returns on an investment are more, when the degrees of danger are high. Nonetheless, there is a high danger of misfortunes in such investment.

Subsequently, investmenting choices are regularly assumed the premise of speculator’s danger craving, and we can characterize investment plan dependent on various danger levels. Here’s a gander at various investment plan, in light of various danger levels

Okay ventures

investors with lower hazard resistance, looking for practically zero instability in their investment portfolios, search for low risk investment choices. Frequently, retirees who’ve gone through many years making a savings, fall under this classification. Fixed-pay instruments like securities, debentures, Fixed Deposit and Government reserve funds plans fall under these investment classifications and suit the necessities of okay investment.

Generally safe investment plan are not connected to the securities exchange developments and are typically represented by the loan fee developments of agents. Nonetheless, the profits on these instruments are generally guaranteed, and you may need to secure your speculation for quite a while to procure considerable profits for these investment roads.

Medium-hazard investment

Financial specialists searching for a moderate degree of danger, however generally better yields when contrasted with fixed-salary instruments, search for medium-hazard investment choices. These are investment that may have a specific degree of danger yet the profits on these investment are additionally higher. Obligation reserves, adjusted shared assets, and list supports fall in this classification.

Such instruments convey a component of obligation and soundness, yet the volatilities related with their profits may likewise prompt misfortunes in chief sum. Because of the abnormalities in profit on these instruments, sorting a standard out salary from these instruments is absurd.

High-hazard investments

For market-smart speculators with a more profound comprehension of protections, and a high capacity to bear hazard, these high-hazard investment work best. In these investments, there is no restriction to the additions, however the degree of danger is additionally high. Unstable investment instruments like stocks, value shared assets, and subsidiaries fall in this class.

The profit for these instruments can give immense returns, however it is essential to realize when to place your cash in an unpredictable climate, and realize when to stop and pull out your cash with exceptional yields. The amount and timing of profits on these instruments are not fixed.

Best Investment Options in India

Notwithstanding your danger hunger, it is essential to pick the correct instruments to develop your reserve funds. To enable you to arrange for where to contribute, here’s a glance at the main 10 investment instruments picked by investors in India.Stocks: As value ventures that speak to a portion of possession in an organization or substance, stocks are outstanding amongst other speculation roads for long haul financial specialists. These can be exchanged a commercial center called the ‘Securities exchange’, where all exchanges are done electronically.Fixed Deposit: For financial specialists searching for worthwhile gets back with most reduced danger, Fixed Deposit (or FD) is a standout amongst other investment roads. By putting resources into a Fixed Deposit, you can get guaranteed returns at fixed timespans. This speculation road is one of the most favored alternatives in India, because of the accommodation and adaptability it offers. Indeed, even financial specialists with high danger craving decide to put resources into FD to expand their ventures and balance out their portfolio.Mutual Funds: These are aggregate investment vehicles oversaw by an asset administrator which pools individuals’ cash and puts resources into stocks and obligations of different organizations and make a return. With the accommodation of low beginning ventures, common assets are unstable investment roads, that are most appropriate for medium-hazard investors.Senior Citizen Savings Scheme: As an administration supported plan for people over 60 years old, Senior Citizen Savings Scheme is an incredible long haul sparing alternative for retirees. It is an extraordinary alternative to get consistent and secure salary, and senior residents can get a high and consistent pace of enthusiasm, as recommended by the legislature from time to time.Public Provident Fund: Public Provident Fund is one of the most widely recognized and believed investment plans in India. It pays loan cost every year and requires a base venture measure of Rs 500 for each annum. It has an existence of 15 years with halfway withdrawals permitted of the corpus at different focuses. This alternative additionally pays a high and consistent pace of enthusiasm as recommended the legislature from time to time.Here’s an outline of these investment, based on hazard, residency, liquidity and returns you can get:

Top 10 Best Investment Options In India

Risk Tenure Liquidity Returns

Stocks High Can be sold anytime High Market-connected

Fixed Deposit Low 7 days to 10 years Premature exit Assured

Shared Fund Moderate-High Open end* High Market-connected

Senior Citizens’ Saving Scheme Low 5 years Low 7.4%

PPF Low 15 years Partial withdrawals** 7.1%

*ELSS accompanies 3-year lock-in **Subject to conditions

Why Bajaj Finance FD is the best venture choice?

Taking a gander at different alternatives, FD has been a supported decision of investment for individuals, from the start. Alongside the accommodation of contributing, adaptability and confirmation of profits, FD is a shelter to financial specialists of all age gatherings and salary levels. The ongoing fall in repo rates has brought about bringing down of FD rates in a few banks, yet in case you’re searching for higher loan fees, you can put resources into NBFC Fixed Deposit. These NBFC FDs offer higher financing costs than bank FDs. Bajaj Finance is one such NBFC that offers rewarding loan costs of up to 7.35%, guaranteeing steady and secure development for your investment funds.

Read Also: What are the best ways to money investment?

Notwithstanding your danger type, you can consider putting resources into a Bajaj Finance Fixed Deposit, and procure these benefits:High Interest Rates – The loan cost offered is one of the most elevated in the Indian monetary market. It is generally 1-2% higher than bank FD at a similar tenor. Bajaj Finance FD offers appealing loan fees of up to 7.35% and you can acquire extra 0.10% on recharging your deposits.Safety Ratings: This FD is appraised most elevated on wellbeing with evaluations of FAAA by CRISIL and MAAA by ICRA, which demonstrates most noteworthy security of your deposit.Online Fixed Deposit: Investing in a Bajaj Finance FD is currently simpler than at any other time, with a start to finish paperless online cycle that lets you contribute from the solace of your home. This office is accessible for both – existing and new clients. Likewise – you can get extra advantages of 0.10% higher financing cost on contributing online.Periodic payout alternatives: When putting resources into this FD, you can decide to get occasional payouts, in light of your prerequisites. For those hoping to make a higher corpus, aggregate FD works best, wherein you get your advantage payouts at development. Then again, for those hoping to get occasional payouts, non-total FD is an extraordinary choice, wherein you can decide to get payouts on a month to month, quarterly, half-yearly or yearly basis.Loan against FD: For those hoping to finance crises, putting resources into a Bajaj Finance FD can be an incredible decision. Not exclusively would you be able to pull back rashly after fruition of least lock-in period, however you can likewise profit a Loan against FD to subsidize unexpected costs.

Economy news

Financial changes effective from September, Aadhaar update, nomination deadline for demat account

Some changes will take effect on the first day, while others will be implemented later in the month. This list will affect people’s finances.

In the month of September, there are many changes occurring, particularly in the financial sector. Some changes will take effect on the first day, while others will be implemented later in the month. This list will affect people’s finances.

The deadline to update an individual’s Aadhaar card details for free is quickly approaching. The Unique Identification Authority of India (UIDAI) extended the deadline from June 14 to September 14, 2023. This scheme is specifically for citizens who obtained their Aadhaar card 10 years ago and have yet to update their information. People can take this opportunity to update their details before it’s too late.

The nomination process for trading and demat accounts is mandatory for holders and the deadline for this has been extended by the Security and Exchange Board of India (SEBI). The account holders have to make nominations or opt out of it before September 30.

People will need to update and link of Aadhaar identity documents with PAN cards. Those who have credit cards from Axis Bank will also experience the effects of these changes starting this month.

As per the updated terms and conditions, Axis Bank’s Magnus credit card users need to pay higher fees. The annual fee has been increased to Rs 12,500. Also, the benefits associated with the card will be updated.

This month marks the final opportunity for individuals to exchange Rs 2,000 notes. As stated by the Reserve Bank of India (RBI) in May, individuals may exchange or deposit these notes into their bank accounts before the specified deadline.

The central bank has specified that individuals may exchange or deposit for lower denomination notes, up to Rs 20,000 at a time, until September 30th. Interestingly, even after the deadline, Rs 2,000 notes will still be considered valid tender.

Starting from the current financial year, the Ministry of Finance has made it mandatory to provide both Permanent Account Number (PAN) and Aadhaar card information when making investments in small saving schemes such as the Public Provident Fund (PPF), Post Office Saving Scheme, and Senior Citizens Saving Scheme (SCSS). Existing subscribers must submit their Aadhaar number before September 30th, or their accounts will be frozen.

Economy news

India will remain on similar growth curve till 2030, expect well behaved inflation this fiscal: CEA

Chief Economic Adviser (CEA) V Anantha Nageswaran on Tuesday projected that India’s economy was poised to do better and expected to grow at 6.5-7 percent till the end of the decade.

Chief Economic Adviser (CEA) V Anantha Nageswaran on Tuesday projected that India’s economy was poised to do better and expected to grow at 6.5-7 percent till the end of the decade.

Nageswaran, while talking to the media after tabling of the Economic Survey in Parliament by Finance Minister Nirmala Sitharaman, said that the inflation is likely to be “well behaved” in the coming fiscal year barring any unforeseen factors.

According to the Economic Survey prepared by the CEA, RBI projection of retail inflation at 6.8 per cent in the current fiscal is neither too high to deter private consumption, nor too low as to weaken inducement to invest.

The Economic Survey for the current fiscal also state that the Indian economy is expected to hit a minor slow down to 6.5 percent in April 2023 but will continue to remain the fastest-growing major economy in the world owing to its ability to better deal with challenges faced by the global economy.

The CEA maintained that the projected growth rate would remain stable as long as oil prices stayed below 100 dollars per barrel. He also pointed out that the quality of public expenditure has gone up and the government has become more transparent with budget deficit numbers, adding that an increased transparency is being witnessed in public procurement.

Read Also: Finance Minister Nirmala Sitharaman tables Economic Survey 2023, check highlights here

Nageswaran stressed that credit growth is picking up across sectors, and credit to MSMEs has grown at 30 per cent since January 2022, while NPAs in NBFCs is lower than what it was 15 months ago.

The CEA revealed that India is well ahead of its targets for renewable energy mix.

Earlier on Tuesday, the International Monetary Fund in its January update of the World Economic Outlook called India as a bright spot in an otherwise gloomy world economy which, together with China, will account for half of the global growth in 2023, compared to the US and Euro area, who account for just a 10th of the world’s growth.

The IMF report had made almost similar projections to the Economic Survey tabled by the government. It has projected India’s growth to dip slightly from 6.1 percent to 6.8 percent during the current fiscal year ending on March 31. IMF also expects some minor slowdown in the Indian economy in the next fiscal year.

Air India Pee Gate: Delhi court grants bail to accused Shankar Mishra

Visakhapatnam to be the new capital of Andhra Pradesh, says CM Y S Jagan Mohan Reddy

Economy news

India a bright spot amid projected decline in global growth: IMF

The International Monetary Fund (IMF) has projected India’s growth to dip slightly from 6.1 percent to 6.8 percent during the current fiscal year ending on March 31. IMF also expects some minor slowdown in the Indian economy in the next fiscal year.

The International Monetary Fund (IMF) has projected India’s growth to dip slightly from 6.1 percent to 6.8 percent during the current fiscal year ending on March 31. IMF also expects some minor slowdown in the Indian economy in the next fiscal year.

According to the January update of the World Economic Outlook released by global fiscal body on Tuesday, global growth is projected to fall from a projected 3.4 percent in 2022 to 2.9 percent in 2023, then rise to 3.1 percent in 2024.

Pierre-Olivier Gourinchas, Chief Economist and Director, Research Department of the IMF said in a statement that the IMF’s projections for India remain unchanged from its October update as they predict a 6.8 percent growth curve for the Indian economy for the current fiscal and an expected minor dip to 6.1 percent in the next fiscal.

According to the IMF World Economic Outlook, the slowdown is largely driven by external factors, adding that the India’s growth will once again see an upward curve and go up to 6.8 percent in 2024 due to resilient domestic demand despite external factors.

The report expects a rise in growth in developing Asian nations in 2023 and 2024 to 5.3 percent and 5.2 percent, respectively, after the slowdown in 2022 to 4.3 percent.

For the first time in the last four decades, China’s growth fell below the global average in the fourth quarter of 2022 which saw a 0.2 percentage point downgrade, settling at 3.0 percent. However, China’s growth is expected to rise to 5.2 percent in 2023 and fall to 4.5 percent in 2024 before settling at below 4 percent over the medium term amid declining business dynamism and slow progress on structural reforms.

Read Also: Railways cancel over 350 trains, divert route of 16 trains, check full list here

Gourinchas pointed out that emerging market economies and developing economies are already on the way up and have seen a slight rise in growth for the region from 3.9 percent in 2022 to 4 percent in 2023.

He stressed that India and China combined account for almost 50 percent of world growth in 2023, adding that IMF’s positive view on India’s growth curve remains unchanged.

Gourinchas in a blog post termed India as a bright spot which, together with China, will account for half of the global growth in 2023, compared to the US and Euro area, who account for just a 10th of the world’s growth.

Gourinchas also forecasted a much more pronounced slowdown for advanced economies with a decline from 2.7 percent last year to 1.2 percent and 1.4 percent this year and next.

Nine out of 10 advanced economies will likely decelerate, he added.

He predicted that the US’ growth will slow to 1.4 percent in 2023 as Federal Reserve interest-rate hikes work their way through the economy. Euro area conditions are more challenging despite signs of resilience to the energy crisis, a mild winter, and generous fiscal support, he said.

Haryana man killed in road mishap, police say; family claims beaten to death by cow vigilantes

Peshawar suicide bombing: Death toll rises to 83, over 150 wounded

-

Entertainment13 hours ago

Entertainment13 hours agoBollywood stars Vidya Balan, Kartik Aaryan, Pratik Gandhi, Ileana D’Cruz, Mouni Roy, Radhika Madan, Mrunal Thakur attend Do Aur Do Pyaar premiere

-

LATEST SPORTS NEWS17 hours ago

LATEST SPORTS NEWS17 hours agoIPL 2024: Delhi Capitals thrash Gujarat Titans by 6 wickets

-

Cricket news12 hours ago

Cricket news12 hours agoHappy Birthday KL Rahul: Suniel Shetty wishes son-in-law KL Rahul on his 32nd birthday

-

India News15 hours ago

India News15 hours agoReligious outfit vandalises The Blessed Mother Teresa High School in Telangana after teachers object to students wearing Hanuman Deeksha dress

-

India News16 hours ago

India News16 hours agoClashes erupt during Ram Navami procession in West Bengal’s Murshidabad district

-

India News10 hours ago

India News10 hours agoEnforcement Directorate seizes Shilpa Shetty’s husband Raj Kundra’s properties worth Rs 97 crore

-

India News9 hours ago

India News9 hours agoEnforcement Directorate says Arvind Kejriwal is deliberately eating mangoes, sweets, taking sugar with tea to increase his blood sugar level and create ground for bail