Latest business news

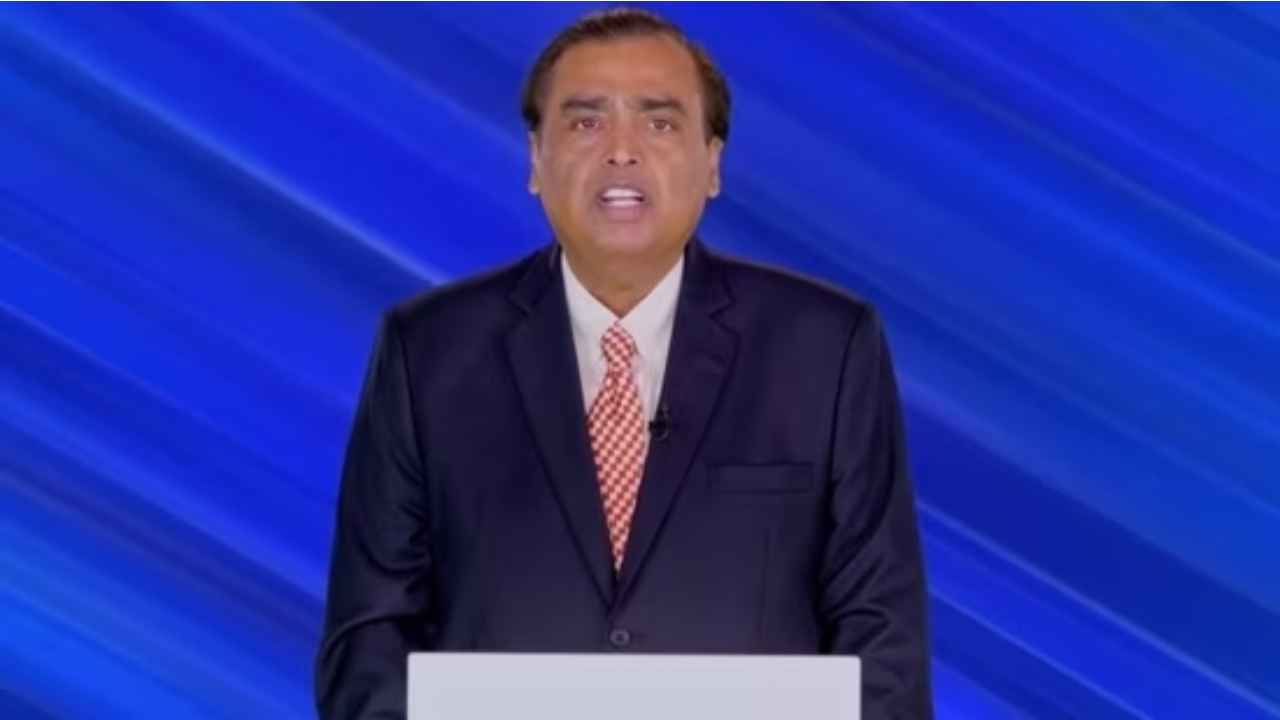

Reliance AGM 2023: Mukesh Ambani says Jio Air Fibre to be launched on Sep 19

For FY23, Reliance’s contribution to the national treasury reached Rs 1,77,173 crore, which includes an increase in both Direct and Indirect taxes amounting to over Rs 16,639 crore.

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

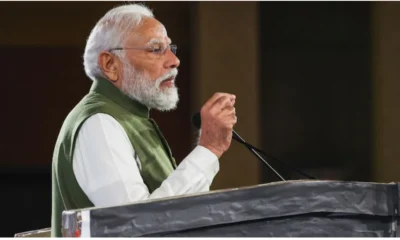

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

India News20 hours ago

India News20 hours agoMK Stalin predicts frequent PM Modi visits to Tamil Nadu before assembly election

-

Latest world news20 hours ago

Latest world news20 hours agoIndia eyes Rs 8,000 crore mid-air refuelling aircraft deal as PM Modi begins Israel visit

-

Latest world news6 hours ago

Latest world news6 hours agoPM Modi reaffirms support for Israel, recalls 26/11 victims in Knesset address

-

Latest world news6 hours ago

Latest world news6 hours agoCanada softens stance on alleged Indian interference ahead of PM Carney’s India visit

-

India News6 hours ago

India News6 hours agoPM Modi crosses 100 million followers on Instagram, first world leader to achieve milestone

-

Latest world news5 hours ago

Latest world news5 hours agoPM Modi and Netanyahu pledge deeper defence, trade ties during Israel visit

-

India News5 hours ago

India News5 hours agoOver 5,000 tribals join BJP in Assam’s Goalpara ahead of elections