Latest business news

As retail inflation eases, RBI cuts repo rate by 25 bps, loans likely to get cheaper

[vc_row][vc_column][vc_column_text]This is the first cut in repo rate – the rate at which the RBI lends to banks – since October 2016. MPC headed by RBI governor Urjit Patel stressed on need to reinvigorate private investments, clear infra bottlenecks and provide big thrust to Pradhan Mantri Awas Yojana.

On the basis of an assessment of the current and evolving macro-economic situation at its meeting today, the Monetary Policy Committee (MPC) of the Reserve Bank of India decided to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 6.25 per cent to 6.0 per cent with immediate effect. Consequently, the reverse repo rate under the LAF stands adjusted to 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.25 per cent.

Following are excerpts from the bi-monthly monetary policy:

The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below:

Since the June 2017 meeting of the MPC, impulses of growth have spread across the global economy albeit still lacking the strength of a self-sustaining recovery. Among the advanced economies (AEs), the US has expanded at a faster pace in Q2 after a weak Q1, supported by steadily improving labour market conditions, increasing consumer spending, upbeat consumer confidence helped by softer than expected inflation, and improving industrial production. Policy and political risks, however, continue to cloud the outlook. In the Euro area, the recovery has broadened across constituent economies on the back of falling unemployment and a pickup in private consumption; political uncertainty has receded substantially. In Japan, a modest but steady expansion has been taking hold, underpinned by strengthening exports, accelerating industrial production and wage reflation.

Among emerging market economies (EMEs), growth has regained some lost ground in China in Q2, with retail sales and industrial production rising at a steady pace. Nonetheless, tightening financial conditions on account of deleveraging financial institutions and slowdown in real estate could weigh negatively. The Russian economy has emerged out of two years of recession, aided by falling unemployment, rising retail sales and strong industrial production.

The modest firming up of global demand and stable commodity prices have supported global trade volumes, reflected in rising exports and imports in key economies. In the second half of July, crude prices have risen modestly out of bearish territory on account of inventory drawdown in the US, but the supply overhang persists. Chinese demand has fuelled a recent rally in metal prices, particularly copper. Bullion prices fell to multi-month lows on improved risk appetite but remain vulnerable to shi ifts in the geopolitical environment. Notwithstanding these developments, inflation is well below target in most AEs and is subdued across most EMEs

International financial markets have been resilient to political uncertainties and volatility has declined, except for sporadic reactions to hints of balance sheet adjustments by systemic central banks . In the currency markets, the US dollar weakened further and fell to a multi-month low in July on weak inflation and uncertainty around the policies of the US administration. The Euro, which has remained bullish, rallied further on upbeat economic data.

On the domestic front, a normal and well-distributed south-west monsoon for the second consecutive year has brightened the prospects of agricultural and allied activities and rural demand. By August 1, rainfall was 1 per cent above the long period average (LPA) and 84 per cent of the country’s geographical area received excess to normal precipitation. Kharif sowing has progressed at a pace higher than last year’s, with full-season sowing nearly complete for sugarcane, jute and soyabean. The ini tial uncertainty surrounding sowing of pulses barring tur and rice in some regions has also largely dissipated. Sowing of cotton and coarse cereals has exceeded last year’s levels but for oilseeds, it is lagging. Overall, these developments should help achieve the crop production targets for 2017-18 set by the Ministry of Agriculture at a higher level than the peak attained in the previous year. Meanwhile, procurement operations in respect of rice and wheat during the rabi marketing season have been stepped up to record levels – 36.1 million tonnes in April-June 2017 – and stocks have risen to 1.5 times the buffer norm for the quarter ending September.

Many challenges ahead for the economy

Industrial performance has weakened in April-May 2017. This mainly reflected a broad-based loss of speed in manufacturing. Excess inventories of coal and near stagnant output of crude oil and refinery products combined to slow down mining activity. For electricity generation, deficiency of demand seems to remain a binding constraint. In terms of uses, the output of consumer non-durables accelerated and underlined the resilience of rural demand. It was overwhelmed, however, by contraction in consumer durables – indicative of still sluggish urban demand – and in capital goods, which points to continuing retrenchment of capital formation in the economy. The weakness in the capex cycle was also evident in the number of new investment announcements falling to a 12-year low in Q1, the lack of traction in the implementation of stalled projects, deceleration in the output of infrastructure goods, and the ongoing deleveraging in the corporate sector. The output of core industries was also dragged down by contraction in electricity, coal and fertiliser production in June, owing to excess inventory and tepid demand.

But there’s some reason for optimism too

On the positive side, natural gas recorded an uptick in production after a prolonged decline and steel output remained strong. The 78th round of the Reserve Bank’s industrial outlook survey (IOS) revealed a waning of optimism in Q2 about demand conditions across parameters, and especially on capacity utilisation, profit margins and employment. The manufacturing purchasing managers’ index (PMI) moderated sequentially to a four-month low in June and the future output index also eased marginally. I n July, the PMI declined into the contraction zone with a decrease in new orders and a deterioration in business conditions, reflecting inter alia the roll out of the GST; however, both new export orders and the future output index rose, reflecting optimism in the outlook.

On inflation and prices:

Prices of food and beverages, which went into deflation in May 2017 for the first time in the new CPI series, sank further in June as prices of pulses, vegetables, spices and eggs recorded year-on-year declines and inflation moderated across most other sub-groups. There are now visible signs, however, of the usual seasonal price spikes, even if with a delay and especially in respect of tomatoes, onions and milk.

Fuel inflation declined for the second month in succession as international prices of liquefied petroleum gas (LPG) fell and price increases moderated in the case of coke, and firewood and chips.

Administered prices of LPG and kerosene are set to rise with the calibrated reduction in subsidy.[/vc_column_text][/vc_column][/vc_row]

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

Cricket news16 hours ago

Cricket news16 hours agoIPL 2024: Marcus Stoinis hits first IPL century as Lucknow Super Giants beat Chennai Super Kings by 6 wickets

-

2024 Lok Sabha Elections8 hours ago

2024 Lok Sabha Elections8 hours agoMallikarjun Kharge vows to continue politics till his last breath to defeat BJP

-

2024 Lok Sabha Elections15 hours ago

2024 Lok Sabha Elections15 hours agoRahul Gandhi clarifies on wealth survey remark, says aim is to identify injustice

-

2024 Lok Sabha Elections12 hours ago

2024 Lok Sabha Elections12 hours agoPM Narendra Modi slams Congress over Sam Pitroda’s inheritance tax remarks, accuses Congress of intending to impose higher taxes

-

India News14 hours ago

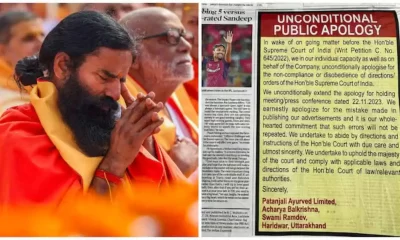

India News14 hours agoRamdev, Balkrishna publish bigger apology in newspapers after Supreme Court’s rap

-

2024 Lok Sabha Elections9 hours ago

2024 Lok Sabha Elections9 hours agoNitin Gadkari says he’s better now after collapsing at election rally in Maharashtra’s Yavatmal

-

Trending13 hours ago

Trending13 hours agoA waiter’s life: Social media users go emotional on watching viral video

-

Entertainment10 hours ago

Entertainment10 hours agoMadhuri Dixit, Karisma Kapoor recreate Dil To Pagal Hai dance battle on Dance Deewane