Latest business news

SC orders Jaypee to deposit Rs 2k crore; directors can’t leave country without permission

[vc_row][vc_column][vc_column_text]Real-estate major also told that it can’t sell any property without seeking prior permission and consent of the court

The Supreme Court bench of Chief Justice Dipak Misra and Justices DY Chandrachud and AM Khanwilkar, on Monday (September 11), passed stringent directives on the promoters and directors of Jaypee Infratech and ordered that they are not to leave the country without prior permission of the court. Their associates have also been directed to deposit Rs 2,000 crore on or before October 27.

The bench also directed that if any property is to be sold by the real-estate major, the sale will take place after obtaining permission and consent of the court.

While the Union government has argued for the case to be dealt with by the Insolvency Code, petitioner Chitra Sharma has said that this will leave homeowners in the lurch, because they come way down in the order of preference as per the code. After paying off top creditors such as the banks and even small time employees of the projects (such as watchmen) there is likely to be nothing left from the proceeds of liquidation for the homeowners.

Earlier, a group of Jaypee Infratech home buyers had moved the Supreme Court, seeking relief against a National Company Law Tribunal (NCLT) order which stayed all court proceedings against the company, including those pending before the consumer courts. On September 5, IDBI Bank had requested the apex court to restore the insolvency proceedings against the realtor.

They also urged the apex court to declare home buyers as ‘secured creditors’ to help them get first right on the company’s assets in case of insolvency.

On Monday, Attorney General KK Venugopal, said that the very purpose of insolvency proceedings is to revive the company.

Additional Solicitor General Tushar Mehta, appearing for the Insolvency and Bankruptcy Board of India, said: “Insolvency professionals will re-structure the company’s scheme and will ensure the supplies and deliveries of the flats to all buyers.”

Justice Misra said: “Kindly give this court a scheme, illustrating, how they will pay the debts of all creditors. This scheme should also show how the parent company’s and its sister company’s assets will be restructured and how they will deliver the flats to homebuyers.”

“We are not concerned with the assets of the company. We are only concerned with interests of all the home buyers,” said the Chief Justice. “It is our constitutional duty to give paramount consideration to valuable interest of all home buyers. Many of them are from middle class income groups.”

Senior advocate P Chidambaram, appearing for the home buyers, requested the court to include all the homebuyers in the category of secured creditors. He said that the scheme of Insolvency and Bankruptcy Code of India (IBC) doesn’t include them as creditors or secured creditors. The resolution plan of insolvency proceedings will throw them out.”

Justice Misra said: “We are not inclined to change the statutory interest. We are just giving utmost consideration to the interests of homebuyers and secured creditors.”

The Attorney General asked for time to frame and submit the scheme of the Insolvency Resolution Profession (IRP).

The Chief Justice ordered: “In modification of the order dated September 4, we issue the following directions:

- The IRP will submit the scheme of payment to the creditors and delivery of flats to the home buyers.

- The company or any of its associate companies will not alienate any of its property in any manner.

- The managing directors and directors of the respondents (3 and 4) will not leave the country, without prior permission of this court.

- The respondents, subject to their arguments and submissions, will deposit certain amounts with this court.

- IRP will take over all the management of the Jaypee Infratech Ltd. and pass the interim resolutions.

- Respondent 4 (an associate) is not the party to this suit. It will deposit Rs 2,000 crore on or before27/10/2017. If any property is to be sold, the sale will take place after obtaining permission and consent of this court.

- Any person who is the director of any of the companies at the time of the IRP proceedings, will not leave the country without obtaining the permission of this court, except nominee directors of the lenders – IDBI, ICCI and SBI.”

The court also allowed all interventions.

The matter has been listed again for November 13.[/vc_column_text][/vc_column][/vc_row]

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections20 hours ago

2024 Lok Sabha Elections20 hours agoMallikarjun Kharge vows to continue politics till his last breath to defeat BJP

-

2024 Lok Sabha Elections23 hours ago

2024 Lok Sabha Elections23 hours agoPM Narendra Modi slams Congress over Sam Pitroda’s inheritance tax remarks, accuses Congress of intending to impose higher taxes

-

Entertainment22 hours ago

Entertainment22 hours agoMadhuri Dixit, Karisma Kapoor recreate Dil To Pagal Hai dance battle on Dance Deewane

-

2024 Lok Sabha Elections20 hours ago

2024 Lok Sabha Elections20 hours agoNitin Gadkari says he’s better now after collapsing at election rally in Maharashtra’s Yavatmal

-

Entertainment2 hours ago

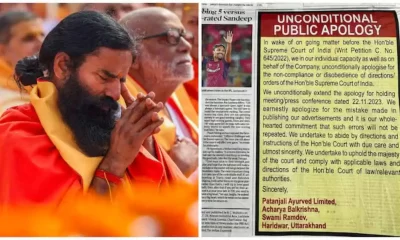

Entertainment2 hours agoBollywood stars Salman Khan, Alia Bhatt, Rekha, Sonakshi Sinha, Aditi Rao Hydari attend Sanjay Leela Bhansali’s Heeramandi premiere

-

Education1 hour ago

Education1 hour agoFarmer’s son Nilkrishna Gajare Nirmalkumar from Maharashtra scores 100 NTA score in IIT-JEE Mains 2024

-

India News4 hours ago

India News4 hours agoTamannaah Bhatia summoned in illegal IPL streaming app case, to appear before cyber cell on April 29

-

India News3 hours ago

India News3 hours agoLandslide hits Arunachal Pradesh, highway linking Indo-China border affected