India News

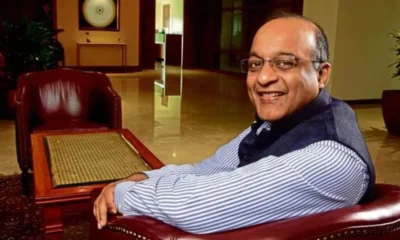

Ashok Hinduja reassures shareholders amid IndusInd Bank’s market turbulence

IndusInd Bank’s promoter, Ashok Hinduja, has assured investors of the bank’s stability, despite a sharp decline in its stock. He confirmed readiness to inject capital if required while emphasizing the strength of the bank’s financial position.

India News

Shashi Tharoor questions Centre over Kerala name change to Keralam

Shashi Tharoor has criticised the Centre’s decision to approve renaming Kerala as Keralam, questioning its impact and pointing to the lack of major projects for the state.

India News

Tamil Nadu potboiler: Now, Sasikala to launch new party ahead of election

Sasikala has announced the launch of a new political party ahead of the Tamil Nadu Assembly elections, positioning herself against AIADMK chief Edappadi K Palaniswami.

India News

As stealth reshapes air combat, India weighs induction of Sukhoi Su-57 jets

India is assessing the possible induction of up to 40 Sukhoi Su-57 fifth-generation fighter jets as stealth becomes central to future air combat strategy.

-

India News21 hours ago

India News21 hours agoAs stealth reshapes air combat, India weighs induction of Sukhoi Su-57 jets

-

Cricket news21 hours ago

Cricket news21 hours agoRinku Singh returns home from T20 World Cup camp due to family emergency

-

India News20 hours ago

India News20 hours agoTamil Nadu potboiler: Now, Sasikala to launch new party ahead of election

-

Latest world news8 hours ago

Latest world news8 hours agoTrump says tariffs will replace income tax, criticises Supreme Court setback in key address

-

Latest world news7 hours ago

Latest world news7 hours agoPM Modi to begin two-day Israel visit, defence and trade in focus

-

Latest world news8 hours ago

Latest world news8 hours agoTrump repeats claim of averting India-Pakistan nuclear war during Operation Sindoor

-

India News7 hours ago

India News7 hours agoShashi Tharoor questions Centre over Kerala name change to Keralam