India News

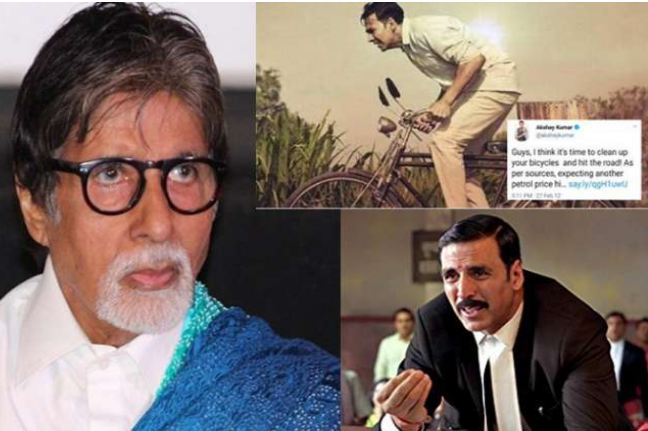

Petrol price jokes: Tweeple dig up old tweets crying of petrol price when it was Rs 75. Now it is almost Rs 100, and silence

Petrol prices were hiked again by 80 paise a litre for a second straight day while domestic cooking gas LPG rates were increased by Rs 50 per cylinder.

India News

Security tightened across Delhi metro stations after bomb threat emails

Delhi is on high alert after bomb threat emails targeted metro stations, the Red Fort and the Assembly. Authorities confirmed the threats were hoaxes but tightened security as a precaution.

India News

JNU protest turns violent as Left and Right student groups trade charges

A late-night protest at JNU turned violent as Left and ABVP student groups accused each other of stone-throwing and attacks near the East Gate.

India News

World praised India’s AI potential at AI Impact Summit, says PM Modi

PM Modi said the world praised India’s AI potential at the AI Impact Summit 2026, where 89 countries endorsed the New Delhi Declaration on artificial intelligence.

-

LATEST SPORTS NEWS16 hours ago

LATEST SPORTS NEWS16 hours agoICC Men’s T20 World Cup 2026: South Africa outclass India with smart slower-ball strategy in Super 8

-

India News16 hours ago

India News16 hours agoJNU protest turns violent as Left and Right student groups trade charges

-

India News17 hours ago

India News17 hours agoDevendra Fadnavis seeks CBI probe into Ajit Pawar plane crash

-

India News16 hours ago

India News16 hours agoWorld praised India’s AI potential at AI Impact Summit, says PM Modi

-

Latest world news10 hours ago

Latest world news10 hours agoBangladesh president Shahabuddin accuses Yunus of conspiracy to unseat him

-

India News9 hours ago

India News9 hours agoSecurity tightened across Delhi metro stations after bomb threat emails