India News

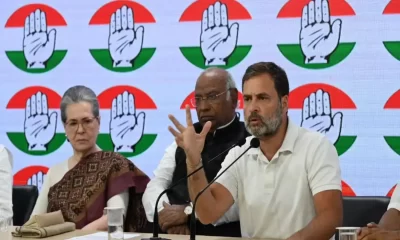

Scrapped notes’ counting still on, opposition dissatisfied

India News

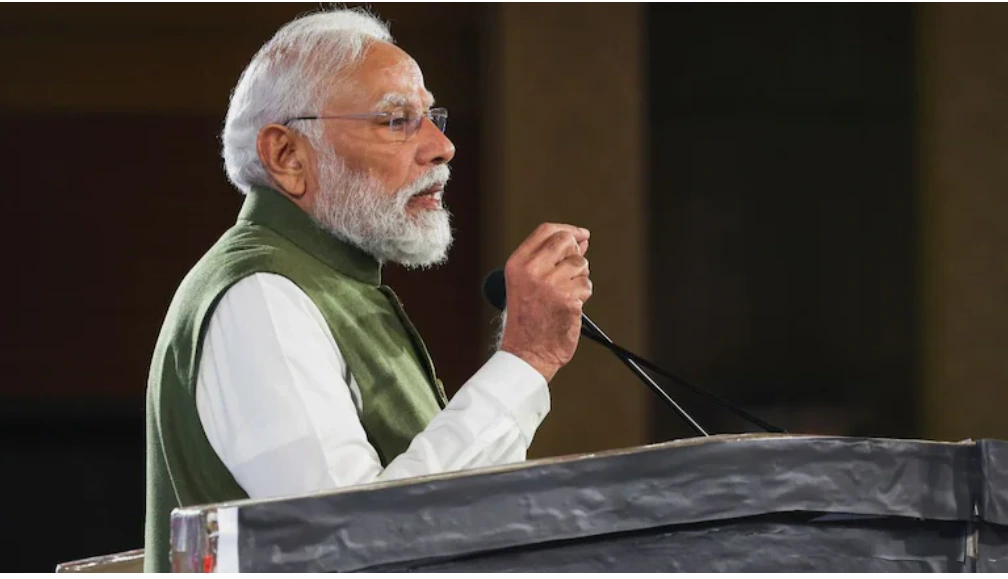

PM Modi skips Lok Sabha reply as protests force repeated adjournments

PM Modi did not deliver his Lok Sabha reply today after sustained Opposition protests led to repeated adjournments over a dispute involving Rahul Gandhi’s proposed speech.

India News

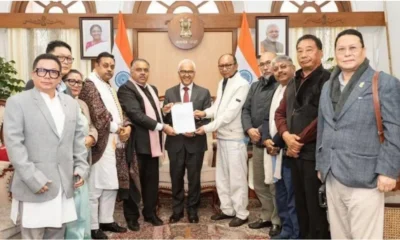

President’s Rule revoked in Manipur as NDA set to form new government

President’s Rule has been withdrawn in Manipur nearly a year after its imposition, paving the way for a new NDA-led government under Yumnam Khemchand Singh.

India News

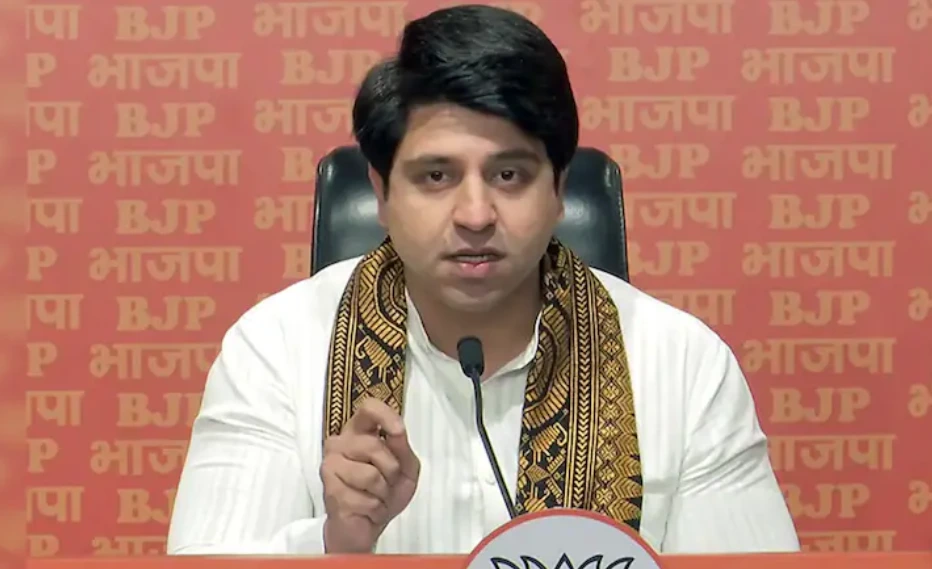

BJP spokesperson Shehzad Poonawalla’s mother injured in hit-and-run incident in Pune

BJP spokesperson Shehzad Poonawalla has alleged that his mother was deliberately hit by a car in Pune and left critically injured. She is scheduled to undergo surgery.

-

India News15 hours ago

India News15 hours agoThree sisters die after jumping from ninth floor in Ghaziabad

-

India News15 hours ago

India News15 hours agoBJP spokesperson Shehzad Poonawalla’s mother injured in hit-and-run incident in Pune

-

Latest world news15 hours ago

Latest world news15 hours agoMoscow says no word from India on stopping Russian oil purchases

-

India News16 hours ago

India News16 hours agoUS tariff cut to 18% is positive signal for Indian exporters, says Sitharaman

-

Entertainment11 hours ago

Entertainment11 hours agoBorder 2 box office collection day 12 crosses Rs 286 crore, eyes Rs 300 crore milestone

-

India News9 hours ago

India News9 hours agoPresident’s Rule revoked in Manipur as NDA set to form new government

-

India News5 hours ago

India News5 hours agoPM Modi skips Lok Sabha reply as protests force repeated adjournments