Latest business news

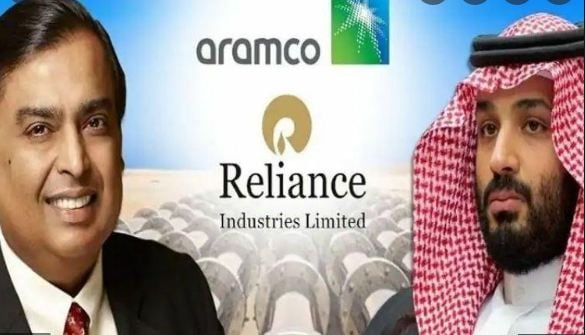

Reliance AGM 2023: The Reliance Industries Limited annual general meeting will be held on August 28, 2023 at 2pm

Analysts in the market predict that after the demerger of Jio Financial Services Ltd (JFSL) from RIL, the AGM will likely bring forth significant announcements regarding the forthcoming IPOs of Future Retail and Reliance Jio

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

India News20 hours ago

India News20 hours agoPM Modi accuses Congress of anti-Sikh bias over Rahul Gandhi’s ‘traitor’ remark

-

India News5 hours ago

India News5 hours agoPunjab AAP leader Lucky Oberoi shot dead in daylight attack in Jalandhar

-

India News5 hours ago

India News5 hours agoPariksha Pe Charcha 2026: PM Modi to interact with students at 10 am today

-

Latest world news4 hours ago

Latest world news4 hours agoBangladesh rushes to finalise US trade deal after India secures lower tariffs