India News

GST 2.0 takes effect: Key tax cuts and reforms you should know

GST 2.0, India’s next generation of Goods and Services Tax reforms, takes effect from September 22. The overhaul brings wide-ranging changes including exemptions on insurance, lower GST on face powders and shampoos, and revised rates for medicines, milk, and delivery services. Here’s a detailed look at the key updates

India News

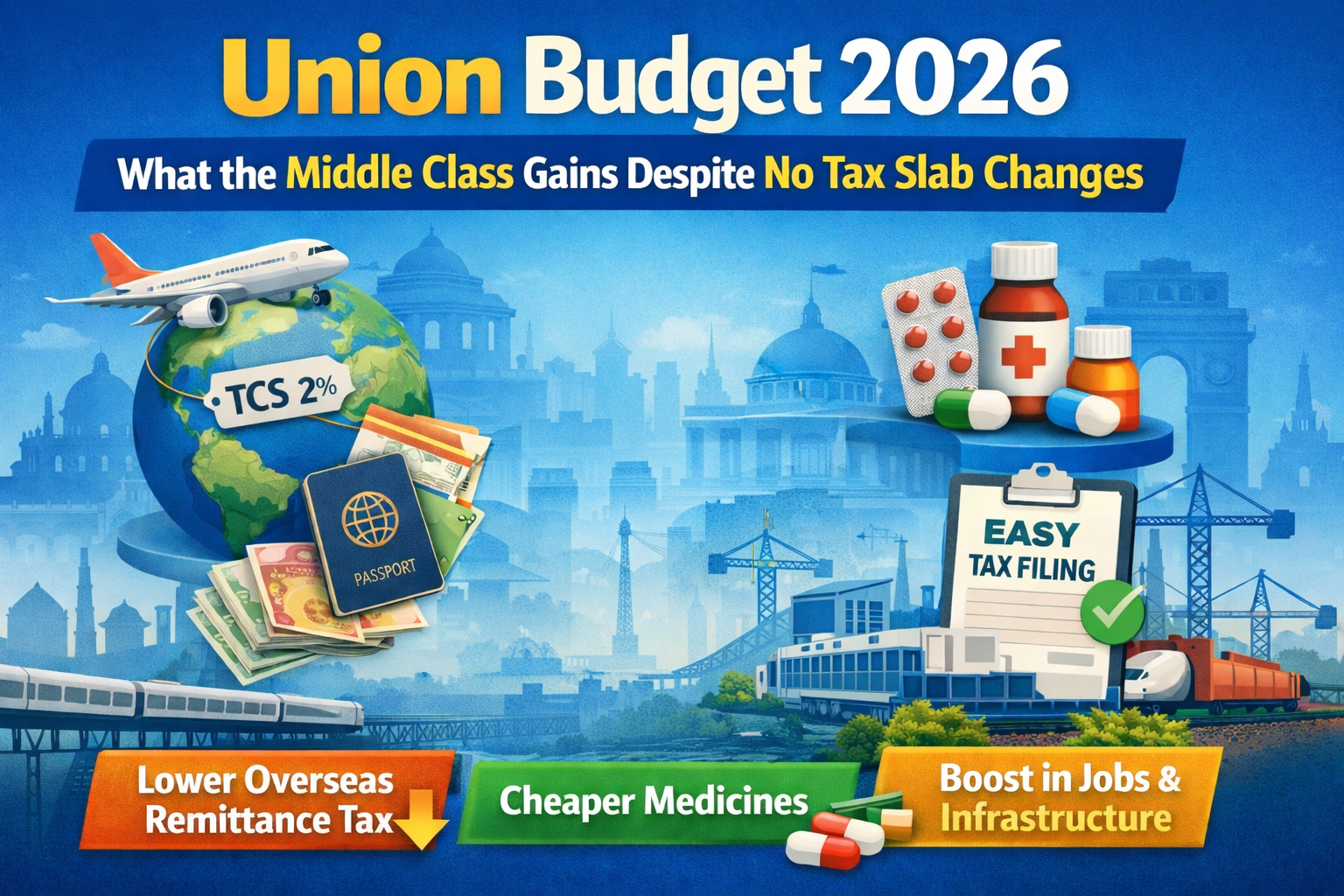

Union Budget 2026: What the middle class gains despite no income tax slab changes

Union Budget 2026 retains income tax slabs but offers indirect relief to the middle class through TCS cuts, simpler tax filing, cheaper medicines and higher job-creating expenditure.

India News

Budget 2026 balances high capex and growth, says PM Modi

Prime Minister Narendra Modi said Union Budget 2026 strikes a balance between high capital expenditure and strong growth while reinforcing reforms and fiscal discipline.

India News

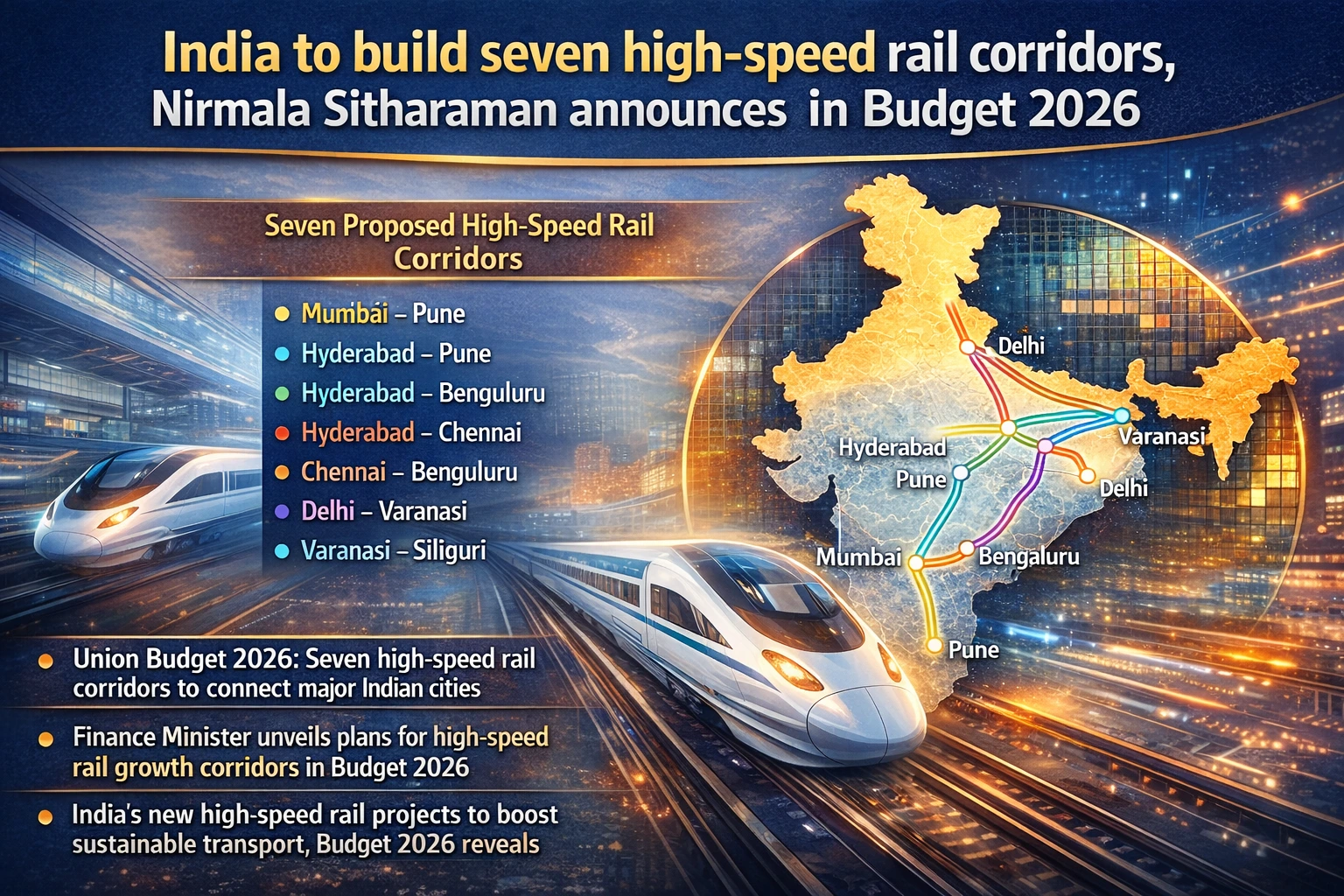

India to build seven high-speed rail corridors, Finance Minister announces

Union Budget 2026-27 unveiled seven high-speed rail corridors and a dedicated east-west freight corridor to boost sustainable transport and economic growth.

-

India News12 hours ago

India News12 hours agoUnion Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

-

India News12 hours ago

India News12 hours agoNirmala Sitharaman to present ninth Union Budget with reforms in focus

-

India News10 hours ago

India News10 hours agoIndia announces Rs 40,000 crore boost for semiconductor sector in Union Budget 2026

-

India News10 hours ago

India News10 hours agoIndia to build seven high-speed rail corridors, Finance Minister announces

-

India News7 hours ago

India News7 hours agoUnion Budget 2026: What the middle class gains despite no income tax slab changes

-

India News7 hours ago

India News7 hours agoBudget 2026 balances high capex and growth, says PM Modi