India News

Poor performance by public sector banks, says RBI report

India News

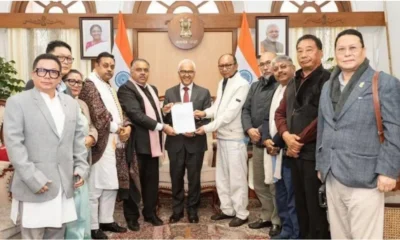

Manipur Assembly to meet at 4 pm today, floor test likely under new chief minister

The Manipur Legislative Assembly will convene at 4 pm today, with a floor test likely as the new chief minister seeks to prove his majority in the House.

India News

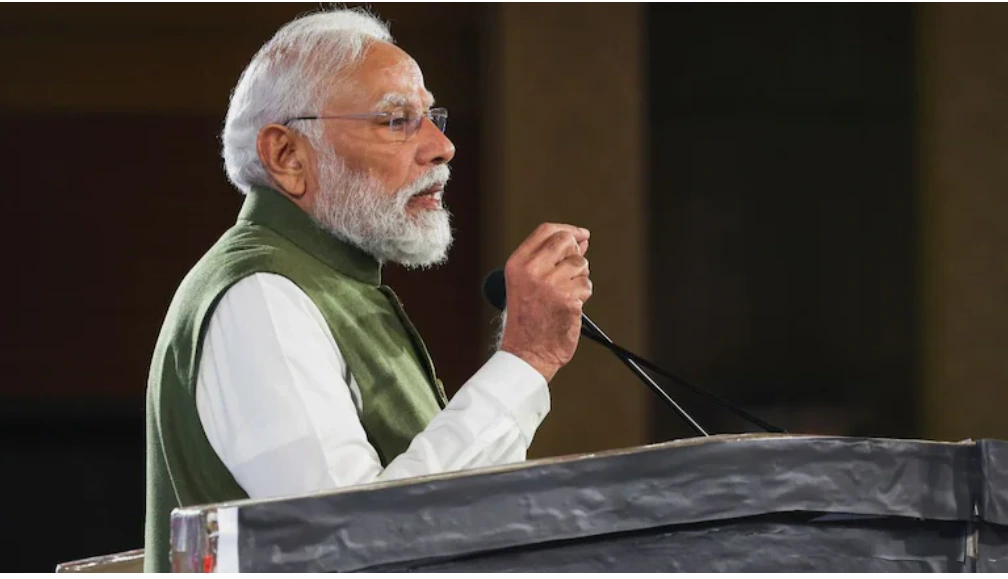

PM Modi skips Lok Sabha reply as protests force repeated adjournments

PM Modi did not deliver his Lok Sabha reply today after sustained Opposition protests led to repeated adjournments over a dispute involving Rahul Gandhi’s proposed speech.

India News

President’s Rule revoked in Manipur as NDA set to form new government

President’s Rule has been withdrawn in Manipur nearly a year after its imposition, paving the way for a new NDA-led government under Yumnam Khemchand Singh.

-

India News24 hours ago

India News24 hours agoPresident’s Rule revoked in Manipur as NDA set to form new government

-

India News20 hours ago

India News20 hours agoPM Modi skips Lok Sabha reply as protests force repeated adjournments

-

Cricket news6 hours ago

Cricket news6 hours agoPakistan PM Shehbaz Sharif confirms boycott of India match at T20 World Cup

-

Latest world news6 hours ago

Latest world news6 hours agoPakistan faces domestic backlash after India secures lower tariffs in US trade deal

-

Latest world news7 hours ago

Latest world news7 hours agoNew Delhi free to buy oil from any source, Russia says amid US deal claims

-

India News2 hours ago

India News2 hours agoManipur Assembly to meet at 4 pm today, floor test likely under new chief minister