[vc_row][vc_column][vc_column_text]Pioneers in Asia: LegitQuest’s technology provides solutions to legal search problems with case references just a click away

In India, every industry or service sector is unique and gets impacted by technology differently. The legal service sector is one such critical sector which ensures that all rules and regulations constituted are implemented well.

The Indian legal services market expanded by 16 per cent through the 2007–12 fiscal years. The market is expected to grow at a CAGR of 14.9 percent between 2015 and 2018. The use and impact of technology arrived a little later in the Indian Legal Services Sector than in other sectors. The use of Artificial intelligence (AI), machine learning, deep learning and Natural Language Processing (NLP), already implemented in various other sectors, such as Healthcare, Banking, Services etc., is now picking up pace within the Legal Services Sector.

Many Indian Legal-Tech startups are looking to leverage such state-of-the-art, modern technologies to make the life of legal professionals easier, more efficient and simpler.

The legal profession is considered to be one of the largest, and a noble profession in India. About 17 lakh lawyers are currently practising in India. But in the years gone by, practising litigation had been a hard task for them. An active litigation requires a practitioner to put approximately a third of his/her time in carrying out solid legal research for his/her cases. And this can only happen if the professionals have sufficient and reliable resources to back their research. Gone are the days when lawyers used to maintain a vast library in their offices/homes.

In this era of digitization, most lawyers, judges and students have moved online to carry out their basic research. However, there is a scarcity of efficient search portals and research tools for them to use for the purpose. Yet 33.9 % of the attorneys frequently initiate their research by using Google, which is the most generic search engine.

And in this search, legal stakeholders are still wasting precious time scanning for relevant case laws or any other secondary source. That has remained a problem issue. There is a great need to have a legal data oriented smart-search engine. Also, case law data is still served in the raw form in India by many online legal data companies. Even when, after wasting a lot of time, the user gets the relevant data, they still have a hard time extracting a specific piece of information that he/she needs for a proper case analysis. The whole approach of reading and analysing case laws demands a revolutionary change. Only that will lead to more efficient and faster research.

LegitQuest as a solution provider

Such significant gaps in the legal research domain in India provide strong reasons for any young, courageous and innovative company to derive a solution. LegitQuest (https://www.legitquest.com/) is such a company.

LegitQuest is a Legal-Tech venture run by a versatile team of tech-savvy attorneys, engineers, designers and management professionals from top-notch universities and institutes who aim to make the practice of law simpler for its end users. Among the professionals are PhD’s and LLMs, sourced from IITs, IIMs and other reputable institutions.

LegitQuest seeks to transform centuries-old unorganised and unstructured legal data for the benefit of the legal fraternity. LegitQuest believes in providing access to a vast and comprehensive legal data bank to its users in the most reliable, accurate, valuable and speedy manner.

Who we are at LegitQuest

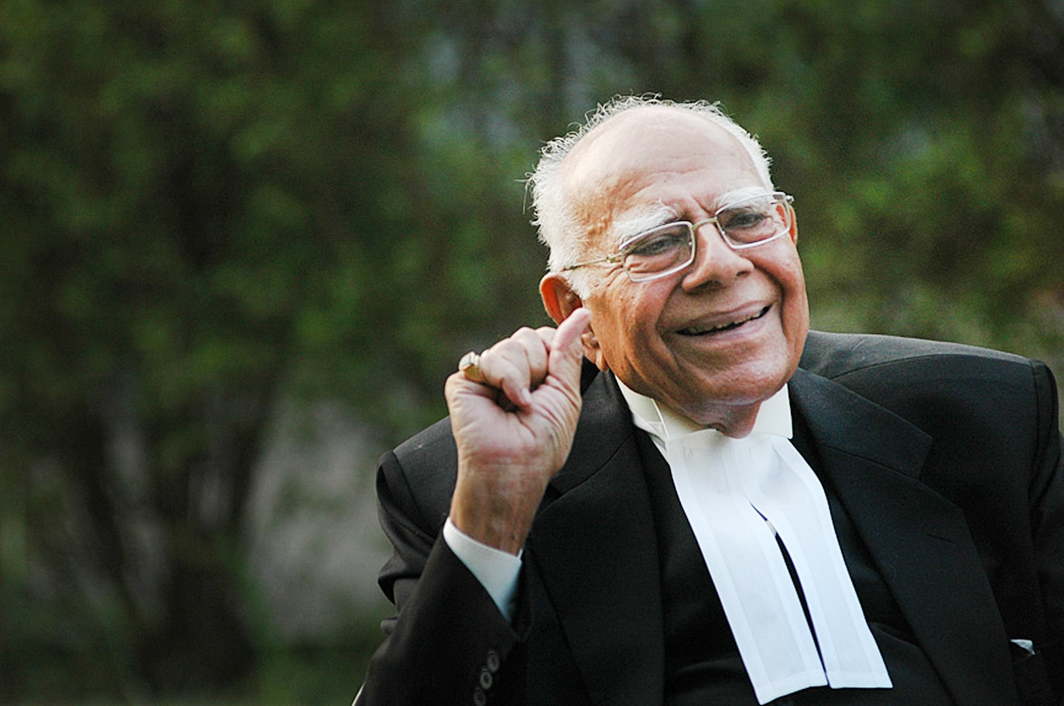

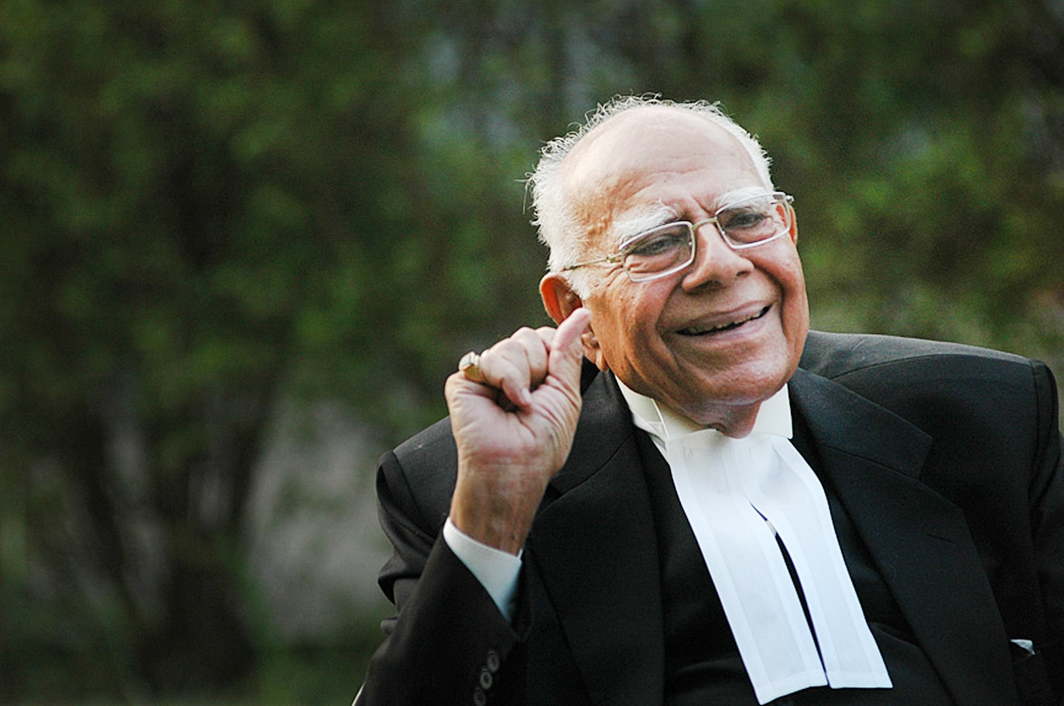

LegitQuest has eminent jurist Mr Ram Jethmalani as its investor, patron and advisor. The company is the initiative of Mr Karan Kalia who is also the CEO. He had previously worked with Mr Ram Jethmalani for more than six years. He has done his Masters of Laws (LLM) and the Wharton Business program from the prestigious University of Pennsylvania, USA. The core team also consists of Mr Himanshu Puri, who takes care of the business operations and management of the company. He has lately worked with one of the most renowned start-ups, UpGrad.com. He holds a Doctorate in Management and a Masters degree in Business Administration from IBS, Hyderabad.

The team also has Mr Rohit Shukla, who is head of Engineering and Technology of the company. He had been the technology head of Lexis India for five years within his vast experience of more than 20 years. He is an alumnus of IIT, Bombay and IIM, Calcutta.

The stakeholders

LegitQuest has built a one of its kind go-to platform with the most advanced technologies for the communities of attorneys, law firms, state judicial officers, law students, corporates, the government, consulting companies, litigants, and many other stakeholders in the legal system.

What we do (Search Engine & Research Tool) and How (the Technology)

To solve the issue of finding a relevant case law or another secondary source, LegitQuest has come up with the most advanced search engine, called as iSearch, developed by using Artificial Intelligence. Such an engine helps find any case by typing the case citation, party name, judge name or anything as free text. It aids to improve user’s work processes, reduce cost and ultimately generates favourable results for users.

It is a known fact that our brain has a hard time processing unstructured and complex data. With the help of machine learning, LegitQuest has also transformed complex and raw data into a user-friendly form to help legal stakeholders to research faster and more efficiently. LegitQuest has a feature called as iDraf that provides the user with decision, reasoning, arguments and finding of a case with just a click. This tool contains tabs that take the user to specific portions of the judgment within a few seconds for making the job of analysing the case simpler and faster.

It must be mentioned here that iDRAF is an absolutely unique feature developed by LegitQuest. Such a feature is not available anywhere else in the world, including start-ups such as Westlaw, LexisNexis and Bloomberg. This is the USP of LegitQuest.

Experts have proven that visuals have a positive impact on the human mind for learning and memorising. LegitQuest is also coming up with iGraphics that condense the treatment of overruled, distinguished, followed and relied upon case laws in relevant figures and charts making data into a single canvas for easy reference and understanding.

The Vision – One Stop solution for legal stakeholders

It does not end here for LegitQuest. LegitQuest is in the process of devising various other features for its users to make their work easier. Some of them are in the pipeline, such as iAlert. Right now, lawyers and litigants spend substantial time in checking the cause list on a frequent basis to get themselves updated about their case hearings. iAlert will notify about the case hearing of a pending matter in various High Courts and the Supreme Court of India. The notification will be sent through SMS, Email and later on through Mobile App. LegitQuest envisions making the legal practice more convenient, effortless and qualitative in India and abroad. The team wants to make LegitQuest as a one-stop solution for its users with the help of such supporting features.[/vc_column_text][/vc_column][/vc_row]

Latest world news12 hours ago

Latest world news12 hours ago

Latest world news12 hours ago

Latest world news12 hours ago

India News11 hours ago

India News11 hours ago

Latest world news11 hours ago

Latest world news11 hours ago

India News11 hours ago

India News11 hours ago