Economy news

RBI cuts interest rates as economy slows, India loses out to China as fastest growing economy

Economy news

ITR filing last date today: What taxpayers must know about penalties and delays

The deadline for ITR filing ends today, September 15. Missing it may lead to penalties, interest charges, refund delays, and loss of tax benefits.

Economy news

India’s GDP surges 7.8% in Q1, outpaces estimates and China

India’s GDP surged 7.8% in Q1 2025-26, the highest in five quarters, driven by strong services and agriculture sector growth, according to NSO data.

Economy news

Sensex falls 600 points, nifty slips 180 as US tariffs hit Indian markets

Indian equity markets witnessed sharp declines as US tariffs on Indian imports took effect. Sensex dropped over 600 points, while Nifty fell nearly 180 points in early trade.

-

India News20 hours ago

India News20 hours agoDMK leader’s son arrested after car rams family in Krishnagiri, one dead

-

India News19 hours ago

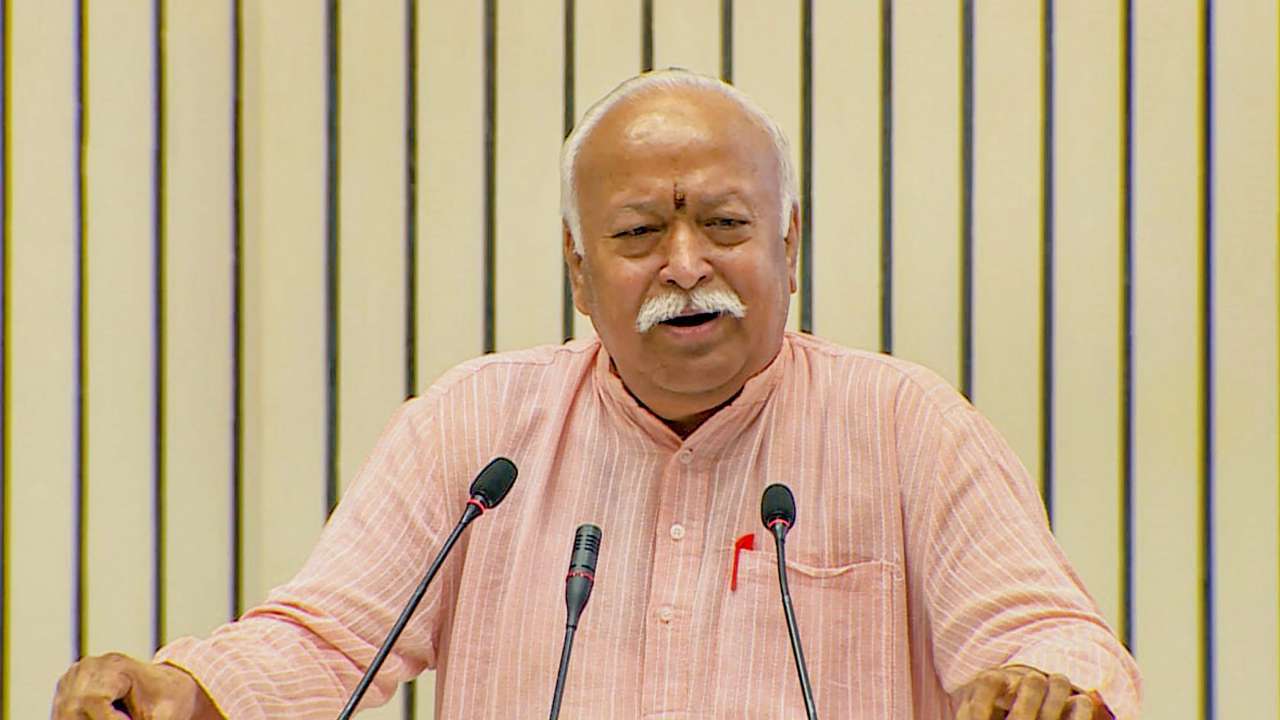

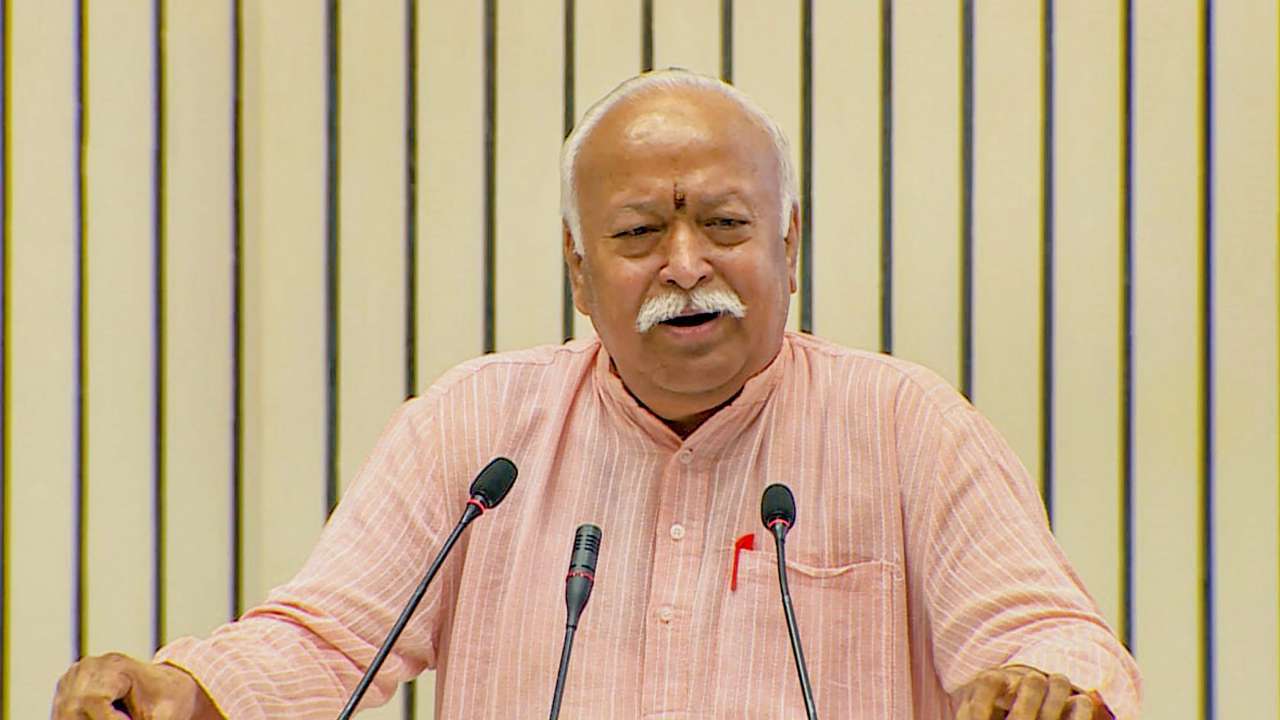

India News19 hours agoRSS chief backs nationwide rollout of Uniform Civil Code, cites Uttarakhand model

-

India News10 hours ago

India News10 hours agoAs stealth reshapes air combat, India weighs induction of Sukhoi Su-57 jets

-

Cricket news10 hours ago

Cricket news10 hours agoRinku Singh returns home from T20 World Cup camp due to family emergency

-

India News9 hours ago

India News9 hours agoTamil Nadu potboiler: Now, Sasikala to launch new party ahead of election