Featured

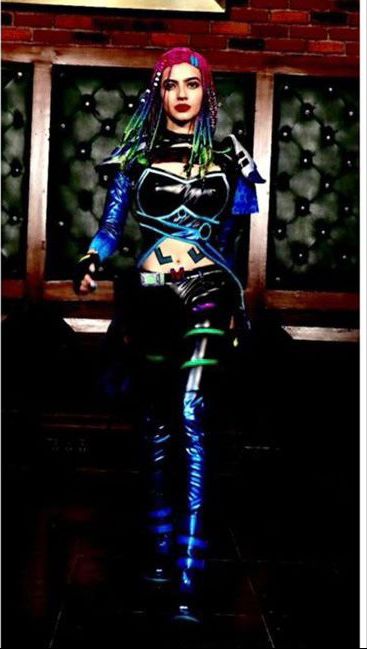

Kashika Kapoor the young 19 year old Becomes the Face of The International Video Game Free Fire- First Ever Indian to do so.

Yes, kashika kapoor, a Diva is born yes your right Our Nations MOCO ( the face & voice of MOCO worldwide) from the Game FreeFire GARENA who has won millions of hearts in less than 7 hours of its release & IS TRENDING ON THE #1 TRENDING IN INDIA ……

SHE IS OUR MOCO,WORLDWIDE.

Yes, kashika kapoor, a Diva is born yes your right Our Nations MOCO ( the face & voice of MOCO worldwide) from the Game FreeFire GARENA who has won millions of hearts in less than 7 hours of its release & IS TRENDING ON THE #1 TRENDING IN INDIA is none other than our 19 year old O mere dil ke chaine girl Kashika Kapoor the gorgeous innocent girl who did Shahid Mallyas romantic song in Saregama.

This super talented girl is now the nations Action girl MOCO of the game Free Fire. Not just that but her voice too becomes extremely famous now. She’s extremely versatile & can get into any character so effortlessly she’s a Star ⭐️ we’ve waited for her since so long & she’s finally arrived.

She’s THE non-nepo product we’ve been waiting for since long & she’s finally here the nation’s new crush the 19 year old Young girl Kashika Kapoor kudos to her & all hearts for her ♥️♥️ Kashika has indeed killed it with her stunts, her looks ,her confidence & her lovely acting skills. Sources from the inside tell us of how She trained for hours & hours in order to get the stunts right.

She got bruised again & again but didn’t stop & instead rehearsed for even longer hours, she trained with Rohit Shetty’s team for hours,the director even told her to take a couple of days off but since she was injured for a very long time but she still continued rehearsing with those injuries… this shows her passion towards her work,not just that but she makes sure to be down to earth as always,which is her normal nature and this has won our hearts even more than ever,her HUGE debut news is going to be out soon! Stay tuned. This young girl has a lot to offer & we believe in that. Shes getting a huge launch even before the star kids & at such a young age, all due to her hardwork & talent. She’s going to be making a massive debut now ,the news on the same will be releasing soon & we’re all completely sure that she’ll be seen as everyone’s competition because of her killer talent & looks. This girl is massively hardworking & has won all of our hearts.

Read Also: Healthy morning drinks that you should try to boost immunity

Kashika kapoor at the same time gets approached & chosen for call of duty’s protagonist role,but drops it since her movie dates are clashing with it. 🤍 she’s also studying side by side,she’s taken up BBA & says that knowledge is power hence she never wants to quit her education. She’s doing wonders already,we can’t wait to see her in Bollywood soon too.

Featured

Nima Sulaiman joins HiLITE Group Board, her father gifts her a Porsche

Nima expressed her gratitude for the opportunity and her eagerness to contribute to the group’s success.

In a move signalling a generational shift in leadership and a commitment to empowering women in the business world, Nima Sulaiman, the daughter of HiLITE Group Chairman P. Sulaiman, has been welcomed onto the board of directors with a stunning gesture—a Porsche worth Rs 3 crore.

At just 18, Nima began her journey with HiLITE Group as a customer service trainee at Hug a Mug Cafe. From there, she transitioned to management roles, showcasing her talent and dedication. With a B.Sc in Economics from the University of London in Singapore, Nima brings a unique blend of academic prowess and practical experience to her new position.

As the Director of HiLITE Urban, a subsidiary of HiLITE Group, Nima is poised to continue the company’s legacy of excellence in construction and development. With a focus on providing quality living spaces and international standards in India, HiLITE Group has been instrumental in transforming Kozhikode city with its innovative projects that include premium residential buildings, ultra modern business parks, state-of-the-art malls and world-class entertainment theaters.

Group Chairman P. Sulaiman expressed his sentiments regarding his daughter’s recent appointment within the Group. He said, “I am immensely proud of Nima’s accomplishments and firmly believe that she is capable to take on greater responsiblities. HiLITE Group has always shed light on the significance of acknowledging and empowering women in leadership positions.” He further emphasised, “The emotional intelligence that women bring to the table is pivotal for fostering effective leadership and establishing trust.”

Nima, in turn, expressed her gratitude for the opportunity and her eagerness to contribute to the group’s success. “Inspired by my experiences visiting renowned malls worldwide, I strive to enrich the atmosphere of HiLITE malls and other projects, infusing them with vibrancy and youthfulness,” she said.

The appointment of Nima Sulaiman to the board of directors represents a significant milestone for HiLITE Group and a testament to the company’s commitment to innovation and inclusivity in the business world. As Nima takes on her new role, she stands as a beacon of inspiration for young women entrepreneurs in South India and beyond.

Featured

Steps to effective retirement planning

The importance of retirement planning depends on ensuring you have adequate funds to live comfortably after you stop earning a stable income.

Retirement planning is a critical aspect of financial stability that often goes overlooked until it’s too late. In India, where the culture of savings is ingrained yet formal retirement planning is still evolving, understanding, and initiating a retirement plan is more crucial than ever.

The importance of retirement planning depends on ensuring you have adequate funds to live comfortably after you stop earning a stable income. It is not only about saving a part of your earnings but also about investing in yourself. Here are some crucial reasons to begin retirement planning – combating inflation, securing financial freedom, managing medical expenditures, maintaining your living standard, supporting family requirements, meeting post-retirement goals, preparing for unanticipated circumstances, and leaving a legacy for dependents.

Here are ways to effectively plan your retirement –

Ø Utilise an online retirement calculator

An important instrument for planning, an online retirement calculator can assist you estimate how much you require to save to live a post-retirement life. It factors in your existing age, savings, retirement age, investments, and anticipated inflation rates.

Anjali is looking to retire at the age of 60 with a lifestyle that needs Rs 50,000 per month. Utilising an online retirement calculator, she considers her existing age of 30, anticipated inflation of 6 per cent and prevailing savings. The calculator estimates she needs a corpus of approximately Rs 2.5 crores to sustain her retirement life, helping her strategise her savings and investments accordingly.

Ø Start early

The sooner you start, the more you benefit from compound interest. Even starting small can lead to substantial growth over decades.

Imagine Rohit, who starts saving Rs 5,000 a month at age 25 in a mutual fund that averages an 8% annual return. By the time he turns 60, his investment would have grown to over Rs 1.50 crore, thanks to compound interest. In contrast, if Priya starts saving the same amount at 35 under the same conditions, she would accumulate about Rs 67 lakhs by age 60. The decade-long head start allows Rohit’s investments more time to compound, significantly impacting his retirement corpus.

Ø Create a retirement budget

Estimate your post-retirement expenses, considering inflation and changing lifestyle needs. Including fixed expenses, healthcare, leisure, and unexpected costs.

Vijay, nearing retirement, lists down his monthly expenses including groceries, utilities, healthcare, and leisure activities like travel and hobbies. Considering inflation, he predicts his current monthly expense of Rs 30,000 will rise to Rs 80,000 by the time he retires. This projection helps him understand how much he needs to save to maintain his lifestyle post-retirement.

Ø Opt for a pension plan

Investing in pension plans offered by insurance companies can guarantee a steady income post-retirement. They also provide tax benefits under Section 80C.

Raj invests in a pension plan that promises a monthly income of Rs 20,000 after retirement. This plan not only secures his future financially but also offers tax benefits today, making it a win-win investment for his retirement years.

Ø Diversify your investment portfolio

Do not put all your eggs in one basket. Invest in a mix of asset classes including equity, debt, mutual funds, and real estate. Consider your risk appetite and investment horizon.

Meena, an investor, allocates her savings across different asset classes—40 per cent in equity for growth, 30 per cent in bonds for stability, 20 per cent in mutual funds for diversified exposure, and 10 per cent in real estate for passive income. This diversification helps balance her risk and provides multiple growth avenues, ensuring her portfolio is well-equipped to handle market volatility.

Ø Maximise your EPF and PPF contributions

The EPF or employee provident fund and PPF or public provident fund are excellent tax-saving instruments that offer secure, high-interest earnings for retirement.

Sunita contributes the maximum allowable limit to her EPF and PPF accounts every year. These contributions not only reduce her taxable income but also accumulate tax-free earnings, creating a significant retirement fund that’s secure and government-backed.

Ø Maintain an emergency fund

Ensure you have an emergency fund worth at least 6-12 months of living expenses. This fund should be easily accessible and kept separate from your retirement savings.

Deepika saves six months’ worth of expenses in a liquid fund, separate from her investments and retirement savings. This fund acts as a financial cushion during unexpected events, such as medical emergencies or sudden unemployment, ensuring her long-term plans remain undisturbed.

Ø Invest in NPS or national pension scheme

The NPS is a government-backed retirement planning instrument that is market-linked and offers various fund options based on your risk tolerance.

Karan opts for the NPS, choosing a mix of equity, corporate bonds, and government securities, aligning with his moderate risk appetite. This allows his retirement savings to grow with the market while offering the flexibility to adjust the asset allocation as he gets closer to retirement.

Ø Educate yourself financially

Stay informed about financial planning, investment options, tax laws, and market trends. Knowledge is power, especially when it comes to managing your money.

Neha spends her time reading blogs linked with finance, attending workshops, and consulting with financial professionals. This constant learning equips her with considerable knowledge to make better decisions about her tax planning, investments, and retirement plan, ensuring she enhances her financial potential.

Ø Assess as well as adjust your plan periodically

Your retirement plan should adapt to your changing life circumstances. Annually, review your assets, savings, and goals and make any necessary modifications.

Every year, Amit updates his retirement plan to reflect changes in his income, spending, and life goals. This regular review keeps him on pace with his retirement objectives, allowing him to make necessary modifications to his savings rate and investment selections.

Final thoughts

Retirement planning is more than a financial responsibility; it is a commitment to your future self. Beginning today not just secures your financial future, but even endows you with mental peace and the opportunity to spend your retirement years as you see fit. Attaining a comfortable retirement involves vision, a proactive attitude, and discipline. Note that it is never too early or very late, to begin with retirement planning. The steps you take now can result in a better and more secure tomorrow.

Featured

Supreme Court AOR firm Vedic Legal settles the debate: Can ancestral property be sold without the consent of successors?

New Delhi (India), June 24: Ancestral property is a valuable asset that is passed

down from one generation to another. It is a symbol of family heritage and pride

that holds significant sentimental value for many families. However, the question

that has been long debated is whether ancestral property can be sold without the

consent of all successors.

According to Indian law, ancestral property is considered to be the collective

property of all successors of the original owner. As a result, the sale of ancestral

property without the consent of all successors is generally not allowed. The

reasoning behind this is that ancestral property is seen as a collective asset, and

all successors have an equal right to it.

However, in certain cases, the sale of ancestral property without the consent of all

successors may be allowed by law. For instance, in cases where the owner of the

property has died intestate and there is no will or agreement in place, legal heirs

may be able to sell off the ancestral property without seeking consent from all

other successors.

It is important to note that the rules regarding the sale of ancestral property

without consent may vary from state to state. Therefore, it is essential to consult a

lawyer before making any decision regarding the sale of ancestral property.

Supreme Court Advocate on record firm with Vedic Legal, a renowned law firm

specializing in property and succession law, recently settled a landmark case in

the Supreme Court. The case involved the sale of ancestral property without the

consent of all successors, and Supreme Court AOR firm Vedic Legal argued that

such a sale was not permissible under Indian law.

The verdict of the Supreme Court, based on Supreme Court AOR firm Vedic Legal

arguments, confirmed that ancestral property could not be sold without the

consent of all successors. This ruling has set a precedent for future cases and has

provided clarity on a contentious issue that has long been debated.

The complexity of the issue of selling ancestral property without the consent of

successors is not lost on legal experts. It is crucial to consider the legal and

ethical implications of such a sale, as it can have significant consequences for all

parties involved.

In some cases, however, selling the ancestral property without the consent of all

successors may be the best option. For example, in cases where there are

disputes between heirs or when some heirs are not reachable, selling ancestral

property without the consent of all successors may be allowed by law.

Additionally, in certain circumstances, selling the ancestral property without

consent may be the only way to resolve financial difficulties faced by the owners of

the property. This may include situations where the owners require funds for

medical treatment or other urgent needs.

However, any decision to sell the ancestral property without the consent of all

successors should be made after careful consideration and consultation with legal

experts. It is essential to ensure that all legal requirements are met and that the

rights of all parties involved are protected.

The sale of ancestral property without consent is a complex issue that requires

careful consideration and legal guidance. While it may be possible in some cases,

it is generally accepted that ancestral property is a collective asset that cannot be

sold without the consent of all successors.

The recent landmark case settled by Supreme Court AOR firm Vedic Legal in the

Supreme Court has provided clarity on the legal aspect of selling ancestral

property without the consent of successors. It has set a precedent for future cases

and has highlighted the importance of seeking legal guidance before making any

decision regarding the sale of ancestral property.

-

Cricket news16 hours ago

Cricket news16 hours agoIPL 2024: Yashasvi Jaiswal hits brilliant century to help Rajasthan Royals beat Mumbai Indians by 9 wickets

-

2024 Lok Sabha Elections15 hours ago

2024 Lok Sabha Elections15 hours agoNCP (SP) leader Sharad Pawar says Prime Minister Narendra Modi is trying to create fear like Russian President Vladimir Putin

-

Entertainment14 hours ago

Entertainment14 hours agoMithun Chakraborty, Usha Uthup honoured with Padma Bhushan

-

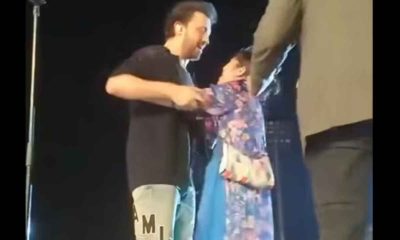

Entertainment12 hours ago

Entertainment12 hours agoFan jumps on stage and hugs Atif Aslam during concert, video goes viral

-

2024 Lok Sabha Elections14 hours ago

2024 Lok Sabha Elections14 hours agoPrime Minister Narendra Modi says listening to Hanuman Chalisa under Congress rule is a crime

-

Entertainment10 hours ago

Entertainment10 hours agoManisha Koirala reveals reason for rejecting Dil To Pagal Hai, says regrets that decision

-

2024 Lok Sabha Elections9 hours ago

2024 Lok Sabha Elections9 hours agoPM Modi says Congress leaders consider themselves above Lord Ram

-

India News16 hours ago

India News16 hours agoArvind Kejriwal given insulin in Tihar jail after sugar levels touch 320