India News

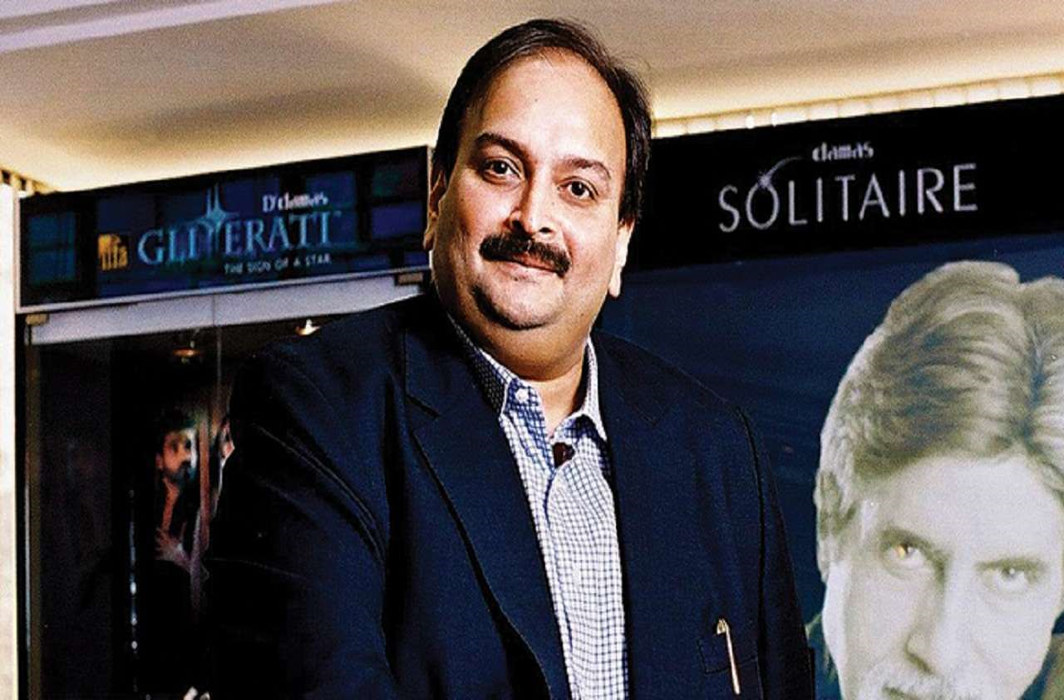

Interpol issues notice for Mehul Choksi in PNB loan scam case

The Interpol today (Thursday, Dec 13) issued a Red Corner Notice (RCN) against diamond merchant Mehul Choksi, said the CBI spokesperson in a statement.

The notice comes six months after the CBI sent a request to the international organisation in connection with the Rs 12,000 crore Punjab National Bank (PNB) fraud case. The fraud is being probed also by Enforcement Directorate (ED) and other agencies.

“The Interpol has issued a Red Corner Notice against Mehul Choksi on the request of the CBI,” CBI spokesperson Abhishek Dayal said.

The Interpol has already issued an RCN against Choksi’s nephew Nirav Modi and a few other associates.

Earlier, Choksi had challenged the CBI’s request, citing the poor condition of Indian jails, which he said violated “human rights conditions”.

Choksi also sought cancellation of the non-bailable warrant issued against him, claiming there was a threat to his life. He also cited “the recent trend of mob lynching” due to which he couldn’t travel to India. The CBI in its reply to Interpol assured that Choksi was an “economic offender” and would be provided with the necessary protection, said a report in The India Express (IE).

A five-member Interpol committee court, called the Commission for Control of Files, was set up to decide on CBI’s request. Choksi is currently residing in Antigua and Barbuda after obtaining citizenship earlier this year.

Antiguan authorities had told New Delhi that the only way it could restrict Choksi’s movement was the CBI could get a Red Corner Notice issued against him. A CBI official said the international warrant would also help the Antigua and Barbuda government to take a call on Mehul Choksi’s citizenship.

Mehul Choksi became a citizen of the Caribbean islands under a programme that extends its citizenship in exchange for investment in the twin-island state of Antigua and Barbuda. The Antigua government had, however, made it clear that there were provisions that allowed it to reopen the issue of his citizenship.

Earlier this year, the ED had moved applications before a special court in Mumbai seeking confiscation of the attached assets of Choksi under the recently promulgated Fugitive Economic Offenders Ordinance.

The CBI has chargesheeted both Nirav Modi and Choksi separately in the scam. The CBI, in its chargesheets last month, alleged Choksi swindled Rs 7,080.86 crore, making it the country’s biggest banking scam at over Rs 13,000 crore.

Nirav Modi allegedly siphoned Rs 6,000 crore.

An additional loan default of over Rs 5,000 crore to Choksi’s companies is also a matter of probe under the CBI.

It is alleged that Nirav Modi and Choksi through their companies availed credit from overseas branches of Indian banks using guarantees given through fraudulent LoUs and letters of credit which were not repaid bringing the liability on the state-run bank, officials said. An LoU is a guarantee given by an issuing bank to Indian banks having branches abroad to grant short-term credit to the applicant.

The instructions for transferring funds were allegedly issued by a bank employee, Gokulnath Shetty, using an international messaging system for banking called SWIFT platform and without making their subsequent entries in the PNB’s internal banking software, thus bypassing scrutiny in the bank, officials said

2024 Lok Sabha Elections

Lok Sabha Elections: Voter turnout 62.02% in Tamil Nadu till 5pm

The voter turnout in Tamil Nadu stands at 62.02%, while Uttar Pradesh records a turnout of 57.5%. Meanwhile, in West Bengal, voter participation surges to 77.5% as of 5 pm.

The Lok Sabha elections 2024 began today, marking the onset of the world’s largest electoral event. Voting ended in all 39 Lok Sabha constituencies in Tamil Nadu with a total voter turnout of 62.02%. State BJP chief and Coimbatore Lok Sabha constituency candidate K Annamalai said, they were getting complaints from a large number of voters that their names were missing from the voters’ list.

This incident happened in many places. Annamalai said they are demanding re-poll in places where the names of a large number of voters were missing.He said they had a doubt that there was some political interference because the names of a large number of BJP caders were missing from the voters list.

The voters in South Chennai showed lukewarm interest to participate in the election process and had a total voter turnout of 57.04% till 5pm. Although the overall percentage is poor, some areas like Thiruvanmiyur witnessed brisk polling from 7am onwards. Elderly, middle aged and young voters turned up and it was a family outing for many as they cast their vote.

Corporation volunteers assisted senior citizens with wheelchairs and guided them to their respective polling booths. The hot weather also had an impact on the polling as it reduced the voter turnout as many booths in the corporation school in MGR Nagar were seen deserted around noon. Senior citizens showed courage as they reached the polling booths in private vehicles to exercise their franchise.

Most of the polling booths had shamianas for voters so that they could wait in a queue. Some people even found refuge in the nearby buildings to save themselves from the scorching heat. The polling officials gave instructions to the voters to keep their phones switched off while they exercised their franchise. The security personnel at the polling booth also regulated traffic outside the polling booth in MGR Nagar.

2024 Lok Sabha Elections

Deserted by key supporters, the Kamal Nath story looks set to wind to an end in Chhindwara

Nath’s closest allies in his near 50-year reign—Deepak Saxena and Kamlesh Shah—have deserted him. His local team of corporators has also decided to jump ship leaving a gaping hole in Nath’s campaign trail.

By Neeraj Mishra

The Congress has lost Chhindwara only once since Independence when the wily Sunderlal Patwa was sent there by Atal Bihari Vajpayee to test Kamal Nath’s hold on the constituency. Patwa won the 1997 by-election by a slim margin in the backdrop of Nath having forced his wife to first contest and later vacate the seat for him. Nath, however, returned to his winning ways the very next year and has won the seat nine times.

It seems possible that Chhindwara, the lone surviving Congress seat, will be lost again this time and may be forever. A day ahead of polling, the town was drowned in saffron. Not so much the effect of vigorous campaigning by Vivek Sahu of the BJP but the Ram Navami festival which brought out saffron flags on every rooftop. The effect is likely to last since the polling is today. At 77, Nath is unlikely to contest another election here and his son Nakul seems like a pale shadow of his father unable to even make a forceful speech. The days of running Chhindwara from Shikarpur kothi are gone.

Nath’s closest allies in his near 50-year reign—Deepak Saxena and Kamlesh Shah—have deserted him. His local team of corporators has also decided to jump ship leaving a gaping hole in Nath’s campaign trail. Nakul had won by a margin of 37,000 votes in 2019 and the biggest lead had come from Kamlesh’s Amarwada Assembly segment. With Saxena in control of Chhindwara and forced to show his strength in his new party, it is highly likely that Nakul will not be depending on these segments. Instead, the Congress campaign was focused on Pandhurna, Parasia and Chaurai.

Amit Shah was in the region a couple of days ago and warned all BJP workers—old and new—against lethargy. His message was clear, the BJP wants all 29 seats this time. Cabinet Minister Kailash Vijayvargiya is camped here and using all his political acumen for the desired results. One such tactic was to raid the Shikarpur Kothi of Kamal Nath for his assistant Miglani who handles almost everything for him. With Miglani temporarily neutralised, BJP is best placed to repeat its win in Chhindwara in 1997.

2024 Lok Sabha Elections

Lok Sabha Elections 2024: Nearly 40% voter turnout till 1pm

Chennai recorded an average voter turnout of 34% as of 1 pm on Friday. According data released by the Election Commission of India, Chennai (North) recorded 35%, Chennai (Central) recorded 32.3% and Chennai (South) recorded 34%.

The first phase of voting for the 18th Lok Sabha elections started taking place in 21 states and Union territories on Friday. Nearly 40% voter turnout was recorded till 1pm across the states. Seats in Assam, Arunachal Pradesh, Chhattisgarh, Bihar, Maharashtra, Madhya Pradesh, Manipur, Mizoram, Meghalaya, Rajasthan, Nagaland, Tamil Nadu, Sikkim, Uttar Pradesh, Tripura, West Bengal, Uttarakhand, Jammu and Kashmir, Andaman and Nicobar Islands, Lakshadweep and Puducherry go to elections on Friday.

There has been a substantial increase in the voter turnout charts across the Northeast states, with Tripura leading at 53.04% until 1 pm, as per the data released by the Election Commission of India. Other northeast states like Manipur (46.92%) and Meghalaya (48.91%) are also witnessing high voter turnout. After Tripura, West Bengal is experiencing a high voter turnout of 50.96%.

Chennai recorded an average voter turnout of 34% as of 1 pm on Friday. According data released by the Election Commission of India, Chennai (North) recorded 35%, Chennai (Central) recorded 32.3% and Chennai (South) recorded 34%.

Over 33% voter turnout was recorded in the first 6 hours of voting on Friday in 12 parliamentary constituencies of Rajasthan. According to the Election Commission, voting started at 7 am amid tight security arrangements and 33.73 % voting took place till 1 pm. The highest voter turnout of 40.72 % was recorded in the Ganganagar Lok Sabha seat while Karauli-Dholpur saw the lowest turnout of 28.32 %. Jaipur recorded a poll percentage of 39.35 %.

Over 37 % voter turnout was recorded till 1 pm in the Lok Sabha election being held for five parliamentary constituencies in Uttarakhand on Friday. Elections began at 7 am and the five constituencies recorded an overall poll percentage of 37.33 % up to 1 pm. The Nainital-Udham Singh Nagar seat recorded the highest turnout of 40.46 %, followed by Haridwar with 39.41%, Pauri Garhwal with 36.60 %, Tehri Garhwal with 35.29 % and Almora with 32.29 %.

-

2024 Lok Sabha Elections18 hours ago

2024 Lok Sabha Elections18 hours agoPrime Minister Narendra Modi urges citizens to vote in record numbers as voting for first phase of Lok Sabha elections begins on 102 seats across India

-

Entertainment13 hours ago

Entertainment13 hours agoDo Aur Do Pyaar social media review: Social media users say Vidya Balan, Pratik Gandhi deliver standout performances in this adorable film

-

2024 Lok Sabha Elections14 hours ago

2024 Lok Sabha Elections14 hours agoLok Sabha elections 2024: Amit Shah files nomination from Gandhinagar

-

2024 Lok Sabha Elections16 hours ago

2024 Lok Sabha Elections16 hours agoKamal Haasan, Rajinikanth, Vijay Sethupathi, Dhanush vote in Chennai

-

Entertainment14 hours ago

Entertainment14 hours agoYami Gautam starrer Article 370 releases on Netflix today

-

2024 Lok Sabha Elections16 hours ago

2024 Lok Sabha Elections16 hours agoLok Sabha elections 2024: TMC, BJP workers clash in West Bengal’s Cooh Behar ahead of voting

-

2024 Lok Sabha Elections10 hours ago

2024 Lok Sabha Elections10 hours agoDeserted by key supporters, the Kamal Nath story looks set to wind to an end in Chhindwara

-

2024 Lok Sabha Elections17 hours ago

2024 Lok Sabha Elections17 hours agoLok Sabha elections 2024: Google Doodle marks the start of polls with index finger voting symbol