Economy news

Sensex breaks past 32,000-mark as inflation hit a record low of 1.54 % in June

Economy news

ITR filing last date today: What taxpayers must know about penalties and delays

The deadline for ITR filing ends today, September 15. Missing it may lead to penalties, interest charges, refund delays, and loss of tax benefits.

Economy news

India’s GDP surges 7.8% in Q1, outpaces estimates and China

India’s GDP surged 7.8% in Q1 2025-26, the highest in five quarters, driven by strong services and agriculture sector growth, according to NSO data.

Economy news

Sensex falls 600 points, nifty slips 180 as US tariffs hit Indian markets

Indian equity markets witnessed sharp declines as US tariffs on Indian imports took effect. Sensex dropped over 600 points, while Nifty fell nearly 180 points in early trade.

-

Latest world news20 hours ago

Latest world news20 hours agoTrump signs 10% global tariffs after US Supreme Court setback

-

Latest world news19 hours ago

Latest world news19 hours agoPM Modi meets Sri Lankan President Dissanayake at AI summit, reviews connectivity agenda

-

India News19 hours ago

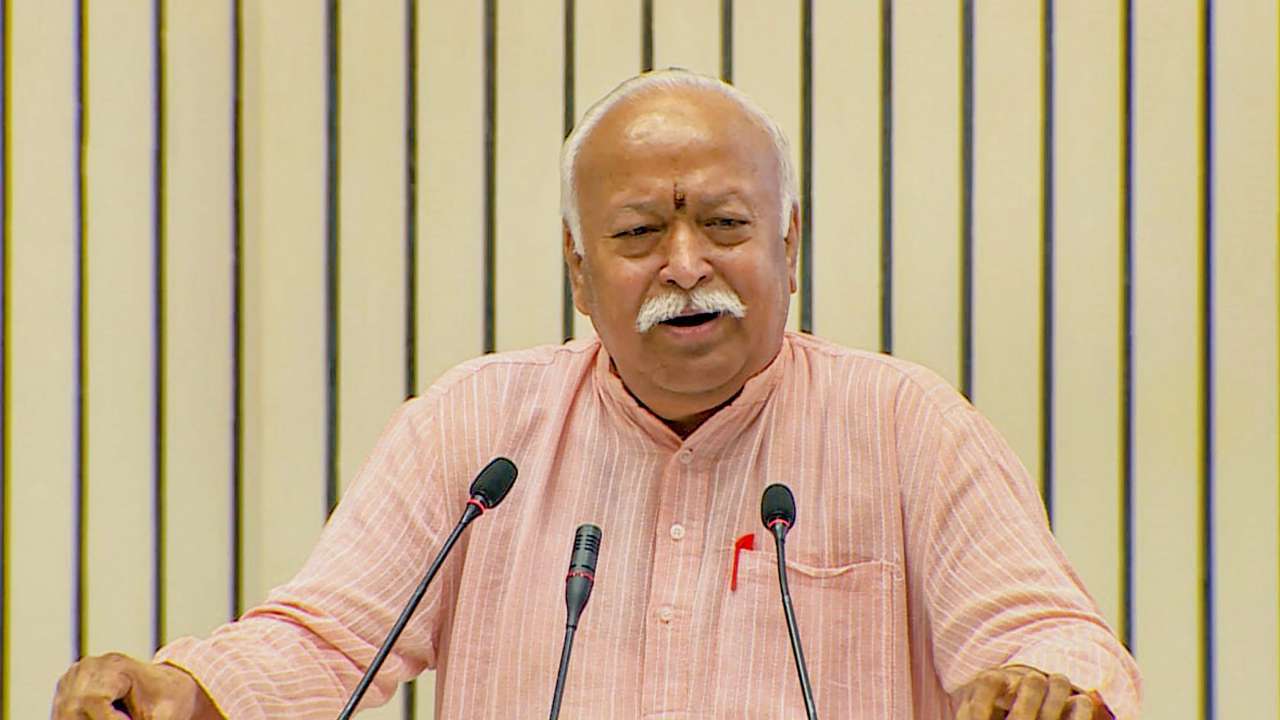

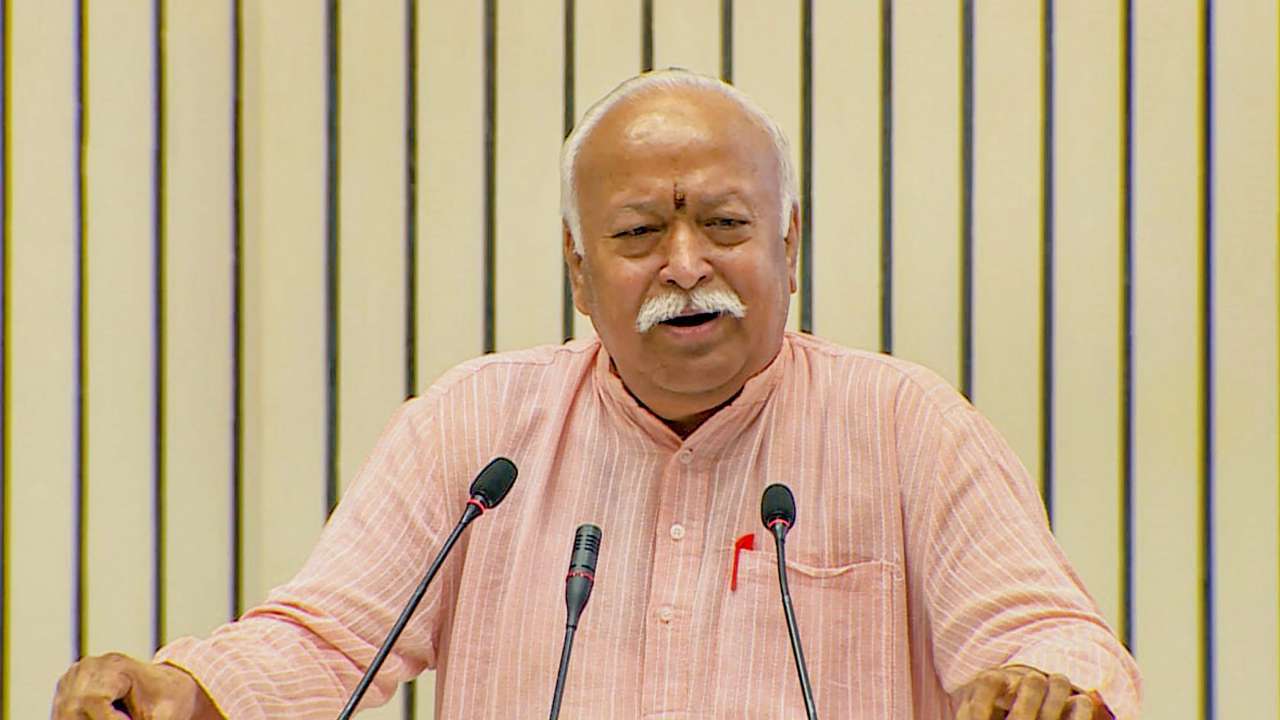

India News19 hours agoRSS not seeking political power, focused on uniting Hindu society, says Mohan Bhagwat

-

Latest world news10 hours ago

Latest world news10 hours agoIndia studying implications after US Supreme Court strikes down Trump’s global tariffs