Top Stories

Ram Mandir inauguration: Full schedule of temple Pran-Pratishtha ceremony today

PM Narendra Modi is set to take over the Ram Mandir Prathistha, or consecration ceremony, in Ayodhya, which is scheduled to start at 12:05 p.m.

Latest world news

India studying implications after US Supreme Court strikes down Trump’s global tariffs

India said it is studying the implications of a US Supreme Court ruling that struck down Donald Trump’s sweeping tariffs, even as a new 10% global duty has been announced under an alternate law.

Latest world news

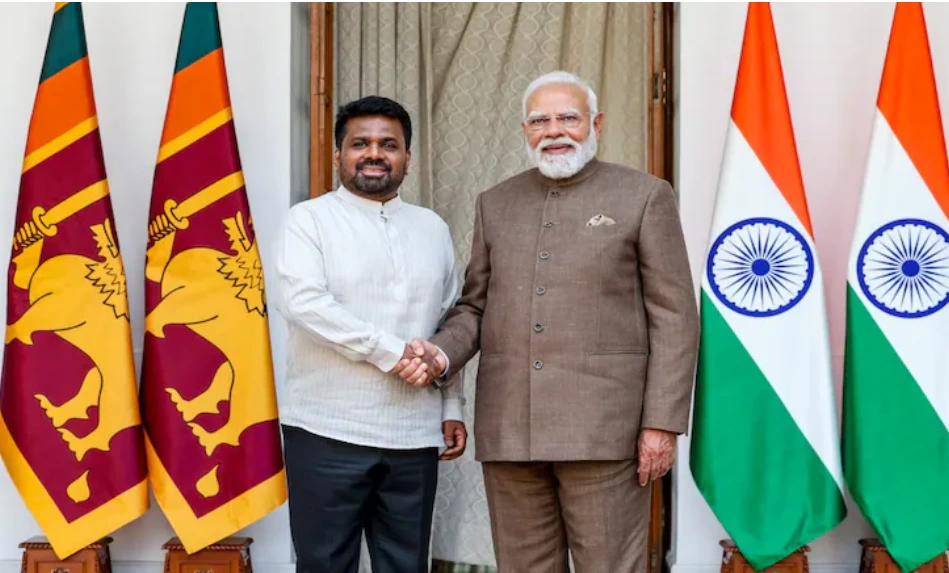

PM Modi meets Sri Lankan President Dissanayake at AI summit, reviews connectivity agenda

PM Modi and Sri Lankan President Anura Kumara Dissanayake reviewed connectivity, AI cooperation and regional stability during talks at the AI Impact Summit in New Delhi.

Latest world news

Trump signs 10% global tariffs after US Supreme Court setback

Donald Trump has signed a new 10% global tariff order after the US Supreme Court struck down much of his earlier sweeping import duties

-

Latest world news11 hours ago

Latest world news11 hours agoTrump signs 10% global tariffs after US Supreme Court setback

-

Latest world news11 hours ago

Latest world news11 hours agoPM Modi meets Sri Lankan President Dissanayake at AI summit, reviews connectivity agenda

-

India News11 hours ago

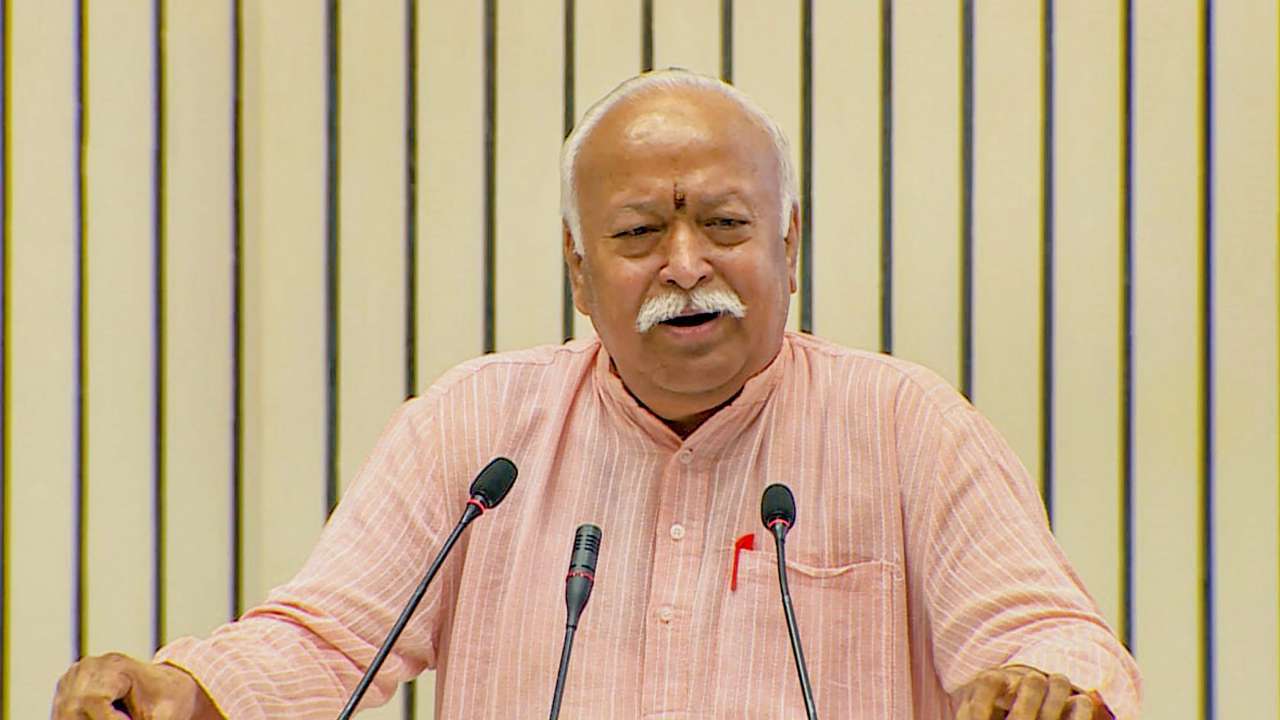

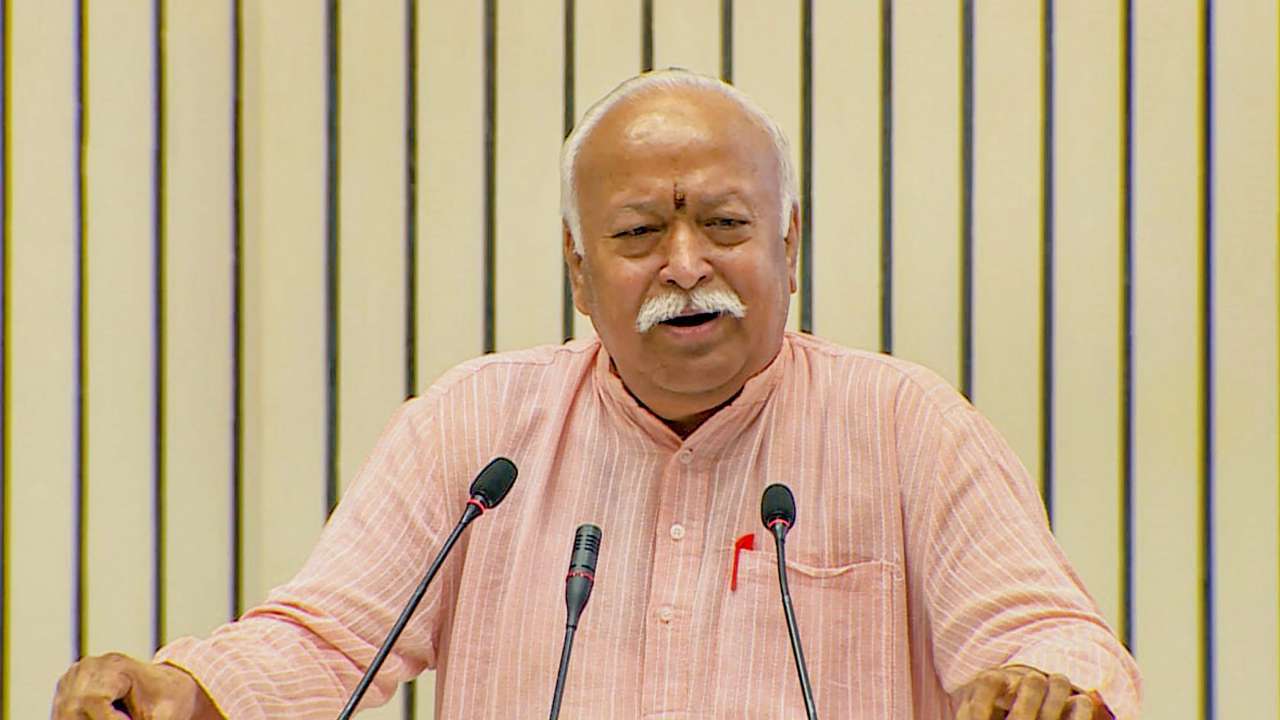

India News11 hours agoRSS not seeking political power, focused on uniting Hindu society, says Mohan Bhagwat

-

Latest world news2 hours ago

Latest world news2 hours agoIndia studying implications after US Supreme Court strikes down Trump’s global tariffs