India News

Rajya Sabha election: Congress’ Ahmad Patel’s fate remained undecided till late

India News

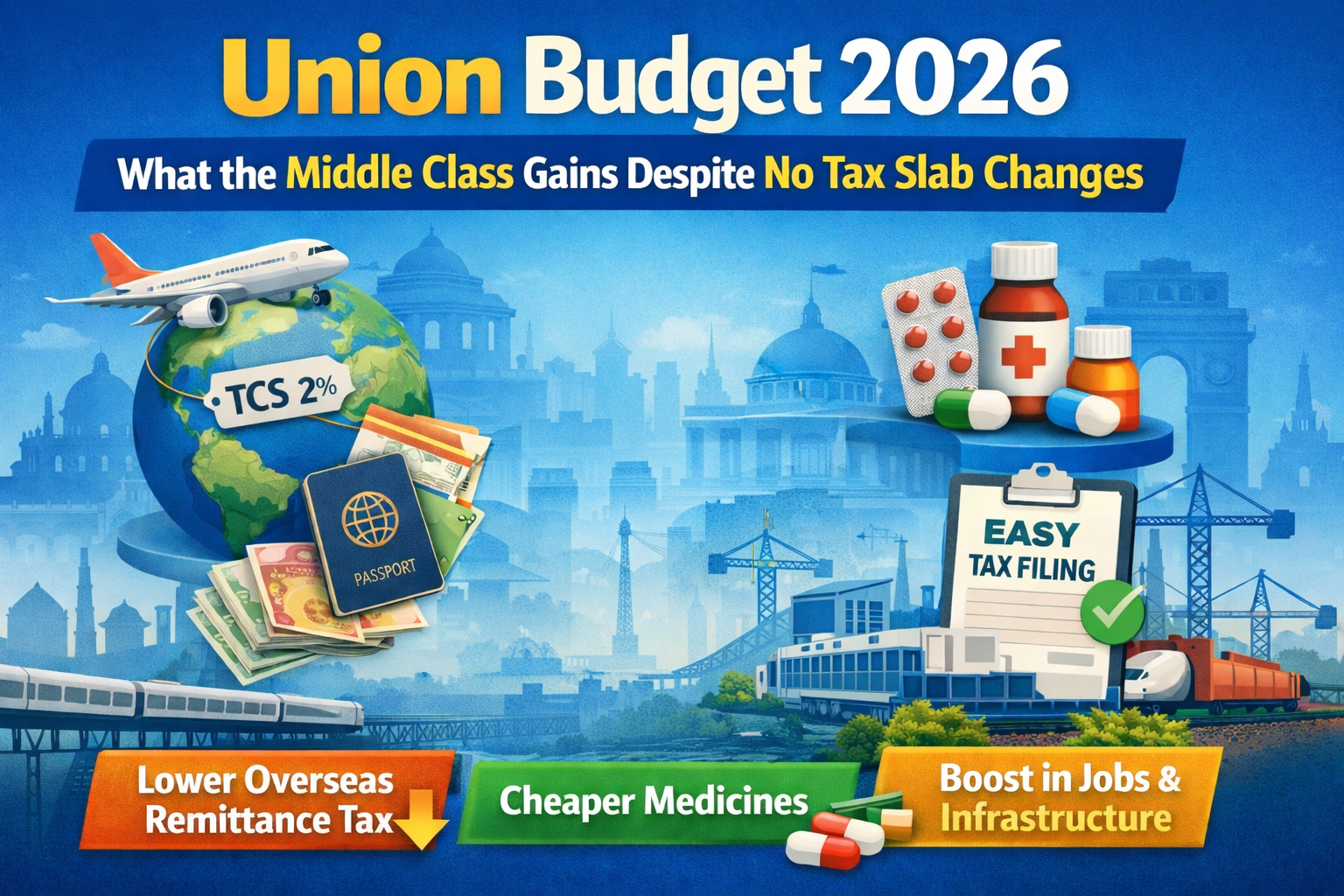

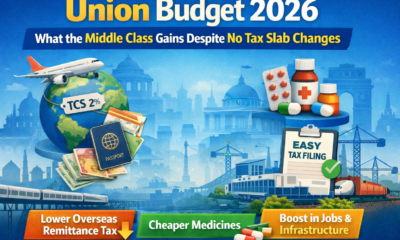

Union Budget 2026: What the middle class gains despite no income tax slab changes

Union Budget 2026 retains income tax slabs but offers indirect relief to the middle class through TCS cuts, simpler tax filing, cheaper medicines and higher job-creating expenditure.

India News

Budget 2026 balances high capex and growth, says PM Modi

Prime Minister Narendra Modi said Union Budget 2026 strikes a balance between high capital expenditure and strong growth while reinforcing reforms and fiscal discipline.

India News

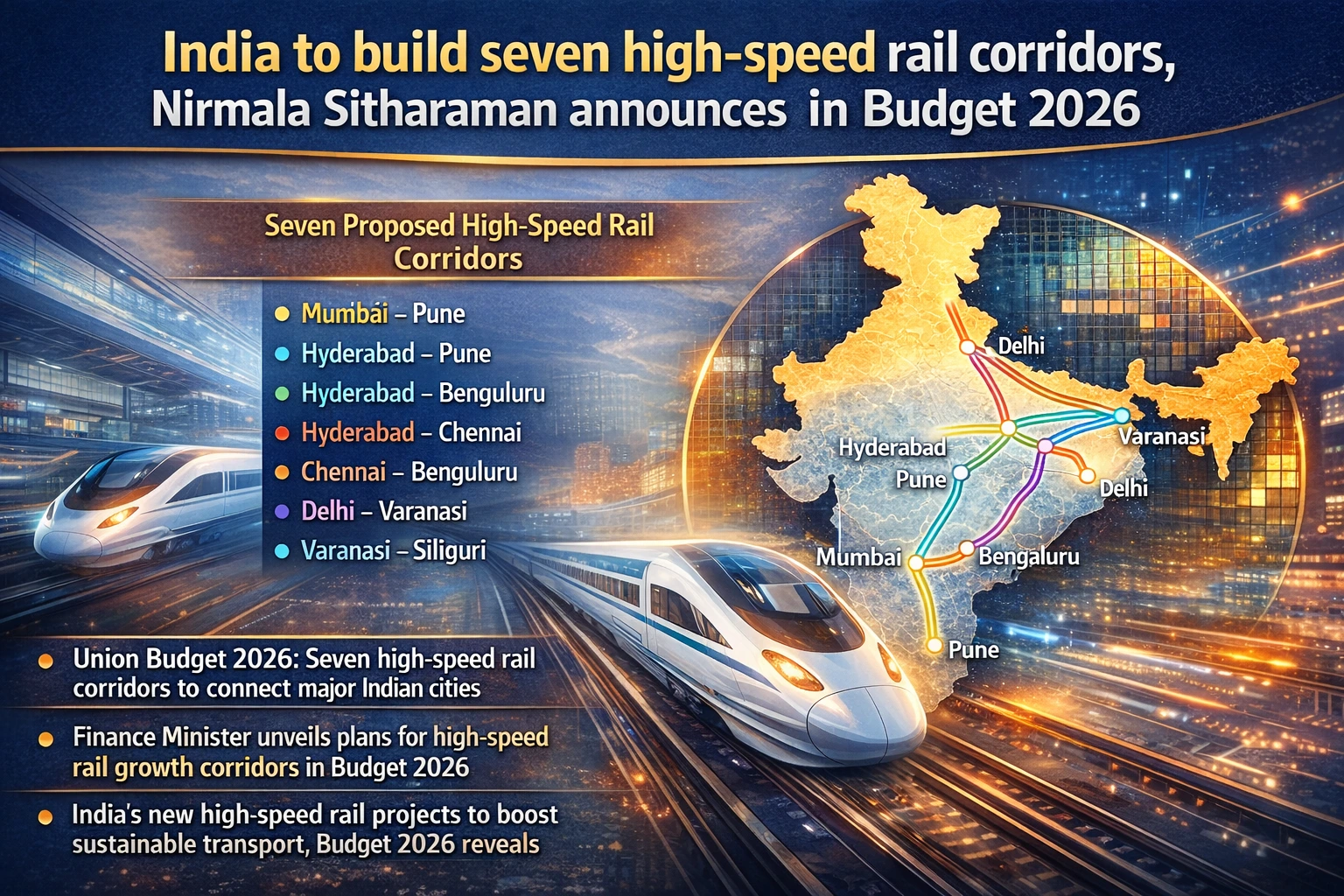

India to build seven high-speed rail corridors, Finance Minister announces

Union Budget 2026-27 unveiled seven high-speed rail corridors and a dedicated east-west freight corridor to boost sustainable transport and economic growth.

-

India News13 hours ago

India News13 hours agoUnion Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

-

India News13 hours ago

India News13 hours agoNirmala Sitharaman to present ninth Union Budget with reforms in focus

-

India News12 hours ago

India News12 hours agoIndia announces Rs 40,000 crore boost for semiconductor sector in Union Budget 2026

-

India News11 hours ago

India News11 hours agoIndia to build seven high-speed rail corridors, Finance Minister announces

-

India News8 hours ago

India News8 hours agoUnion Budget 2026: What the middle class gains despite no income tax slab changes

-

India News8 hours ago

India News8 hours agoBudget 2026 balances high capex and growth, says PM Modi