Two days after US said it would not waive sanctions to India or any country if they do not stop oil imports from Iran by November 4, and a day after it called off the ‘2+2’ dialogue slated for July 6, reports suggested India was preparing to stop buying oil from Iran.

India’s oil ministry has asked refiners to prepare for a “drastic reduction or zero” imports of Iranian oil from November, said a report by news agency Reuters quoting two persons from the industry.

The Indian government said it is evaluating ‘all options’ to ensure the country’s energy security, reported LiveMint. “We feel that Iran is a traditional partner. We have historical civilisational linkages with Iran,” said Raveesh Kumar, spokesperson for India’s ministry of external affairs on Thursday.

“It should be noted that the statement was not India specific and it applies to all countries across the world. As far as we are concerned, we will take all necessary steps including engagement with relevant stakeholders to ensure our energy security,” Kumar added.

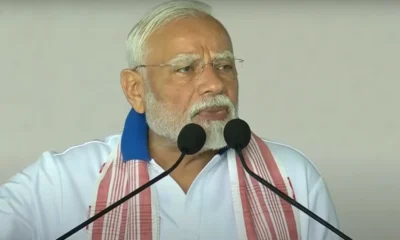

This comes in the backdrop of US Ambassador to the United Nations Nikki Haley urging Prime Minister Narendra Modi on Wednesday to stop oil imports from Iran. She was on a visit to India.

At the same time, the inaugural India-US “2+2” dialogue between the foreign and defence ministers of the two countries that was to be held in Washington on 6 July was postponed for a second time. “This scheduling change was prompted by reasons entirely unrelated to the bilateral relationship,” the US embassy in New Delhi said in a statement on Thursday. Iran’s oil import was expected to have been a major topic of discussion at the 2+2 dialogue.

Also, on Wednesday, June 27, a PTI report said US has told all countries, including India and China, to stop their oil imports from Iran by November 4 or face sanctions for carrying out any transaction with Tehran as there would be “zero” waivers to any country.

India views Iran as a gateway to Afghanistan and Central Asia besides a key source of energy. In a recent press conference, Indian foreign minister Sushma Swaraj said that India would only adhere to UN sanctions and not unilateral strictures placed by countries.

According to news wire agency Press Trust of India, petroleum minister Dharmendra Pradhan on Thursday in Mumbai said that the government “will go by the national interest.”

Reuters report quoting industry people said India, the biggest buyer of Iranian oil after China, will be forced to take action to protect its exposure to the US financial system. India’s oil ministry held a meeting with refiners on Thursday, urging them to scout for alternatives to Iranian oil, the people said.

“(India) has asked refiners to be prepared for any eventuality, since the situation is still evolving. There could be drastic reduction or there could be no import at all,” said one of the sources, who has knowledge of the matter.

During the previous round of sanctions, India was one of the few countries that continued to buy Iranian oil, although it had to reduce imports as shipping, insurance and banking channels were choked due to the European and US sanctions.

One of the persons quoted above said this time the situation is different, reported Reuters. “You have India, China and Europe on one side, and US on the other… At this moment we really don’t know what to do, but at the same time we have to prepare ourselves to face any eventuality,” said this person.

The US push to curb countries’ imports of Iranian oil comes after President Donald Trump withdrew from a 2015 deal between Iran and six world powers and ordered a reimposition of sanctions on Tehran.

Some sanctions take effect after a 90-day “wind-down” period ending on 6 August, and the rest, notably in the petroleum sector, following a 180-day “wind-down period” ending on 4 November.

Companies halt imports

Under pressure from the US sanctions, Reliance Industries Ltd, the operator of the world’s biggest refining complex, has decided to halt imports.

Nayara Energy, an Indian company promoted by Russian oil major Rosneft, is also preparing to halt Iranian oil imports from November after a communication from the government, a second source said. The company has already started cutting its oil imports from this month.

Indian Oil Corp. Ltd, Mangalore Refineries and Petrochemicals Ltd and Nayara Energy, the top three Indian buyers of Iranian oil, and the oil ministry did not respond to Reuters’s request for comments.

Removing Iranian oil from the global market by November as called for by the US is impossible, an Iranian oil official told the semi-official Tasnim news agency on Wednesday.

The options to find replacements to Iranian oil have widened after Opec agreed with Russia and other oil-producing allies last week to raise output from July by about 1 million bpd, with Saudi Arabia pledging a “measurable” supply boost but giving no specific numbers.

Saudi Arabia’s plans to pump up to 11 million barrels of oil per day (bpd) in July would mark a new record, an industry source familiar with Saudi oil production plans told Reuters on Tuesday.

The second source said there were plenty of options available in the market to replace Iranian oil. “There are companies and traders that are willing to give you a 60 day credit, crude is available in the market,” the source said.

To boost its sales to India, Iran recently offered virtually free shipping and an extended credit period of 60 days.

“We can buy Basra Heavy, Saudi or Kuwait oil to replace Iran. Finding replacement barrels is not a problem, but it has to give the best economic value,” a third source in New Delhi said.

Latest world news16 hours ago

Latest world news16 hours ago

India News16 hours ago

India News16 hours ago

Latest world news1 hour ago

Latest world news1 hour ago

India News1 hour ago

India News1 hour ago

India News49 mins ago

India News49 mins ago

India News41 mins ago

India News41 mins ago

LATEST SPORTS NEWS27 mins ago

LATEST SPORTS NEWS27 mins ago