India News

Now, curbs on Karnataka co-operative bank. Another PMC-like crisis unfolding?

The Karnataka bank situation reminds of the Punjab and Maharashtra Co-operative (PMC) bank crisis of 2019, when it was revealed that the PMC bank defaulted on loans to the tune of Rs. 6,500 crore.

India News

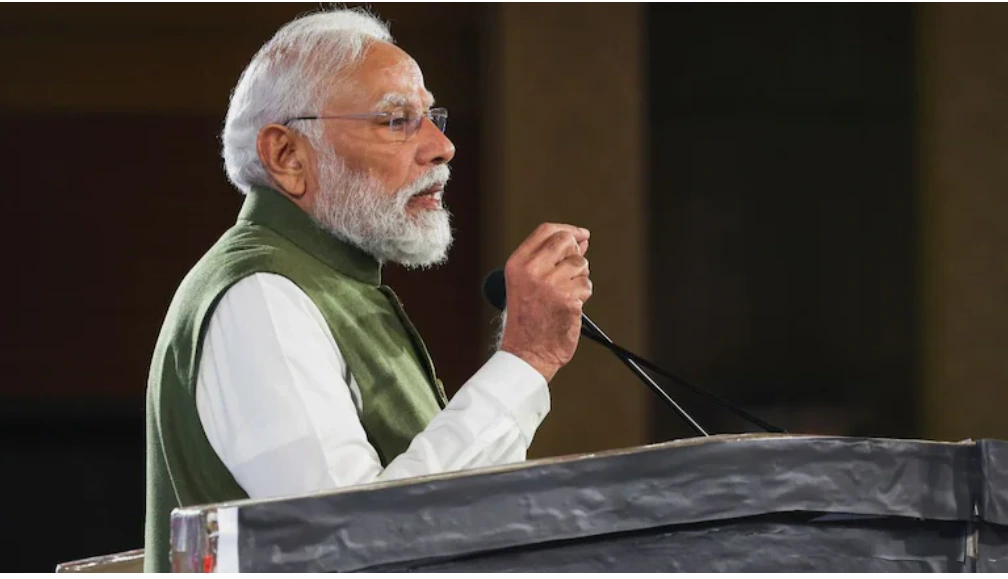

PM Modi accuses Congress of anti-Sikh bias over Rahul Gandhi’s ‘traitor’ remark

Prime Minister Narendra Modi accused Rahul Gandhi of targeting BJP MP Ravneet Singh Bittu with a ‘gaddar’ remark because of his Sikh identity while speaking in the Rajya Sabha.

India News

Manipur Assembly to meet at 4 pm today, floor test likely under new chief minister

The Manipur Legislative Assembly will convene at 4 pm today, with a floor test likely as the new chief minister seeks to prove his majority in the House.

India News

PM Modi skips Lok Sabha reply as protests force repeated adjournments

PM Modi did not deliver his Lok Sabha reply today after sustained Opposition protests led to repeated adjournments over a dispute involving Rahul Gandhi’s proposed speech.

-

India News24 hours ago

India News24 hours agoPM Modi skips Lok Sabha reply as protests force repeated adjournments

-

Latest world news10 hours ago

Latest world news10 hours agoNew Delhi free to buy oil from any source, Russia says amid US deal claims

-

Cricket news10 hours ago

Cricket news10 hours agoPakistan PM Shehbaz Sharif confirms boycott of India match at T20 World Cup

-

Latest world news9 hours ago

Latest world news9 hours agoPakistan faces domestic backlash after India secures lower tariffs in US trade deal

-

India News6 hours ago

India News6 hours agoManipur Assembly to meet at 4 pm today, floor test likely under new chief minister

-

India News50 mins ago

India News50 mins agoPM Modi accuses Congress of anti-Sikh bias over Rahul Gandhi’s ‘traitor’ remark