Latest business news

Adani-Hindenburg row: PIL in Supreme Court seeks action against US short-seller for defrauding investors

A Public Interest Litigation (PIL) was filed, Friday, in the Supreme Court seeking probe against US-based short seller Hindenburg Research whose scathing report led to rout in Adani Group shares since last week.

A Public Interest Litigation (PIL) was filed, Friday, in the Supreme Court seeking probe against US-based short seller Hindenburg Research whose scathing report led to rout in Adani Group shares since last week.

The PIL, filed by Advocate Manohar Lal Sharma seeks action against Hindenburg Research and its founder Nathan Anderson for “defrauding innocent investors” of the Adani Group and sought compensation for the said investors.

In the petition, Advocate Sharma has asked the top court to issue directions to the Central government for launching an investigation against the short-seller and its founder in India and outside, and prosecute them for forgery under section 420 of the Indian Penal Code (IPC) read with section 15HA of the SEBI Act.

A penalty of up to Rs 25 crores or thrice the amounts of profits made by indulging in fraudulent and unfair trade practices relating to securities, is provided under the aforementioned act.

The PIL has alleged that Hindenburg Research exploited “innocent investors via short selling under the garb of artificial crashing”. The petition has asked the Supreme Court to declare short selling an offence of fraud and urged the court to issue directions to recover their turnover of short selling with a penalty to “compensate investors in the interest of justice”.

Meanwhile, Adani Group’s woes continue to mount as the National Stock Exchange (NSE), Thursday, put Adani Ports, Adani Enterprises, and Ambuja Cements under additional surveillance measure (ASM) framework from February 3 (Friday). This will require 100 precent margin to trade in their shares and will likely curb short selling.

Adani Group has endured over $100 billion in market losses till Thursday, creating panic about the potential systemic impact this would have over the market in general. On Wednesday, the group called off its Follow-On Public Offering (FPO) returned money to its investors.

Hindenburg Research published a report last week, accusing the Adani Group of indulging in improper use of offshore tax havens and stock manipulation while also raising concerns about high debt and the valuations of seven listed Adani companies.

Read Also: Video of elderly man flaunting weapon during marriage ceremony in UP goes viral | WATCH

The group has denied the allegations, saying the short-seller’s narrative of stock manipulation has “no basis” and stems from an ignorance of Indian law, adding that it has always made the necessary regulatory disclosures.

Hindenburg Research on Monday hit back at the Adani Group, day after the business house dubbed the New York-based firm’s report as “calculated attack on India.”

In a response titled “Fraud cannot be obfuscated by nationalism or a bloated response that ignores every key allegation we raised,” Hindenburg Research accused the Adani Group of holding back India’s progress by draping itself in the Indian flag while systematically looting the nation.

Hindenburg said it believes that India is a vibrant democracy and an emerging superpower with an exciting future. However, the research group alleged that the country’s future was being held back by the Adani Group, “which has draped itself in the Indian flag while systematically looting the nation.”

Hindenburg stressed that it’s a firm believer in the fact that fraud is fraud even when perpetuated by one of the wealthiest individuals globally.

Kerala: Video of Class 6 boy’s world class back heel goal claims the heart of users

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

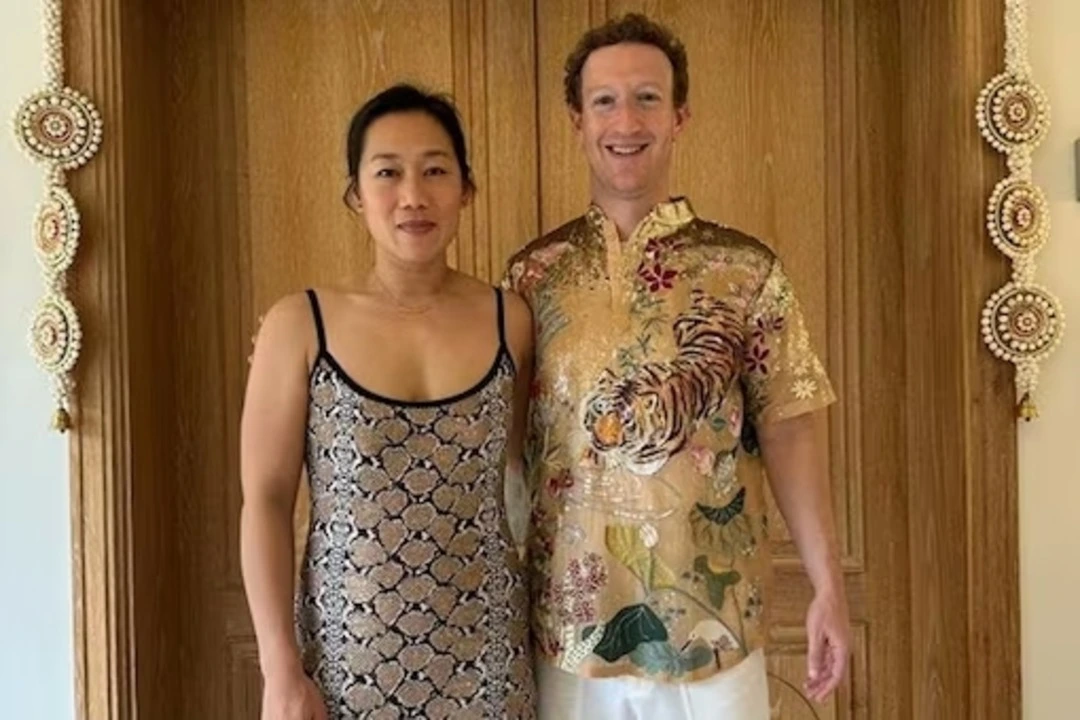

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections7 hours ago

2024 Lok Sabha Elections7 hours agoRahul Gandhi clarifies on wealth survey remark, says aim is to identify injustice

-

Cricket news8 hours ago

Cricket news8 hours agoIPL 2024: Marcus Stoinis hits first IPL century as Lucknow Super Giants beat Chennai Super Kings by 6 wickets

-

India News6 hours ago

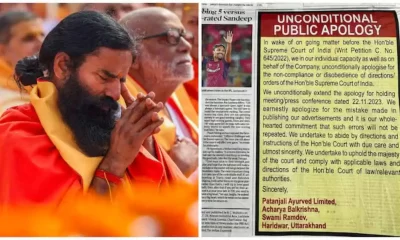

India News6 hours agoRamdev, Balkrishna publish bigger apology in newspapers after Supreme Court’s rap

-

Trending4 hours ago

Trending4 hours agoA waiter’s life: Social media users go emotional on watching viral video

-

2024 Lok Sabha Elections3 hours ago

2024 Lok Sabha Elections3 hours agoPM Narendra Modi slams Congress over Sam Pitroda’s inheritance tax remarks, accuses Congress of intending to impose higher taxes

-

Entertainment2 hours ago

Entertainment2 hours agoMadhuri Dixit, Karisma Kapoor recreate Dil To Pagal Hai dance battle on Dance Deewane

-

2024 Lok Sabha Elections36 mins ago

2024 Lok Sabha Elections36 mins agoNitin Gadkari says he’s better now after collapsing at election rally in Maharashtra’s Yavatmal