Latest business news

NSE’s old and new hands decide to settle off court in co-location case

[vc_row][vc_column][vc_column_text]Driven into a corner for favouring some High Frequency Trading brokers, exchange has no option but to agree to SEBI diktat

~By Sujit Bhar

The National Stock Exchange (NSE) had retreated into its shell after a bout of aggressive behaviour when it had slapped a Rs 100 crore defamation suit on Moneywise Media Pvt Ltd, a fortnightly magazine that is published jointly by Debashis Basu and Sucheta Dalal. The suit, filed at the Bombay High Court by the NSE on July 21, 2015 was to stop the publication and circulation of an article which blew the whistle on an alleged illicit activity within the NSE, in which certain brokers were supposedly given an unfair advantage.

This happened in an area called the co-location facility, which is a favourably positioned area for systems which use a time differential of a fraction of a second to put in bids within a High Frequency Trading (HFT) environment. The time differential is in respect to computers of other brokers.

When the magazine placed its documents, the NSE had withdrawn their suit, but its troubles did not go away. It was also ordered to pay a fine of Rs 50 lakh, which it did. SEBI, meanwhile, had taken up the issue and had show-caused the exchange and many of its top officials. Now it has been revealed that the NSE has used some of its top current and former executives to drive a settlement through the consent mechanism available with the Securities and Exchange Board of India (SEBI).

A media report says that former board members and chief executives Ravi Narain and Chitra Ramkrishna and current chief of business development Ravi Varanasi are among those who have applied for settlement.

SEBI had issued notice to the NSE in May and to 14 officials (former and current) regarding preferential treatments given to some brokers. This arbitration system, available with SEBI, can be compared to out-of-court settlements in normal cases. The NSE has no option but to comply.

There was an administrative gap at the NSE for a while, and as soon as Vikram Limaye took over as CEO in June (he quit as member of the Supreme Court-appointed Committee of Administrators of the BCCI) the exchange filed its consent application with SEBI. The media report says that 12 of the 14 notified officials have filed their consent applications.

However, it is said that the man responsible for the technical part of the NSE has yet to file his consent application. In his absence, things could get murkier.

What is HFT?

In this context, it becomes necessary to know the exact nature of the NSE’s folly.

Trading on the stock markets, at least in certain sections of it, has evolved beyond normal human reaction levels. Certain sections of trading are now being done in hundredths and even millionths of a second. This is way removed from what billionaire investor Warren Buffet and his company Berkshire Hathaway does. While Buffet believes in staying invested in a stock for a while, sometimes for a very long while, there are High Frequency traders (HFT) who have brought this time down to milliseconds.

This trading technique arrived in India a decade earlier and the Securities and SEBI allowed it in 2007-2008. This was allowed across many asset classes, such as equity, currency and commodity, which means that within the overall trading environment now exists advanced computers that use special algorithms to offer, buy and sell and incredible speeds.

Technically, this would be done on very small price differences, things big investors would really not be interested in, but if worked on massive volumes (which they are) these computer traders rake in huge profits each day. They make money if they win, and they make money if they lose. This happens on their micro-commissions on each trade, win or lose. It is, therefore, a win-win. Also, for an investor going in for the long haul, the asset values rarely change because of HFT, a complete cycle of spikes and troughs (in stock value) being completed in a couple of trading hours. Unless, of course, there is an interested party that wants to drive down a stock or artificially add value to it, in which case it becomes illegal.

That is where co-location comes in. The basic idea is location. Nearer the broker’s office and his systems are to the exchange, earlier (even if it is a millisecond earlier) does it get the information through the cables connected to the exchange. Logically, it would require huge investment on the part of the broker to arrange for offices nearer the exchange and more funds to arrange for super advanced computers and expensive software and algorithms. So, while participation is low, competition is fierce.

If, amid this, the exchange had provided a further advantage (in time) to some brokers, it robs the rest the level playing field they demand.

The case was all about that.

The problem with HFT is that while it is legitimate, there are few instruments within the grasp of SEBI (or even the US’ Securities and Exchange Commission, for that matter) even today to totally control and oversee this lightning-fast activity. ‘Spoofing’, for example, is a disruptive algorithmic trading entity, in which algorithms often throw up notices of interest in buying a stock for a few milliseconds before withdrawing without trade being completed. That, in turn, drives up a stock, which also settles a direct course of trade for a short time. Fast computers and algorithms then utilise this predictable trajectory to benefit.

With most computer systems within HFT facilities at almost the same level, running similar algorithms, a minor time advantage is of great use.

The source

Dalal had gained access to a document from Singapore that opened the can of worms. The magazine wrote: “Fortunately, we have in our possession a detailed document that blows the whistle on what’s possibly going on in NSE. The document came by snail mail from Singapore and addressed to Mr B K Gupta, DGM Securities and Exchange Board of India (SEBI). It is dated 14th January 2015 with a copy to Sucheta Dalal. It is not clear what SEBI has done with it in all these months.”

The NSE wanted this news to be aborted. When it was not, the defamation suit ensued.

NSE moved the Bombay High Court on 21 July 2015 to stop the publication and circulation of the article and also asked Moneylife to offer an unconditional apology. This application was heard by Justice Gautam Patel, who passed severe strictures against NSE and imposed a cost and penalty of Rs 50 lakhs. Moneywise Media was represented by Advocate Bapoo Malcolm while Debashis Basu and Sucheta Dalal argued their own positions. NSE had filed an appeal against this order before a division Bench of the Bombay High Court.

Then the NSE told the division Bench of Justice Naresh Patil and Justice Z A Haq that it would honour the judgement of Justice Patel and withdraw appeal in the defamation case.

In any case, this could put brakes on technical trading that really adds no value to the overall net worth of a stock or company.[/vc_column_text][/vc_column][/vc_row]

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

India News21 hours ago

India News21 hours agoLandslide hits Arunachal Pradesh, highway linking Indo-China border affected

-

Entertainment20 hours ago

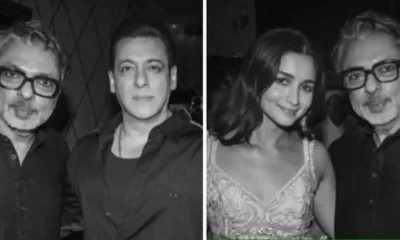

Entertainment20 hours agoBollywood stars Salman Khan, Alia Bhatt, Rekha, Sonakshi Sinha, Aditi Rao Hydari attend Sanjay Leela Bhansali’s Heeramandi premiere

-

Cricket news14 hours ago

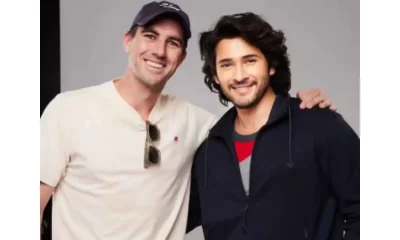

Cricket news14 hours agoTelugu superstar Mahesh Babu meets SRH captain Pat Cummins, says it is an absolute honour

-

Education19 hours ago

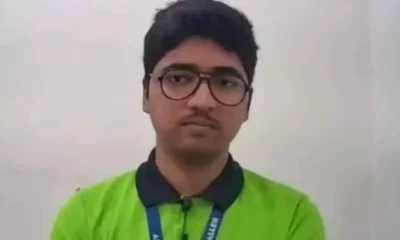

Education19 hours agoFarmer’s son Nilkrishna Gajare Nirmalkumar from Maharashtra scores 100 NTA score in IIT-JEE Mains 2024

-

India News22 hours ago

India News22 hours agoTamannaah Bhatia summoned in illegal IPL streaming app case, to appear before cyber cell on April 29

-

Cricket news22 hours ago

Cricket news22 hours agoIPL 2024: Rishabh Pant, Axar Patel score half centuries as Delhi Capitals beat Gujarat Titans by 4 runs

-

2024 Lok Sabha Elections20 hours ago

2024 Lok Sabha Elections20 hours agoBihar: Election Commission extends voting timings for 4 Lok Sabha seats due to heatwave

-

Entertainment17 hours ago

Entertainment17 hours agoAamir Khan to begin shooting in Delhi for Sitaare Zameen Par next month