Latest business news

What is a CVV Number on a Credit Card?

In many instances, the CVV number of a credit card is required while making a transaction online. Get the best credit cards for free with no hidden fees. You’ve probably filled in a CVV, or card verification value, hundreds of times, but have you ever stopped to consider what it is? Know more about “what is the meaning of cvv?” here.

What is CVV?

A card verification value (CVV) is a three or four digit number on your card that serves as an extra security measure when making purchases online or over the phone. So secure your card number and CVV as this feature also ensures that someone else can’t make a transaction using your card.

CVVs and their Goals

Although using chip-enabled cards has dramatically reduced the incidence of physical card fraud, thieves have turned their attention to online platforms. Internet-based identity theft has taken over the production of counterfeit cards. Banks and credit card companies utilise CVVs to lower the risk of fraudulent online purchases.

Most debit and best credit cards have a pair of CVVs printed on the back. The first is present on the card’s magnetic strip, while the second is shown on the back of the card for online purchases. You’ll need this to complete your transaction on the web.

Where is the CVV located on your card?

CVV is located inside or just above the signature strip on the back of the card. If you don’t know how to identify if it is a cvv number, just focus on the three-digit code present on the back of the card. It is the standard for Visa and Mastercard cards, but for American Express it is four digits and displayed on the front of the card, just over the company’s emblem.

Are CVVs and PINs the Same Thing?

A “personal identification number” (PIN) is a number chosen by the user. While most financial institutions accept only four-digit PINs, others provide extensive codes. PINs are used for cash withdrawals and purchases on cards. And these PINs are not the same as CVVs. A CVV is a unique number generated by the card issuer for each card.

Is the CVV number different on a replacement card?

The CVV number is a unique identifier and for security reasons it is different when you replace your new credit card apply with an old one. In case your card expires and you need a new one, the bank will issue it, and you’ll get a new CVV code.

How is CVV generated –

CVVs are not meaningless three or four digit codes. Instead, they are generated by the bank using the primary account number, expiration date in four-digit format and a pair of DES (Data Encryption Standard) keys and a three-digit service code. The specific algorithms employed have yet to be discovered and that’s for the best.

What Can You Do to Safeguard Your CVV?

Like any other sensitive financial information, you should keep your CVV secure to avoid being a victim of credit card fraud. If you want to keep your CVV safe from identity thieves, here are seven easy steps.

- Install anti-virus software on your PC. This checks for malicious software, including viruses, keyloggers, and other forms of spyware.

- Create a password for your home WiFi network. If you don’t, anyone in range can access your network, spy on your communications, and steal your data.

- Keep your financial details to just any website. Websites lacking the prefix “https:” in their address should be avoided, as should any that lack a verifiable SSL lock icon in your browser.

- When you’re away from home, use a virtual private network. While utilising a virtual private network (VPN) at home could be considered excessive, it is highly recommended when using a public network or a hotel’s WiFi.

- Only show someone a photo of your credit card, even close. Your credit card information is vulnerable to fraud.

Credit Card Number Verification Value (CVV) and EMV Chip Cards

Using chip-based debit and credit cards has increased security for in-person transactions at both banks and retailers. Its innovation over the magnetic strip allows the card’s internal code to fluctuate with each scan. To no one’s surprise, this has dramatically helped cut down on fraud.

But what about CNP transactions (card-not-present) like those done over the phone or online? There is a CVV printed on your card since a physical chip would be useless. Even though stores aren’t supposed to save CVVs digitally, the most sophisticated thieves still find ways to get their hands on them.

This issue has a proposed solution known as dynamic CVV, allowing the printed code to vary at regular intervals. This would take place on a tiny screen powered by a lithium battery on the back of the card. This may be a sure thing, but while technology has its benefits, it has challenges. Difficulties arise when choosing the code-change frequency, and the cards would likely cost four to five times as much to manufacture as present models. Yet, the potential fraud cost savings may be sufficient to offset any future increases in manufacturing expenses.

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

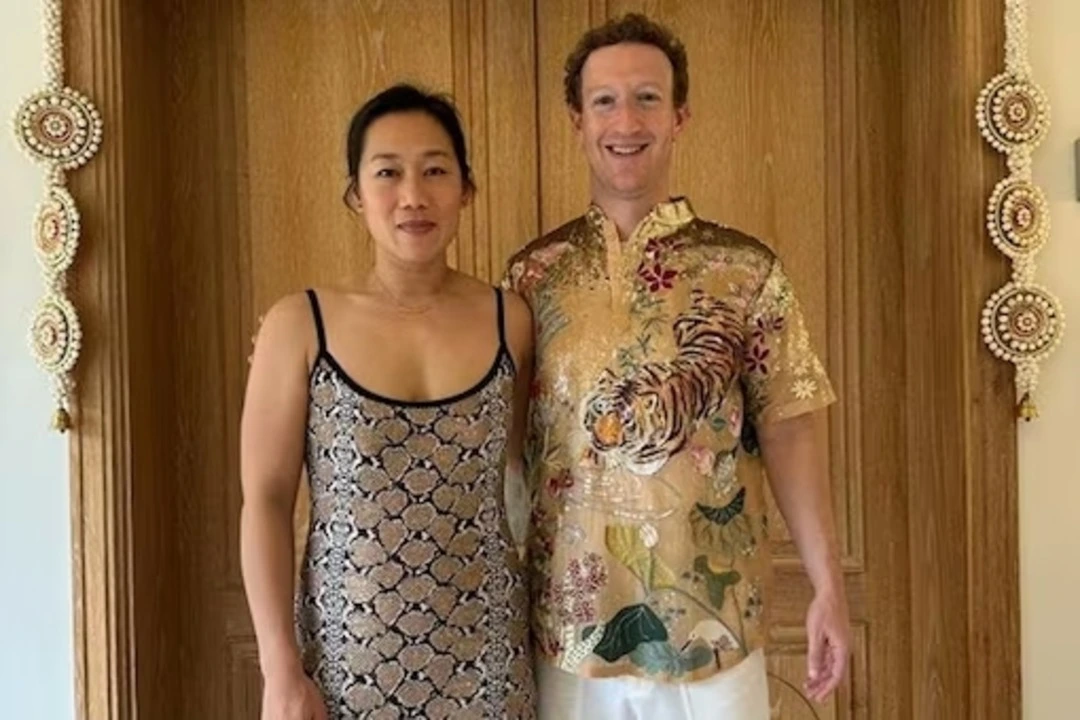

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections10 hours ago

2024 Lok Sabha Elections10 hours agoRahul Gandhi clarifies on wealth survey remark, says aim is to identify injustice

-

Cricket news12 hours ago

Cricket news12 hours agoIPL 2024: Marcus Stoinis hits first IPL century as Lucknow Super Giants beat Chennai Super Kings by 6 wickets

-

India News10 hours ago

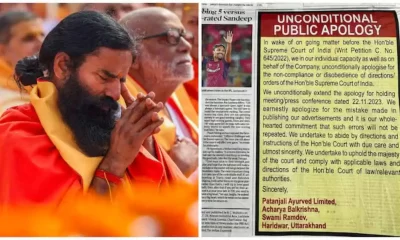

India News10 hours agoRamdev, Balkrishna publish bigger apology in newspapers after Supreme Court’s rap

-

Trending8 hours ago

Trending8 hours agoA waiter’s life: Social media users go emotional on watching viral video

-

2024 Lok Sabha Elections7 hours ago

2024 Lok Sabha Elections7 hours agoPM Narendra Modi slams Congress over Sam Pitroda’s inheritance tax remarks, accuses Congress of intending to impose higher taxes

-

2024 Lok Sabha Elections4 hours ago

2024 Lok Sabha Elections4 hours agoNitin Gadkari says he’s better now after collapsing at election rally in Maharashtra’s Yavatmal

-

2024 Lok Sabha Elections4 hours ago

2024 Lok Sabha Elections4 hours agoMallikarjun Kharge vows to continue politics till his last breath to defeat BJP

-

Entertainment6 hours ago

Entertainment6 hours agoMadhuri Dixit, Karisma Kapoor recreate Dil To Pagal Hai dance battle on Dance Deewane