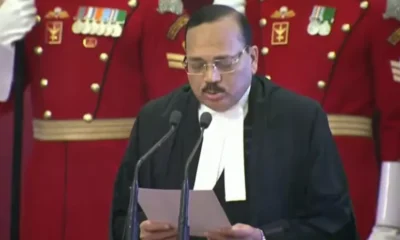

Chief Justice of India (CJI) Ranjan Gogoi today – Monday, Sep 16 – sought a report from the Jammu and Kashmir High Court Chief Justice on allegations that people were finding it difficult to approach the High Court and said that he will visit J&K if required.

“It is a very, very serious matter if people are unable to approach the High Court, I will myself visit Srinagar,” Gogoi said. The top court also directed the Jammu and Kashmir High Court Chief Justice to submit a report on whether the High Court is accessible to litigants or not in the wake of restrictions put in place since August 5, when the centre ended special status to the state and bifurcated it into two Union Territories.

Justice Gogoi also warned the petitioners to be ready to face the ‘consequences’ if the HC chief justice’s report was contrary to their plea.

The plea was filed by child rights activist Enakshi Ganguly on the state of children between six and 18 years because of the restrictions in Jammu and Kashmir.

“You want things done under the aegis of the High Court, you can go there,” the court said to the activist, reported NDTV.

When Ganguly’s lawyer said it was difficult to go to the High Court, CJI Gogoi responded: “Why is it difficult to go to the Jammu and Kashmir High Court? Is anyone coming in the way? We want to know from the Chief Justice (High Court). If required, I will go to the Jammu and Kashmir High Court.”

The Supreme Court, calling upon the High Court Chief Justice to submit a report, said, “The petitioner alleges access to the High Court is seriously affected.”

The CJI warned the lawyer that if the report of the High Court Chief Justice indicates contrarily, then there would be “consequences”.

Ganguly has filed a joint writ petition with Prof. Shanta Sinha, the first Chairperson of the National Commission for Protection of Child Rights in the Supreme Court on reports of illegal detention of many children in Kashmir, seeking judicial intervention in the matter.

The petition, reported India Legal, seeks court’s directions to the government for a status report on actual number of detentions, injuries and deaths of children and monitoring of detention incidents by the Juvenile Justice Committee of the J&K High Court.

The petition submits that reports of violations of different kinds “are serious enough to merit judicial review of the situation with respect to children and to enforce and monitor certain immediate corrective action.”

Also Read: CJI may visit J&K ‘if required’ as petitioners allege difficulty in approaching J&K High Court

Specific reports of children being detained, including one where an 11 year old boy was “kept in detention without any formal records between 5th August and 11th August 2019” have given rise to the need of this petition, they said.

The petition states that Kashmir is going through an ‘extraordinary situation’ and it is imperative that the court ensures that no excesses take place against the ‘most vulnerable’, keeping in view Constitutional principles and International Child rights commitments.

The petition alleges several instances of maiming and injuries caused to children and fears “deep and everlasting impact on the psychological well-being of children and by ignoring the urgency of the situation we may ‘lose’ a generation of citizens to state excesses.”

It has invoked state obligations under the UN Convention on the Rights of the Child (CRC), which India has ratified in 1992, which recalls the ‘Declaration on the Protection of Women and Children in Emergency and Armed Conflict, in its Preamble and recognizes that, in all countries in the world, there are children living in exceptionally difficult conditions, and that such children need special consideration’.

Also Read: “Can’t harass people”: Telangana CM on new Traffic rule violation fines

The petitioners have prayed that “the Supreme Court act as parens patriae to the children and direct the government to submit a status report on actual detentions, injuries and deaths of children between August 5th 2019 to the present day.”

While demanding compensation for the injured children, the petition also seeks the implementation of Integrated Child Protection System, and fortnightly review of care plans by the J&K High Court’s Juvenile Justice Committee.

Latest world news18 hours ago

Latest world news18 hours ago

Latest world news18 hours ago

Latest world news18 hours ago

India News18 hours ago

India News18 hours ago

Latest world news9 hours ago

Latest world news9 hours ago