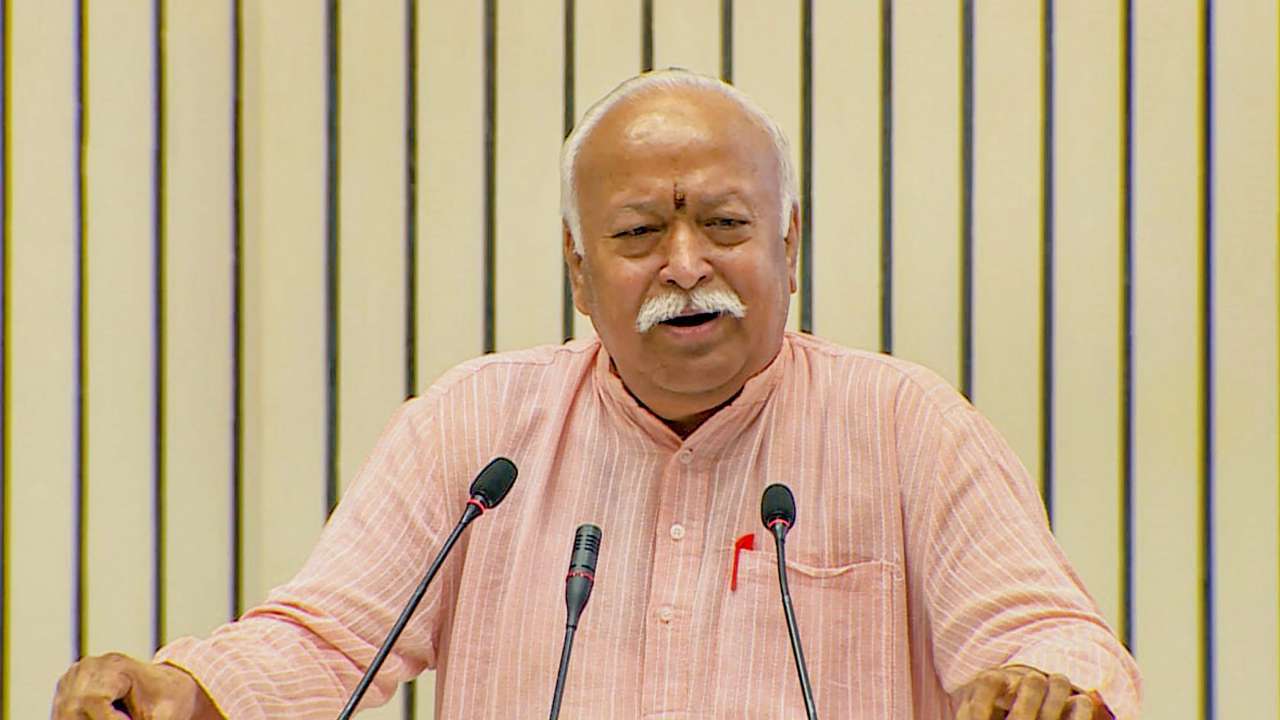

Rashtriya Swayamsevak Sangh (RSS) chief Mohan Bhagwat on Friday said the organisation is not driven by any ambition for political power and is instead dedicated to uniting Hindu society and building individual character.

He made the remarks while interacting with nearly 950 national and international sportspersons at Madhav Kunj in Shatabdi Nagar, Meerut, as part of the RSS centenary outreach initiatives. According to participants present at the event, Bhagwat spoke for about 50 minutes and stressed the importance of social harmony and collective responsibility in nation-building.

Quoting Bhagwat, a participant said the RSS’ “sole objective is the organisation of the entire Hindu society and character-building of individuals,” adding that the organisation does not function in opposition to or competition with any specific group.

Emphasis on unity and cultural roots

Explaining his idea of India, Bhagwat said the nation goes beyond geographical boundaries and draws inspiration from figures such as Lord Ram, Lord Krishna, Lord Buddha, Lord Mahavira, Swami Vivekananda, Swami Dayanand and Mahatma Gandhi, participants said.

He reportedly stated that the term “Hindu” reflects unity in diversity rather than caste identity. Differences in modes of worship and deities, he said, do not weaken society as long as cultural harmony is preserved. He added that whenever social unity declined, the country faced crises.

The RSS chief outlined four foundational pillars of society — value inculcation, Sanatan culture, the spirit of dharma and adherence to truth — reiterating that the Sangh’s mission centres on strengthening society through individual development. Volunteers, he said, are active across various spheres of social life and prioritise national interest.

Sports as a tool for nation-building

Addressing the athletes, Bhagwat described sports as a powerful medium for bringing people together. He said nation-building is not the responsibility of any single organisation but of society as a whole.

Referring to Meerut’s historic role in the First War of Independence in 1857, he said the legacy later inspired Keshav Baliram Hedgewar to establish the Rashtriya Swayamsevak Sangh in 1925.

Bhagwat also shared five guiding principles for those interested in associating with the RSS — understanding the organisation from within, engaging with its affiliated bodies, supporting its programmes, maintaining dialogue and working selflessly for the nation. He also answered questions from athletes during the session.

Outreach events in Uttar Pradesh

Bhagwat is currently on a tour of Uttar Pradesh. Earlier, he attended a two-day outreach event in Lucknow on February 17 and 18 and had also visited Gorakhpur. During his stay in Lucknow, he briefly met Chief Minister Yogi Adityanath, while both deputy chief ministers called on him before he left for Meerut.

Arjuna Award-winning wrestler Alka Tomar described the programme as grand and praised the organisational efforts of RSS volunteers. She said sportspersons must contribute to nation-building and appreciated Bhagwat’s emphasis on working in the national interest.

Para Cricket Club of India player Surya Pratap Mishra of Bareilly, selected for a Sri Lanka tour, said Bhagwat assured support for para athletes to help them enhance the country’s pride. Kabaddi coach Pintu Malik from Shukratal in Muzaffarnagar termed the interaction inspiring, especially the message that players should support one another.

Bhagwat reached Meerut on Thursday night and held breakfast discussions on Friday with representatives from the sports and industry sectors. On Saturday, he is scheduled to interact with members of the intelligentsia, including representatives from education, industry, medicine, literature, art and trade. Entry to the event is restricted to invitees with passes issued by the RSS headquarters.

Latest world news23 hours ago

Latest world news23 hours ago

India News23 hours ago

India News23 hours ago

Latest world news23 hours ago

Latest world news23 hours ago

Latest world news14 hours ago

Latest world news14 hours ago