Latest business news

5G spectrum auction: Ambani Vs Adani

According to the department, Reliance Jio has made a Rs. 14000 crore Earnest Money Deposit (EMD) and Adani Enterprises has made Rs. 100 crores deposit. The EMD reflects bidding power of a company. Therefore the market experts are expecting that Reliance Jio will lead the auctions.

Department of Telecommunications on Wednesday started a second-round auction of the 5G spectrum. The bidding began at 10 am and will continue till 6 pm. Mukesh Ambani’s Reliance Jio, Gautam Adani’s Adani Enterprises, Bharti Airtel and Vodafone Idea will participate in the auction.

Reports said the new 5G Spectrum will be 10-time faster than 4G and provide ultra-high speed data. All telecom leaders participated in yesterday’s bid which saw bids exceeding Rs 1.5 lakh crores for the 5G spectrum.

Telecom Minister Ashwini Vaishnaw informed that the first day of the auction exceeded all the expectations and will surpass the records of 2015.

The telecom department will auction 72 gigahertz of radio waves worth Rs 4.3 lakh crores on offer. The department, however, said that it is expecting anywhere between Rs 70,000 crores to Rs 1 lakh crores from the auctions.

Read Also: Indore residents donate clothes to Ranveer Singh amid his nude photoshoot outrage

According to the department, Reliance Jio has made a Rs 14,000 crores Earnest Money Deposit (EMD) and Adani Enterprises has earned Rs 100 crores deposit. The EMD reflects bidding power of a company. Therefore the market experts are expecting that Reliance Jio will lead the auctions.

The fifth generation of mobile networks (5G network) has been designed to connect everyone virtually and connect machines, objects and devices.

Mobile towers emit non-ionizing Radio frequencies having minuscule power and are incapable of causing any kind of damage to living cells including human beings. Department of Telecommunications (DoT) has prescribed norms for exposure limits for the Radio Frequency Field (i.e. Base Station Emissions) which are 10 times more stringent than the safe limits prescribed by International Commission on Non-Ionizing Radiation Protection (ICNIRP) and recommended by World Health Organization (WHO), the telecom department said in a press release.

APJ Abdul Kalam Death Anniversary: Know why he is known as Missile Man of India

MPSOS Class 10th, 12th Result 2022: Ruk Jana Nahi Scheme Result declared, direct link to check

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

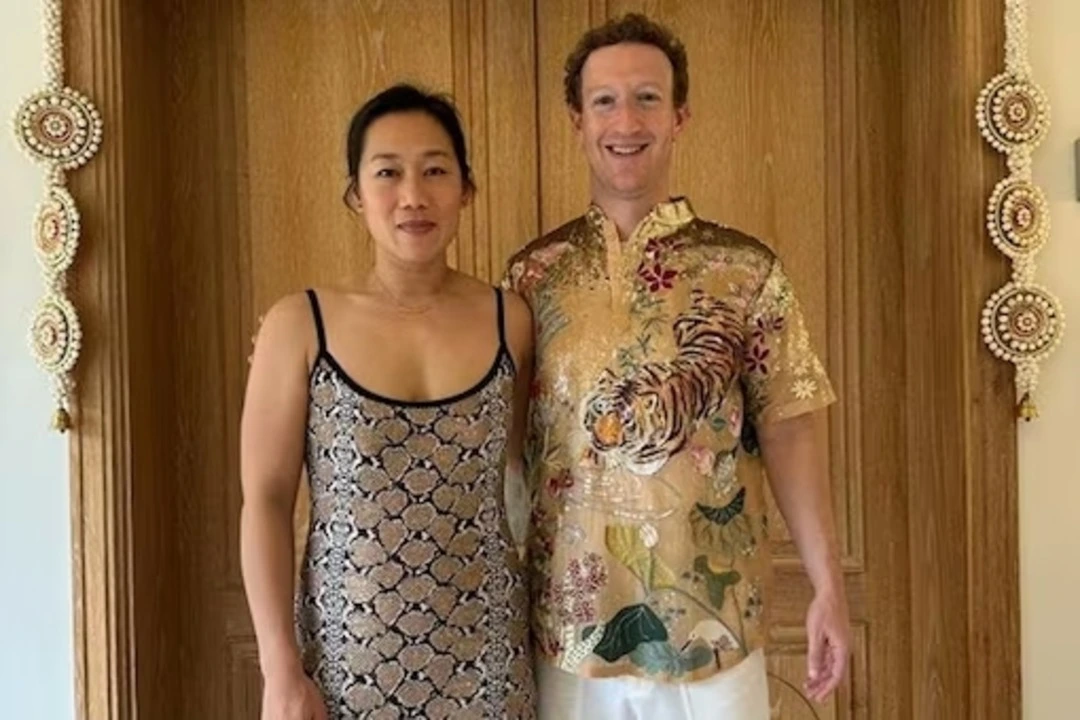

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections23 hours ago

2024 Lok Sabha Elections23 hours agoLok Sabha Elections: Voter turnout 62.02% in Tamil Nadu till 5pm

-

Cricket news7 hours ago

Cricket news7 hours agoIPL 2024: Lucknow Super Giants beat Chennai Super Kings by 8 wickets

-

Trending24 hours ago

Trending24 hours agoRanveer Singh reacts to his viral deepfake video promoting political party

-

2024 Lok Sabha Elections6 hours ago

2024 Lok Sabha Elections6 hours agoPrime Minister Narendra Modi takes dig at Rahul Gandhi, says like Amethi, Congress will lose its ground from Wayanad also

-

India News2 hours ago

India News2 hours agoAAP leader Saurabh Bharadwaj says a conspiracy is underway for slow death of Arvind Kejriwal

-

2024 Lok Sabha Elections5 hours ago

2024 Lok Sabha Elections5 hours agoRJD leader Tejashwi Yadav says BJP’s 400 paar film has become a super flop on the first day itself

-

2024 Lok Sabha Elections4 hours ago

2024 Lok Sabha Elections4 hours agoRahul Gandhi says BJP will not get more than 150 seats in Lok Sabha elections

-

Entertainment30 mins ago

Entertainment30 mins agoBollywood star Ajay Devgn shares emotional birthday post on his daughter Nysa Devgan’s 21st birthday