Latest business news

Indian Rupee hits an all-time low of 77.42 against US dollar

The Indian Rupee touched a new low and is at the 77.42 mark against the US dollar on Monday. As a result of the slip in value, the NSE Nifty 50 index was down 1.06 percent, and the BSE Sensex was down by 1.09 percent

India News

Union Budget 2026 highlights: Nirmala Sitharaman Raises Capex to Rs 12.2 Lakh Cr, West Bengal Gets Major Allocation

Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026 in Parliament today. Follow this space for live updates, key announcements, and policy insights.

India News

Union budget 2026 to be presented on Sunday with special trading session

The Union Budget 2026 will be presented on a Sunday for the first time in over two decades, with NSE and BSE announcing special trading sessions for the day.

India News

Modi says right time to invest in Indian shipping sector; meets global CEOs

-

India News12 hours ago

India News12 hours agoDevendra Fadnavis seeks CBI probe into Ajit Pawar plane crash

-

LATEST SPORTS NEWS11 hours ago

LATEST SPORTS NEWS11 hours agoICC Men’s T20 World Cup 2026: South Africa outclass India with smart slower-ball strategy in Super 8

-

India News11 hours ago

India News11 hours agoJNU protest turns violent as Left and Right student groups trade charges

-

India News11 hours ago

India News11 hours agoWorld praised India’s AI potential at AI Impact Summit, says PM Modi

-

Latest world news5 hours ago

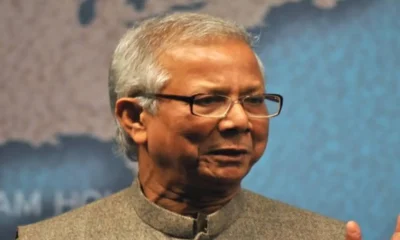

Latest world news5 hours agoBangladesh president Shahabuddin accuses Yunus of conspiracy to unseat him

-

India News4 hours ago

India News4 hours agoSecurity tightened across Delhi metro stations after bomb threat emails