Crypto NFT

Top 10 cryptocurrencies to buy now in India

After all the incidents that happened inside crypto including LUNA, FTT, and others, The current bear market means one thing – solid crypto assets are available to buy at a major discount.

Even large-cap tokens like Bitcoin and Ethereum have since dropped by more than 70% from their prior highs – which offers an attractive entry price.

The purpose of this beginner’s guide is to make a list of the 10 best cryptos to buy now for upside potential.

Trace Metaverse ($TRC) Token: Currently the most trending Crypto game token, $TRC is the native token of Trace Metaverse, Trace is a geolocation-based metaverse with AR technology for smartphones. It is a virtual copy of the world’s map, where your avatar moves according to your geolocation. Trace is like Pokemon Go with the possibility of earning. You go, look for boxes inside which have valuable NFTs, go to work or school and make money, you can also post something there, meet new friends and chat, pumping up your avatar, you earn all the time. In short, the game does not force narrow banal mechanics. You live your life, develop in the real and digital world in parallel and earn more. Trace missions to impress people to spend their lifetime using good habits, exploring surroundings, engaging in more communications in real life, and bringing them more motivation to move instead of sitting all the time in front of a computer.

When you move in the real world, your Trace avatar moves around the map in the metaverse. Trace governance token ($TRC) has only 5,000,000,000 token issuances and it has already raised more than 3.5 million USD. Trace will soon make its limited NFT sales, you may love to buy some rare NFTs so that you can be eligible to buy the token at their token pre-sale. You can join the Discord community, Twitter Page, or Telegram community of Trace Geometaverse to stay updated. Trace has also announced its partnership with a famous crypto exchange Bitmart and the most promising blockchain Polygon (Polygon Studios) to create a bigger gaming metaverse world.

This real-life app has a strong possibility to explode in 2023, if you are a game and metaverse fan, Trace metaverse token (TRC) can be your big bet to be rich.

VITA INU TOKEN ($VINU): Vita Inu (VINU) is the governance token of the VINU Ecosystem and is native to the Vite DAG chain. VINU is the world’s first fast, feeless (and cheeky) dog-themed coin with high TPS and smart contracts. VINU is a powerful multi-chain currency (BNB, Polygon, Ethereum, and others) and governance token of the Vinuverse.

The VINU community believes cryptocurrencies should be moved around freely, securely, and efficiently. Vinupay, VinuSwap, Vinuverse, Vinu games, and a lot more utilities are already existing for this token. VINU even has the world’s first crypto Designer Clothing brand! You can buy VINU tokens at Bybit, the world’s best cryptocurrency exchange. It is also available in other cryptocurrency exchanges.

VITA INU TOKEN ($VINU): A governance token of the VINU ecosystem, Vita Inu Coin (VINU) is a fast and feeless meme coin. The currency’s purpose is to help people make friends and learn about cryptocurrencies. This makes it ideal for people investing in cryptocurrencies for the first time.

Another reason Vita Inu ($VINU) is pulling investors is due to its developing Vinuverse metaverse, which will be a VR world with NFTs, staking, rewards and merchandise. Even though the crypto market is currently suffering, the perks Vita Inu ($VINU) offers such as no fees, speedy transactions, and an educational community, are perhaps why Vita Inu ($VINU) is doing better than other cryptocurrencies. We can say it’s the best meme token in the market right now. With a strong following on social media, including the backing of social media influencers Gino Assereto (@GinoAssereto) and Abraham Abraham (@abrfps), this emerging cryptocurrency has the groundwork to survive the crypto winter successfully. You can buy VINU tokens at Bybit, the world’s best cryptocurrency exchange. It is also available in other cryptocurrency exchanges.

Social Good ($SG) Token: SocialGood ($SG) is a cryptocurrency that makes the world a better place. SocialGood ($SG) has a maximum supply limit. Just like Bitcoin, SG operates within a token ecosystem, which means that as the number of users increases, the crypto’s value rises (This is not a promise from Social Good Foundation Inc. that the value of SG will rise in the future. SocialGood is designed to maximise the user’s profits the longer that the user holds their SG. SG users can earn a staking bonus of up to 15% APY, awarded every 6 hours. The SocialGood (SG) market cap reached an all-time high of $1.47 billion on Jan. 19, 2021.

The more you participate in the growth of the SocialGood Ecosystem™, the more benefits you will gain. Supportive members of the community are more likely to earn 100% Crypto Back rewards. You could also win $1,000 worth of SG just by sharing a screenshot of your $SG earnings with the hashtag #SocialGoodApp_CryptoBack on social media.

Cardano ($ADA): An “Ouroboros proof-of-stake” cryptocurrency called Cardano ($ADA) was developed using a research-based methodology by engineers, mathematicians, and cryptography professionals. Charles Hoskinson, one of the original five founding members of Ethereum, co-founded the project. It has the 8th largest volume and can be your medium-risk bet as well.

Apex Protocol ($APEX) TOKEN: ApeX, a decentralized and non-custodial derivatives protocol incubated by Davion Labs, has recently closed its seed round funding, which is led by global investors including Dragonfly Capital Partners, Jump Trading, Tiger Global, Mirana Ventures, CyberX, Kronos and M77 Ventures. The $APEX token was launched at Bybit Launchpad, the best IEO launchpad service at this moment worldwide.

The protocol successfully launched its beta version on the Arbitrum main net and released its original series of NFTs equipped with special equity attributes to the public.

BITDAO ($BIT): BitDAO is poised to be a major player and influencer in the decentralized tokenized economy. The flexibility and transparency of DAO governance allow BIT token holders to “build their own adventure”. BITDAO ($BIT) is supported by Bybit as well. BitDAO allows for multiple independent teams to coordinate proposals, negotiate partnerships, and develop products for BitDAO governance approval. There can be hundreds of developers and partnership coordinators contributing to the BitDAO mission. BIT token holders can pick and choose the best ideas. If you like DAO, $BIT can be your ideal bet.

Polygon ($MATIC): Polygon is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development.

Polygon effectively transforms Ethereum into a full-fledged multi-chain system (aka Internet of Blockchains). The $MATIC token will continue to exist and will play an increasingly important role, in securing the system and enabling governance. Recently they announced partnerships with Disney, Instagram, Facebook, and many more. If you are a fan of Layer 2, Matic can be your steady bet.

Ethereum ($ETH): A decentralized software platform called Ethereum ($ETH) makes it possible to create and manage smart contracts and decentralized apps (dApps) without the need for a third party’s oversight, control, or interference. Ethereum aims to build a decentralized ecosystem of financial services that anybody in the world can use freely, regardless of their country of origin, race, or religion.

Solana ($SOL): Developed to help power decentralized finance (DeFi) uses, decentralized apps (DApps), and smart contracts, Solana runs on a unique hybrid proof-of-stake and proof-of-history mechanisms that help it process transactions quickly and securely. SOL, Solana’s native token, powers the platform. When it launched in 2020, SOL’s price started at $0.77. By March 1, 2022, its price was around $101, a gain of nearly 13,000%.

Xinfin ($XDC) Token: XDC is the native utility token of the XDC blockchain that facilitates global and domestic trade by providing liquidity to the financial industry. The token also supports business efficiency through different sectors by offering non-tokenized and tokenized services. Utility tokens for particular industries are created with small chains on the XDC01 protocol. You can buy Xinfin at the best exchange of India, Bybit.

Xinfin also offers in-house crypto wallet services that perform real-time transactions worldwide. The wallet also runs on the XCD01 protocol and aims to give high transaction output with utmost security. Hello Fans (Hellofans.app and Hellofans.io), Heart Of Shades (Luxury web3 cosmetics), StorX are some of the great projects getting built on this network.

RACA ($RACA) Token: RACA is a web 3.0 infrastructure solution provider. In July 2021, RACA released its first web 3.0 product, a collection of PFP (profile picture style NFTs) for Maye Musk (Elon’s mother). You can buy RACA in Bybit India, the best crypto exchange in India. RACA earned $142 million in revenue from NFT drops in 2021.

Crypto NFT

What is The Next Big Cryptocurrency? Top 5 Most Potential Cryptocurrencies

Due to the bearish state of the cryptocurrency market, only coins with proven value and applications will attract investors in 2023. With so many options, it’s more important than ever to invest in the cryptocurrency that offers the best potential return. This article will cover the top five cryptocurrencies with positive price predictions for 2023.

Metacade

Metacade is a new blockchain-based project that aims to build the largest play-to-earn (P2E) virtual video arcade in the metaverse. A gaming community hub where players can connect with one another, earn money while playing the best P2E titles, and help lead the Web3 gaming revolution.

Forecasts predict that the momentum generated by MCADE during the presale will result in high demand, potentially significantly increasing value. The price is expected to break $1 in 2023, thanks to Metacade’s excellent roadmap and long-term potential.

Ripple

Ripple is a DeFi digital asset that facilitates affordable financial transfers in a cost-effective and efficient manner, enabling real-time global payments. The average customer can save up to 60% on transaction fees when compared to traditional providers.

If XRP can get past the legal stumbling block, it will be a strong contender for a surge in 2023. The sky is the limit for XRP in 2023, with great gains possible if the coin takes off, thanks to the backing of some of the world’s largest and most established financial institutions. As a result, it is considered one of the most promising DeFi projects for 2023.

Shiba Inu

Shiba Inu has been recommended as a good starting point for those new to crypto investments and the Web3 space. Shiabrium, an Ethereum layer 2 network, will be launched in 2023, giving SHIB token holders a secure, scalable network to receive and send SHIB. It will also continue to assist crypto artists in creating NFT artwork, as well as provide a marketplace for Shiba-inspired art to be bought and sold.

With the launching of Shibarium in 2023, Shiba Inu hopes to shift from a popular meme coin to a significant contender in the DeFi arena. With SHIB trading at more than 90% of its all-time high and hugely appealing plans for 2023 on the horizon, the current minuscule trading price represents an exceptional opportunity for traders to seek high income. SHIB is considered as one of the most profitable DeFi projects you shouldn’t miss in 2023.

Polygon

Being utilized as a layer 2 scaling mechanism to improve the scalability of Ethereum, Polygon enables businesses and developers to build advanced dApps and DeFi solutions on the Ethereum blockchain while gaining increased security, faster transaction speeds, and lower costs.

Polygon has shown to be one of the most innovative companies, aiding developers in the development of cutting-edge digital services and becoming a global player. With the use of blockchain projected to grow in the coming years, Polygon will play an important role in driving innovation, making it one of the best DeFi projects to invest in.

The beauty of MATIC is that it must be held by anyone who must pay transaction fees. As a result, a growing number of people will need MATIC in their cryptocurrency wallets. This could cause the coin to skyrocket, pushing it past its all-time high of $2.

The Sandbox

Because of its 3-D blocky aesthetic, The Sandbox, a decentralized digital real estate platform, will look familiar to Minecraft and Roblox fans. User-generated content (UGC) such as characters can be created and shared by users while purchasing and utilizing digital real estate plots in a variety of ways.

The Sandbox’s most appealing selling point is its innovative and intuitive creative tools, which allow users with no coding skills to use its plug-and-play interface to develop interesting, entertaining games that users may monetize through premium DeFi staking and a variety of other techniques.

The Sandbox appears to be one of the best DeFi projects to invest in ahead of 2023 and beyond, thanks to its multifaceted offering. Considering this, its current token level of less than $0.50 appears to be excellent value as crypto markets recover and SAND’s value rises significantly.

Crypto NFT

Bitcoin at $23.4k; Solana, Ethereum also witness minor dips

The cryptocurrency market, infamous for its instability and volatile highs and lows, has seen a significant dip in the past few months. Bitcoin, the largest cryptocurrency by market capitalization, dipped by 1.40% and is currently trading at $23,402.75 while Ethereum, the second biggest cryptocurrency was trading at around $1,604.10, a decrease of 1.59%, as of January 30, 2023.

Although infamous for its volatility, the crypto market is currently holding stable with Bitcoin holding stable around the $23,700 mark. The value of Bitcoin has more than tripled since 2021 and remains one of the most popular investments among retail and institutional investors, despite recent price rectifications.

In what is seen as an indication of a strong demand for alternative cryptocurrencies besides Bitcoin and Ethereum, the Solana and Binance Coin (BNB) have increased up to 6 percent in value.

Solana, a high-performance blockchain platform, has been attracting attention due to its ability to handle high transaction volumes and its fast-processing times. On the other hand, Binance Coin is the native token of the Binance exchange, one of the world’s largest cryptocurrency exchanges.

Trading prices of major cryptocurrencies:

• Bitcoin :$23,157.54

-2.99%

• Ethereum : $1,586.03 USD

-3.54%

• Tether : $1.02 USD

+0.59%

• USD Coin : $1.00 USD

-0.10%

• BNB: $315.00 USD

-1.28%

• XRP : $0.3989 USD

-4.87%

• Dogecoin : $0.09418 USD

+4.71%

• Cardano : $0.3778 USD

-4.79%

• Polygon : $1.11 USD

-5.32%

• Polkadot : $6.35 USD

-5.02%

• Tron : $0.06263 USD

-1.26%

• Litecoin : $97.14 USD

+0.87%

• Shibu Inu : $0.00001205 USD

-1.45%

• Solana : $24.77 USD

-5.40%

Crypto prices are notorious for being unstable and massive price swings in either direction is a common phenomenon in the market. However, a recent trend has seen somewhat of a stability on the scene as other cryptocurrencies, alongside Bitcoin are also seeing an upswing.

Crypto NFT

Three soccer stars who should have done better at Chelsea

The summer transfer market is here again, and teams are battling it out in the Premier League to acquire the best legs. Along with football enthusiasts, punters are flocking to top bookmakers, as well as crypto bookmaker sites, to stake on which teams land the top stars.

Liverpool, desperate to save a failing season, have already procured the likes of Cody Gakpo.

Man United have moved on from the dramatic exit of their once-upon-a-time icon, Cristiano Ronaldo, in the January acquisition of the Dutch mountain man, Wout Werghost.

Chelsea pulled off a coup by landing the skillful Jao Felix from Atletico Madrid in a stunning half-season loan. Of course, there is so much expectation on the shoulders of the young Portuguese to rescue an underperforming Chelsea side.

Just like Jao Felix, there are other players who arrived at Chelsea with similarly high expectations…but FAILED.

In this article, we will discuss three players who could have done better during their time at Chelsea.

Alvaro Morata

When the Spaniard arrived from Real Madrid to Chelsea, he was flaming with confidence.

Morata had previously played the role of a super substitute for Real Madrid, where he Kareem Benzema a run for the first striker position.s

Acquired for 58 million pounds, many expected him to slot into Antonio Conte’s team and steadily pull of the goals.

His calm demeanor was also expected to introduce some calm forward, particularly after the unpredictably aggressive Diego Costa fought with almost every Premier League defender.

Indeed, Morata’s first season was not as miserable.

He managed to score 15 goals in 30 starts. But after a bright start, his performances nosedived dramatically. By the second season, Morata was severely short on confidence, haunted by his extensive portfolio of big chances missed.

Notably, in the second season, Morata only had five goals and was already a laughingstock at Stamford Bridge. Injuries didn’t help his cause either, as the Spaniard struggled with reoccurring back issues.

Ultimately, Chelsea would cut their losses by shipping him on loan to Atletico Madrid.

Khalid Boulahrouz

Khalid Boulahrouz played a defensive position for Chelsea from 2006 – 2008. Even in this short time (2 years) at Chelsea, he was loaned out to Sevilla for a year, where he made six appearances and scored no goals.

Due to several issues, Khalid Boulahrouz’s performance in the English Premier League was subpar.

First of all, he struggled to adapt to the toughness and pace of the English Premier League. Secondly, he had trouble adjusting to the Chelsea team’s tactical demands, which represented a significant improvement above the league he had previously played in.

Ultimately, he could not perform to the greatest standards because of his lack of experience playing at the highest level of European football, which revealed his flaws. Additionally, he was frequently played out of position, which prevented him from using his skill.

In all, Khalid Boulahrouz made a total of 13 appearances, scored no goals, and gave no assist. You can clearly see that Khalid Boulahrouz terribly flopped at Chelsea when put on par with his defensive counterpart, Ashley Cole, who gave several goal assists, scored 7 goals, and made 229 appearances in his stay at Chelsea.

After his loan tenor was over in 2008, Khalid Boulahrouz was later sold off to VfB Stuttgart, where he made more appearances and scored two goals.

Winston Bogarde

Winston Bogarde’s performance at Chelsea was a total flop because, despite his considerable talent and experience, he was unable to have an impact on the team. He struggled to make the first team and was frequently criticized for his lack of effort and dedication to the club.

His ability to get along with the other players was also lacking, and his attitude toward teamwork and training was frequently questioned.

Winston Bogarde’s performance at Chelsea was more like the display of a dying star. Although Winston Bogarde had played full-back for several popular clubs, which includes SVV, Sparta Rotterdam, Ajax, Milan, and Barcelona, he failed to replicate his successes at Chelsea.

Winston Bogarde made a total of 9 appearances, scored no goals, and gave no goal assists in his stay at Chelsea (2000 – 2004). Given his experience playing at popular clubs, the French center-back player, William Gallas, seems to be beating Winston Bogarde at his game with 12 goals in 159 appearances whilst having no prior high-grade experience at any popular clubs.

In the end, when Winston Bogarde’s contract ended in 2004, he refused to accept a wage cut, which led to his eventual dismissal from the team in 2006 and his retirement from football. Now he is pursuing a managerial career at Ajax.

Patrick van Aanholt

Due to a lack of opportunity and playing time, Patrick van Aanholt’s performance at Chelsea was a flop compared to other clubs he had played for.

Van Aanholt spent five years with Chelsea but only made two appearances and had no goals or assists before being eventually loaned out four times to different clubs.

Due to the presence of more seasoned players like Ashley Cole and Branislav Ivanovic, who had made over 200 appearances and had scored more than six goals, he also had trouble making an impression.

Van Aanholt ultimately failed to join Chelsea’s first team and left the club for Sunderland in 2014, where he made 82 appearances and scored 7 goals. After Sunderland, he furthered his career at Crystal Palace and is now in Galatasaray, where he is making significant progress.

These mentioned players clearly had potential. But somehow, we never saw enough of it at Chelsea.

-

Cricket news16 hours ago

Cricket news16 hours agoIPL 2024: Marcus Stoinis hits first IPL century as Lucknow Super Giants beat Chennai Super Kings by 6 wickets

-

2024 Lok Sabha Elections8 hours ago

2024 Lok Sabha Elections8 hours agoMallikarjun Kharge vows to continue politics till his last breath to defeat BJP

-

2024 Lok Sabha Elections14 hours ago

2024 Lok Sabha Elections14 hours agoRahul Gandhi clarifies on wealth survey remark, says aim is to identify injustice

-

2024 Lok Sabha Elections11 hours ago

2024 Lok Sabha Elections11 hours agoPM Narendra Modi slams Congress over Sam Pitroda’s inheritance tax remarks, accuses Congress of intending to impose higher taxes

-

India News14 hours ago

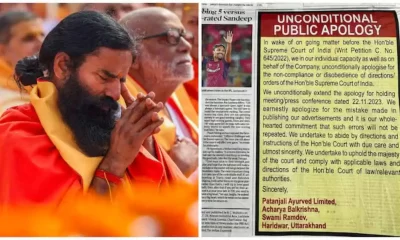

India News14 hours agoRamdev, Balkrishna publish bigger apology in newspapers after Supreme Court’s rap

-

2024 Lok Sabha Elections9 hours ago

2024 Lok Sabha Elections9 hours agoNitin Gadkari says he’s better now after collapsing at election rally in Maharashtra’s Yavatmal

-

Trending12 hours ago

Trending12 hours agoA waiter’s life: Social media users go emotional on watching viral video

-

Entertainment10 hours ago

Entertainment10 hours agoMadhuri Dixit, Karisma Kapoor recreate Dil To Pagal Hai dance battle on Dance Deewane