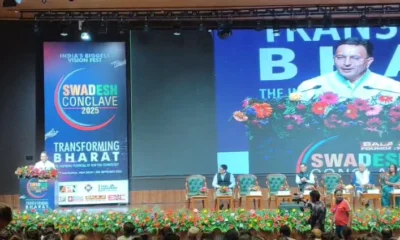

Artificial Intelligence comes with the great potential to transform the lives of crores of Indians despite the myriad challenges posed by it, speakers said at the Swadesh Conclave 2025, held in New Delhi’s Bharat Mandapam on the theme, Transforming Bharat.

Tourism and Culture Minister Gajendra Singh Shekhawat said India has been accorded a warm and respectful welcome at the Shanghai Cooperation Summit under Prime Minister Narendra Modi’s leadership. This was because of the progress the country has made in all fields including technology, from the farm to the sports stadiums.

Indians abroad are now proudly proclaiming themselves as being from this nation because of this government. It used to be the land of Gandhi and now it is recognised as the land of Modi. The world is happy to mark World Yoga Day after PM Modi’s efforts, Shekhawat said.

He called on the people to join the mission to transform the nation by adopting swadeshi.

Earlier, Union Minister of State Jitin Prasada, who looks after both the Ministry of Commerce & Industry and the Ministry of Electronics & Information Technology, said the unveiling of the Made in India chip yesterday by Prime Minister Narendra Modi had placed India among a rare group of countries that have developed their own chip. The age of oil has long passed and it is the age of the semi-conductor chip, he said.

He said AI will change the lives of millions of Indians and take them to the path of development. The government has established a Rs 10,000 crore fund just for promoting AI and regulating it for its people. Opportunity will also come via AI, he said.

Supreme Court judge Justice N Kotiswar Singh said digital technology has changed the face of the Indian justice system but AI’s ability to be a judge is suspect since it relies only on data. It doesn’t have room to analyse human emotions, characters and attitudes, elevating it to judge people will be dangerous and extremely risky, he warned.

SP Singh Baghel, the Union Minister of State for Animal Husbandry, Fisheries and Panchayati Raj, said India has led the world in multiple fields in ancient times and one should be proud of it. India’s development is certain since it is going ahead to become one of the top three economies in the world, he said.

Former JNU Professor Arun Kumar underlined the need for greater growth and the possibilities of using AI for it, despite its challenges. JNU Econophysics Professor Anirban Chakrabarti said an interdisciplinary approach is required along with AI to take on issues that pose challenges including climate.

Lok Sabha MP Manoj Tiwari said it is very important to have patience in a person to advance in any field. He said he has come up in life after years of hard work and with honest effort everything is possible. Tiwari told the gathering that they should not lose faith in politics even if they have lost faith in politicians, and invited young minds to join politics.

AI expert Dr Vidushi Chaturvedi said that AI is mechanizing humans and making machines human. AI is thus changing the whole world. Today, we need to contribute what we can in the field of AI, she said.

Supreme Court Senior Advocate Pradeep Rai spoke on the need for improving the education system so that students can take on the problems posed by AI by using it. He suggested limited use of AI in deciding some features of law enforcement.

Balaji Foundation Chairperson Smt. Rajshri Rai introduced the Swadesh Conclave, saying it is a platform for collective dialogue. She said this year is the sixth edition of Swadesh Conclave. Swadesh is the platform to talk about national interests. This year’s theme is Transforming India. She quoted Faiz Ahmed Faiz’s Bol, saying everybody is entitled to airing their opinion and welcomed them to the Conclave.

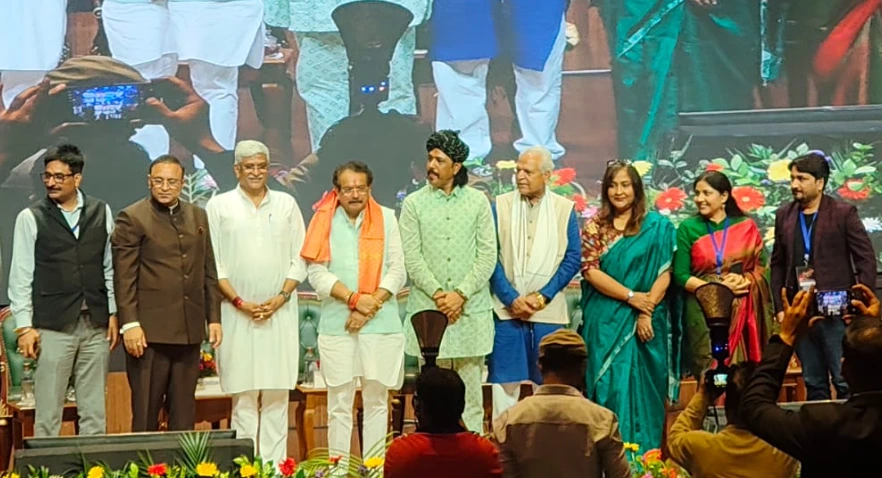

The Swadesh Samman Awards were conferred on Shri Dr S. Somanath, former ISRO Director, Shri K. P. Mahadevaswamy, Chairman & Managing Director of NBCC, social activist Azim Alam, Kabir musician Padma Shri Prahlad Singh Tipania, KFSE Chairman K Varadarajan and MD SK Sanil, Rajasthani folk singer Mame Khan and photographer Jhuma Dutta were conferred the Swadesh Samman Awards by the Minister.

Tipania and Mame Khan performed some songs from their repertoire for the audience with the latter getting everyone to their feet.

Latest world news18 hours ago

Latest world news18 hours ago

Latest world news18 hours ago

Latest world news18 hours ago

India News18 hours ago

India News18 hours ago

Latest world news9 hours ago

Latest world news9 hours ago