India News

Gandhi Jayanti: President Droupadi Murmu, PM Modi pay tribute at Rajghat

Mahatma Gandhi’s influence is global and inspiring the entire humankind to further the spirit of unity and compassion, said PM Modi.

India News

Over 5,000 tribals join BJP in Assam’s Goalpara ahead of elections

More than 5,000 tribals, largely from the Garo community, joined the BJP in Assam’s Goalpara district during a large-scale ST Morcha programme ahead of elections.

India News

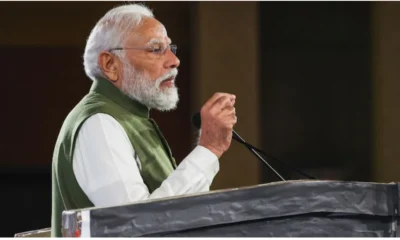

PM Modi crosses 100 million followers on Instagram, first world leader to achieve milestone

Prime Minister Narendra Modi has crossed 100 million followers on Instagram, becoming the first world leader to achieve the milestone and widening the gap with global counterparts.

India News

MK Stalin predicts frequent PM Modi visits to Tamil Nadu before assembly election

MK Stalin has said Prime Minister Narendra Modi will visit Tamil Nadu more often ahead of the Assembly election, calling the tours politically motivated and questioning the Centre’s support to the state.

-

India News18 hours ago

India News18 hours agoMK Stalin predicts frequent PM Modi visits to Tamil Nadu before assembly election

-

Latest world news17 hours ago

Latest world news17 hours agoIndia eyes Rs 8,000 crore mid-air refuelling aircraft deal as PM Modi begins Israel visit

-

Latest world news3 hours ago

Latest world news3 hours agoPM Modi reaffirms support for Israel, recalls 26/11 victims in Knesset address

-

Latest world news3 hours ago

Latest world news3 hours agoCanada softens stance on alleged Indian interference ahead of PM Carney’s India visit

-

India News3 hours ago

India News3 hours agoPM Modi crosses 100 million followers on Instagram, first world leader to achieve milestone

-

Latest world news3 hours ago

Latest world news3 hours agoPM Modi and Netanyahu pledge deeper defence, trade ties during Israel visit

-

India News2 hours ago

India News2 hours agoOver 5,000 tribals join BJP in Assam’s Goalpara ahead of elections