Latest business news

Amazon gets interim relief, Singapore court puts Future-Reliance retail deal on hold

Passing an interim award in favour of Amazon, V K Rajah asked the Future group to put the deal on hold and said that the deal cannot go through until it finally decides the matter, sources with direct knowledge of the development said.

US based e-commerce giant Amazon.com Inc. on Sunday secured interim relief in its dispute with partner Future group as the Singapore-based single-judge arbitration court issued an emergency order to restrain the Future Group’s Rs 24,713-crore deal to sell assets to billionaire Mukesh Ambani’s Reliance Industries Ltd.

In a statement issued late Sunday, an Amazon spokesperson confirmed the development and said it got all the relief it sought, without providing specifics and expects an expeditious conclusion of the arbitration process.

Passing an interim award in favour of Amazon, former Attorney General of Singapore V K Rajah asked the Future group to put the deal on hold and said that the deal cannot go through until it finally decides the matter, sources with direct knowledge of the development said.

The ruling was on Amazon’s request for an interim order before main tribunal hearings start.

The order, issued by an emergency arbitrator of the Singapore International Arbitration Centre (SIAC), will be valid for the next 90 days until an official arbitration panel is appointed, sources said.

Amazon had agreed to purchase 49 percent of one of Future’s unlisted firms last year with the right to buy into flagship Future Retail Ltd after a period of three years to 10 years. However, on August 29, indebted Kishore Biyani owned Future group announced the deal with Reliance Retail Ventures (RRVL) to sell its retail, wholesale, logistics and warehousing units.

The e-commerce giant then slapped a legal notice on Future Group, claiming its “contractual rights” had been violated and dragged the firm into arbitration proceedings.

Meanwhile, Reliance Retail Ventures said it has entered into the transactions for the acquisition of assets and business of Future Retail group under proper legal advice and the rights and obligations are fully enforceable under Indian Law.

The Reliance retail arm has informed that it intends to enforce its rights and complete the transaction in terms of the scheme and agreement with the Future Group without any delay.

Read Also: Ananya Birla slams US restaurant for being racist

Reliance Industries’ deal to acquire Future Group’s retail business was coupled with its launch of JioMart earlier in May. The company operates the country’s largest, fastest-growing and most profitable retail business spanning supermarkets, cash and carry wholesale business, consumer electronics chain stores, fast-fashion outlets and online grocery store JioMart.

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

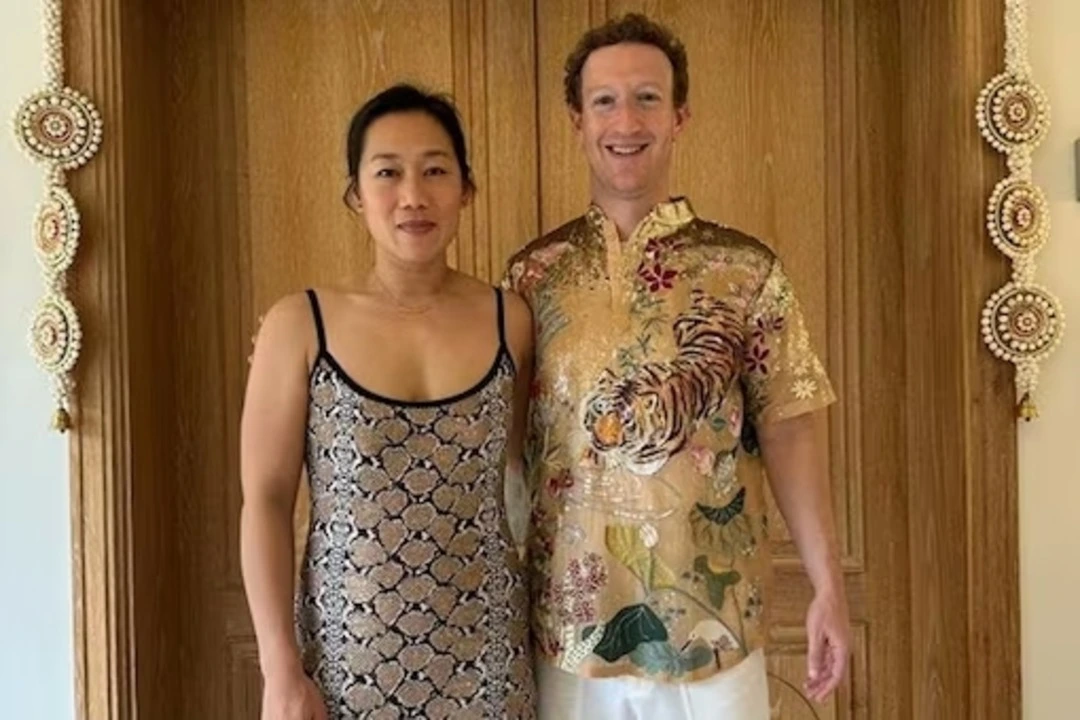

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections17 hours ago

2024 Lok Sabha Elections17 hours agoPrime Minister Narendra Modi urges citizens to vote in record numbers as voting for first phase of Lok Sabha elections begins on 102 seats across India

-

Entertainment12 hours ago

Entertainment12 hours agoDo Aur Do Pyaar social media review: Social media users say Vidya Balan, Pratik Gandhi deliver standout performances in this adorable film

-

2024 Lok Sabha Elections13 hours ago

2024 Lok Sabha Elections13 hours agoLok Sabha elections 2024: Amit Shah files nomination from Gandhinagar

-

2024 Lok Sabha Elections15 hours ago

2024 Lok Sabha Elections15 hours agoKamal Haasan, Rajinikanth, Vijay Sethupathi, Dhanush vote in Chennai

-

Entertainment13 hours ago

Entertainment13 hours agoYami Gautam starrer Article 370 releases on Netflix today

-

2024 Lok Sabha Elections15 hours ago

2024 Lok Sabha Elections15 hours agoLok Sabha elections 2024: TMC, BJP workers clash in West Bengal’s Cooh Behar ahead of voting

-

2024 Lok Sabha Elections16 hours ago

2024 Lok Sabha Elections16 hours agoLok Sabha elections 2024: Google Doodle marks the start of polls with index finger voting symbol

-

2024 Lok Sabha Elections14 hours ago

2024 Lok Sabha Elections14 hours agoTamil Nadu BJP chief K Annamalai says party will sweep Karnataka and emerge victorious in Telangana, accuses DMK, AIADMK of influencing voters in Coimbatore