Latest business news

Inflation, demonetisation continue to bother RBI

[vc_row][vc_column][vc_column_text]Interest rate remains unchanged at 6.25 per cent

Parsa Venkateshwar Rao Jr

While the Narendra Modi government wanted to show the low inflation figure for April – less than 4 per cent – as evidence that it was in control of the price line, and that it was reason enough for the Reserve Bank of India to cut interest rates which could spur growth rate, the RBI seemed quite skeptical about the whole thing.

“First, it needs to be assessed as to whether or not the unusually low momentum in the reading for April will endure,” it said in the Bi-Monthly Policy Statement on Wednesday.

It analysed the reasons for the sharp fall in inflation in April, “a historical low”. It reasoned that “Underlying this surprising softness was a sharp fall in food inflation brought about by a deflation in the prices of pulses and vegetables.”

The central bank also looked at the potential inflationary pressures arising from “global political and financial risks” the burden of financial commitments entailed by the 7th Pay Commission and the upward movement of international crude oil prices in June compared to April. It says that if the April reading of inflation were to be sustained, then inflation rates for the first half-year would be 2.0 to 3.5 per cent, and it would be between 3.5 per cent 4.5 per cent in the second half.

Effects of demonetisation countered by remonetisation seemed to have played a significant role in the improvement and stabilisation of money supply. The RBI had noted that the excess liquidity in the banks post-demonetisation has been drained by increasing circulation of new currency of Rs 1.5 trillion in April and May. But massive spending by Government increased liquidity in the banking system by Rs 4.2 trillion in April and by Rs 3.5 trillion in May.

It also says that “the transitory effects of demonetization have lingered on in price formations relating to salient food items,” noting in passing the “fire sales” – distress sales, in others words – of vegetables and fruits in the immediate aftermath of demonetisation in November 2016. And it says that Central Statistics Office (CSO) figures “attest to the effects of demonetisation on the broader economy being sector specific and transient”. It takes note of the fact that “The continuing remonetisation should enable a pick-up in discretionary consumer spending, especially in cash-intensive segments of the economy.”[/vc_column_text][/vc_column][/vc_row]

Latest business news

Google restores delisted Indian apps after government intervention

Google on Saturday restored all Indian apps it had removed.

Google has started to restore all the delisted Indian mobile apps on Play Store agian, which they had removed due to a disagreement over service fees. After a discussion between company representatives and IT Minister Ashwini Vaishnaw, the decision was made, according to sources.

The step was taken in response to Vaishnaw’s strong statement in which he said that it is not allowed for apps to be removed from the Google Play Store. The minister had said, India is very clear, our policy is very clear…our startups will get the protection that they need.

Vaishnaw continued saying that he has already given Google a call. They will be speaking with the app developers who were delisted this week. This is not acceptable. The minister said this kind of delisting cannot be permitted.

Ten Indian companies’ apps were banned by Google on Friday, causing outrage in one of its fastest-growing markets. With 94% of phones running on its Android platform, Google holds a large portion of the Indian market. Popular names like Naukri and Bharatmatrimony were on the list.

The main point of contention is Google’s in-app purchase fees, which range from 11% to 26%. Indian startups have long opposed the US tech giant’s actions, believing them to be unfair.

The founder of Bharat Matrimony, Christian Matrimony, Muslim Matrimony, and Jodii, Matrimony.com, expressed shock at the matchmaking apps’ removal from the Google Play Store.

Shaadi. Com CEO Anupam Mittal described it as a dark day for India’s internet, highlighting the possible broad effects on matchmaking services. He also called Google an evil.

While, Kuku FM Co-founder Vinod Kumar Meena in a statement had said that Google was behaving like a monopoly.

Meanwhile, Google temporarily withdrew the famous Indian payments app Paytm from the Play Store in 2020, claiming a few policy infractions. Due to this decision, the founder of the company as well as the larger startup community came together to build their own app stores and file lawsuits against Google.

Latest business news

Anant Ambani says he is 100% lucky to get Radhika Merchant in his life

Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her. He added although he had known Radhika for the last 7 years, it felt he had met her only yesterday. He thanked Radhika for everything.

Anant Ambani and Radhika Merchant’s grand three-day wedding celebrations began with a glamorous cocktail night on Friday in Jamnagar. During the celebrations, Anant Ambani also gave a speech wherein he thanked his late grandfather Dhirubhai Ambani and grandmother Kokilaben Ambani for inspiring him. Anant Ambani said he was grateful to get Radhika as his life partner. He said he is 100% lucky to get Radhika Merchant in his life. He said every day he is falling more and more in love with her.

He expressed his gratitude to his mother for pulling together the lavish three-day wedding celebrations in Jamnagar. Anant thanked his mother for all she had done. He said all the arrangements had been done by his mother and nobody else. He added his mother had gone all out and she had worked 18-19 hours a day and he was extremely grateful to her.

He also thanked all the guests who were present there at the pre-wedding celebrations. He said everyone had made it to Jamnagar to make him and Radhika feel special. He said both of them were honored and humbled to have all of them present there. Anant said he was sorry if they had caused an inconvenience to anyone. He asked for forgiveness. He hoped everyone is going to enjoy the coming three days. He also thanked his mother, father, sister, brother, his sister-law and his brother in-law for making this event memorable.

Anant said everyone has been sleeping for less than 3 hours a day for the last 2-3 months and he was very happy to share this joy with everyone. The youngest Ambani talked about his personal struggles and how his parents had always supported him. He further added his life had not been entirely a bed of roses. He said he had also experienced the pain of thorns. He said he had faced many health crises.

Latest business news

Facebook chief Mark Zuckerberg shares pictures from 2nd day of Anant Ambani and Radhika Merchant pre-wedding celebrations

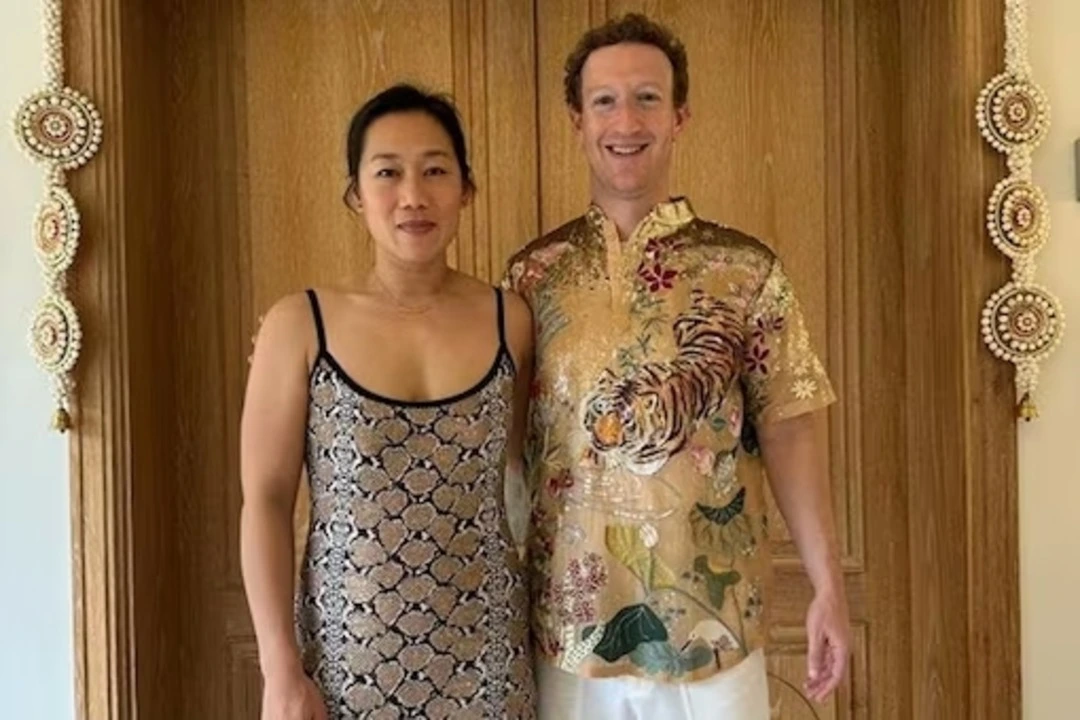

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

Facebook boss Mark Zuckerberg and wife Priscilla Chan joined the star- studded pre-wedding celebrations of Anant Ambani and Radhika Merchant in Jamnagar on Friday. The event was attended by many prominent figures from different fields. Zuckerberg took to his Instagram handle congratulated the couple and said he loved Indian weddings.

Zuckerberg shared pictures from the 2nd day of Anant Ambani and Radhika Merchant’s pre-wedding celebrations. In the photograph Mark Zuckerberg can be seen along with his wife Priscilla Chan. The couple is exuding happiness as they prepare for the event. He captioned the picture it is getting wild out here.

The theme of the opening day of the pre-wedding celebrations was Evening in Everland as the guests wore cocktail attire. The first day of the grand celebrations elevated the expectations of the guests for the following days. The theme of the 2nd day of the pre-wedding bash is known as a Walk on the Wildside and the guests can be seen in Jungle Fever attire.

Zuckerberg has opted for an animal print shirt with white trousers, Chan is complementing his look in a strappy one piece in black and golden. The Jungle theme is aligned to Vantara, Reliance’s animal welfare initiative undertaken and launched by Anant Ambani a few days back.

International pop star Rihana electrified the pre wedding celebrations on Friday with an amazing performance, marking her debut appearance in India. The chart topping artist engaged the audience with performances of her iconic hits which included Pour it Up, Work and Diamonds.

Zuckerberg graced the opening day, wearing a black-on-black firefly blazer and shoes from Alexander McQueen while his wife Priscilla wore a black gown with gold flower details and other accessories such as dainty chain bracelet, gold necklace and stud earrings. Mark Zuckerberg and wife Priscilla Chan are one of the Power couples invited from the global business community for the festivities currently underway at Jamnagar.

-

2024 Lok Sabha Elections20 hours ago

2024 Lok Sabha Elections20 hours agoPrime Minister Narendra Modi urges citizens to vote in record numbers as voting for first phase of Lok Sabha elections begins on 102 seats across India

-

Entertainment15 hours ago

Entertainment15 hours agoDo Aur Do Pyaar social media review: Social media users say Vidya Balan, Pratik Gandhi deliver standout performances in this adorable film

-

2024 Lok Sabha Elections16 hours ago

2024 Lok Sabha Elections16 hours agoLok Sabha elections 2024: Amit Shah files nomination from Gandhinagar

-

Entertainment16 hours ago

Entertainment16 hours agoYami Gautam starrer Article 370 releases on Netflix today

-

2024 Lok Sabha Elections18 hours ago

2024 Lok Sabha Elections18 hours agoKamal Haasan, Rajinikanth, Vijay Sethupathi, Dhanush vote in Chennai

-

2024 Lok Sabha Elections12 hours ago

2024 Lok Sabha Elections12 hours agoDeserted by key supporters, the Kamal Nath story looks set to wind to an end in Chhindwara

-

2024 Lok Sabha Elections18 hours ago

2024 Lok Sabha Elections18 hours agoLok Sabha elections 2024: TMC, BJP workers clash in West Bengal’s Cooh Behar ahead of voting

-

Entertainment13 hours ago

Entertainment13 hours agoAditya Roy Kapur, Sara Ali Khan’s Metro In Dino to release this November