Latest world news

Forever 21 files for Chapter 11 Bankruptcy Protection

US fashion retailer Forever 21 filed for Chapter 11 bankruptcy protection, adding another big fashion merchant to the tally of retailers who couldn’t cope with high rents and heavy competition, BBC reported.

Latest world news

India eyes Rs 8,000 crore mid-air refuelling aircraft deal as PM Modi begins Israel visit

India and Israel are in talks for a Rs 8,000 crore deal to convert six Boeing 767 jets into mid-air refuelling aircraft for the Indian Air Force.

Latest world news

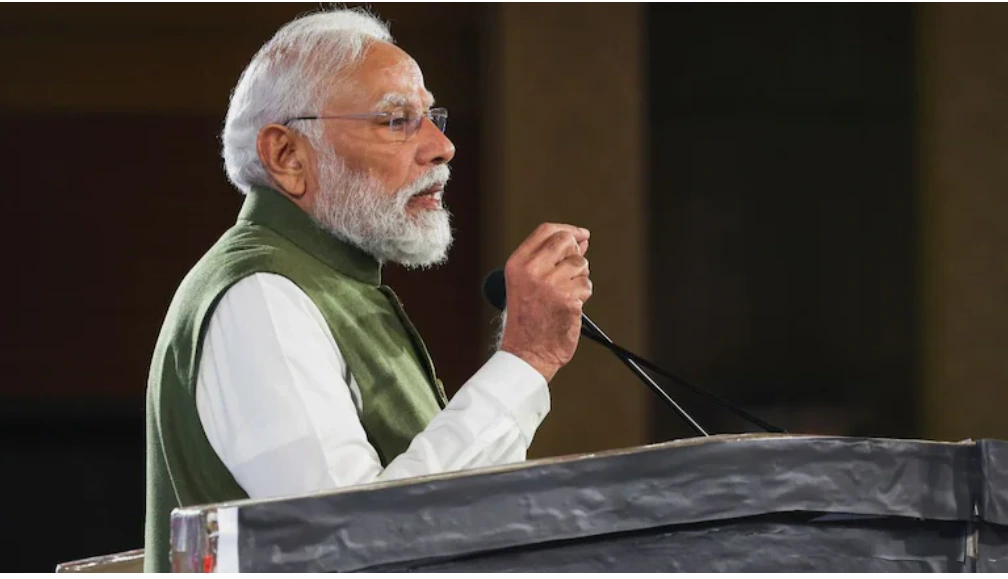

PM Modi to begin two-day Israel visit, defence and trade in focus

PM Narendra Modi begins a two-day Israel visit aimed at strengthening defence cooperation, trade ties and upgrading bilateral relations to a special strategic partnership.

Latest world news

Trump says tariffs will replace income tax, criticises Supreme Court setback in key address

Donald Trump has said tariffs collected from foreign nations could eventually replace income tax in the US, while criticising a Supreme Court ruling against his earlier import duties.

-

Latest world news14 hours ago

Latest world news14 hours agoTrump says tariffs will replace income tax, criticises Supreme Court setback in key address

-

Latest world news14 hours ago

Latest world news14 hours agoTrump repeats claim of averting India-Pakistan nuclear war during Operation Sindoor

-

Latest world news14 hours ago

Latest world news14 hours agoPM Modi to begin two-day Israel visit, defence and trade in focus

-

India News14 hours ago

India News14 hours agoShashi Tharoor questions Centre over Kerala name change to Keralam

-

India News5 hours ago

India News5 hours agoMK Stalin predicts frequent PM Modi visits to Tamil Nadu before assembly election

-

Latest world news5 hours ago

Latest world news5 hours agoIndia eyes Rs 8,000 crore mid-air refuelling aircraft deal as PM Modi begins Israel visit