India News

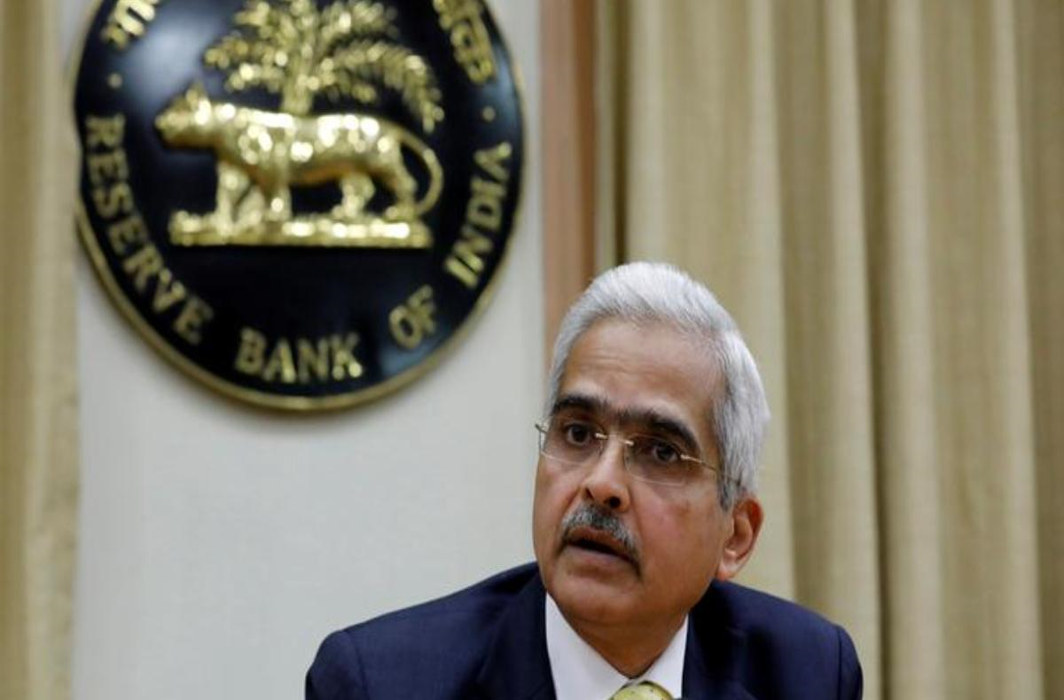

RBI cuts repo rate by 0.25% to bring it to 5.15%, reverse repo rate at 4.9%; fifth cut this year

The Reserve Bank of India cut its repo rate by 25 basis points to 5.15 percent, the fifth cut this year, in a bid to boost the flow of credit and reverse economic slowdown.

[vc_row][vc_column][vc_column_text]The Reserve Bank of India (RBI) today – Friday, Oct 4 – cut its repo rate by 25 basis points to 5.15 percent, the fifth time this year, in a bid to boost the flow of credit and reverse economic slowdown. [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text css=”.vc_custom_1570179377756{border-top-width: 10px !important;border-right-width: 10px !important;border-bottom-width: 10px !important;border-left-width: 10px !important;padding-top: 10px !important;padding-right: 10px !important;padding-bottom: 10px !important;padding-left: 10px !important;background-color: #b2b2b2 !important;border-radius: 10px !important;}”]Repo rate is the rate of interest at which the RBI lends money to commercial banks, reverse repo rate is the rate at which it borrows.

One basis point is a hundredth of a percentage point and 25 basis points means 0.25%.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The central bank also decided to continue with an accommodative stance “as long as it is necessary” to revive growth, while ensuring inflation remains within the target.

All members of the six-member Monetary Policy Committee (MPC), that met on October 4 to review interest rates, voted to reduce the policy rate, the RBI said.

With this cut, the repo rate, which serves as the MPC’s policy rate, has been reduced for the fifth consecutive time this year, the total coming to 135 basis points. Lower interest rates are expected to make home and vehicle loans cheaper. However, banks have passed on only a fraction of these cuts so far, said reports.

The MPC meeting comes in the backdrop of RBI’s mandate to banks to link their loan products to an external benchmark, like repo rate, for faster transmission of reduction in policy rates to borrowers, from October 1.

The MPC also sharply reduced its growth forecast for the fiscal year 2019-2020 to 6.1% from 6.9% earlier. The committee noted that risks to growth have emerged due to weak domestic demand and sagging export prospects on account of continuing trade tensions. MPC on the other hand retained its consumer price inflation forecast for the second half of the fiscal year 2019-202 as expected at 3.5%-3.7%

The RBI said that while these measures are likely to help strengthen private consumption and spur private investment activity, the continuing slowdown warrants intensified efforts to restore the growth momentum.

The Indian economy grew at the pace of just 5 percent in the June-ended quarter, it’s slowest since 2013. This triggered a slew of measures by the government and the central bank in past few months, including a corporate tax rate cut and setting up loan melas to encourage fresh investments.

Inflation has remained well within the MPC’s target of 4 percent for the past 13 months, giving room for the central bank to respond with policy rate cuts.

“With inflation expected to remain below target in the remaining period of 2019-20 and first quarter of 2020-21, there is policy space to address these growth concerns by reinvigorating domestic demand within the flexible inflation targeting mandate,” RBI said.

The MPC was largely expected to vote in the favour of a rate cut and back government’s efforts to address the current economic slowdown.

The MPC is next scheduled to meet during December 3-5, 2019.

The announcements from the six-member Monetary Policy Committee (MPC) came after a three-day meeting. The rate cut comes at a time when the Indian economy is facing its worst slowdown since the dip in economic activity following the global financial crisis of 2008-09.[/vc_column_text][/vc_column][/vc_row]

2024 Lok Sabha Elections

PM Modi says Congress leaders consider themselves above Lord Ram

PM Modi slammed Congress during a rally in Chhattisgarh, ahead of the Lok Sabha elections 2024

Prime Minister Narendra Modi slammed the Congress party for declining to attend the pran pratishtha ritual at the Ayodhya Ram temple on January 22 this year.

The prime minister said Congress leaders consider themselves above Lord Ram and denied invitation for Pran Pratishtha at Ram Temple, while speaking at a rally in Janjgir-Champa, Chhattisgarh. The PM question the people present at the rally that is it not a disrespect of Mata Shabri? Congress leaders inclination toward appeasement politics runs in their family.

For political appeasement, they won’t think twice about stealing the rights of Adivasis, the poor, and Dalits. Poor, young, and women are BJP’s top priorities, Modi said.

PM Modi criticized the Congress again during the rally for claiming that the BJP would alter the constitution.

The leaders of Congress recite the same old phrases whenever an election is about to happen, the PM said. He also said they claim that if the BJP wins power, it will renounce the constitution and abolish reservations. For how long will you continue selling lies?” he asked.

The prime minister continued saying that nobody can change the Constitution, even if Dr. Babasaheb Ambedkar were to come and insist on it, it wouldn’t happen.

Those in the Congress threaten to break Modi’s head. Nobody can harm Modi as long as the mothers and sisters of this county stands by him. These mothers and sisters are Raksha Kavach, Modi remarked.

The prime minister further attacked the Congress after Viriato Fernandes, the party’s candidate for South Goa, asserted that Goa was forced to adopt the Indian Constitution.

Referring to his conversation with Congress leader Rahul Gandhi ahead of the 2019 Lok Sabha elections, Fernandes said he had told him, when Goa was liberated in the year 1961, the Indian Constitution was forced upon us.

The prime minister said, Congress candidate from Goa says Constitution was forced upon Goans; is this not an insult of Ambedkar and Constitution.

2024 Lok Sabha Elections

Amit Shah says neither Congress nor Trinamool chief Mamata Banerjee can interfere with CAA

Amit Shah revealed the BJP’s target for West Bengal and said they have set a target of winning 35 Lok Sabha seats from West Bengal.

Union home minister Amit Shah on Tuesday said neither Congress nor Trinamool Congress chief Mamata Banerjee can interfere with the Citizenship Amendment Act (CAA). He was speaking at the Karandighi rally in West Bengal where he also made the prediction as to how many seats BJP will win in the Lok Sabha elections in West Bengal.

The union home minister asked the masses to cut the money culture. Amit Shah revealed the BJP’s target for West Bengal and said they have set a target of winning 35 Lok Sabha seats from West Bengal. In 2019 Lok Sabha elections the BJP had won 18 out of 42 seats in West Bengal. He asked Mamata Banerjee, what problem will she have if the Buddhist and Hindu refugees from Bangladesh get citizenship in India?

Shah further added if the people of West Bengal want to stop infiltration in the state, then they will have to make Narendra Modi the Prime Minister of India again. He said if the people of West Bengal want to free Bengal of violence, stop infiltration in the state, give citizenship to refugees, to stop disrespecting mothers and sisters of the state as it happened in Sandeshkhali, then only way is to make Narendra Modi the Prime Minister.

Amit Shah said that PM Modi had sent Rs 7 lakh crore to West Bengal but the TMC indulged in corruption. He said one can see the houses of Trinamool Congress leaders; 10 years ago they used to live in a hut, moved on cycle and now all of them have 4-storey houses and move around in big cars. He added this is the money of people of West Bengal.

The Citizenship Amendment Act (CAA), will make it easier for non-Muslim refugees from Afghanistan, Pakistan and Bangladesh to get Indian citizenship, was enacted in 2019. But the rules were notified in March this year by the Centre.

2024 Lok Sabha Elections

Prime Minister Narendra Modi says listening to Hanuman Chalisa under Congress rule is a crime

PM Modi was addressing an election rally in Rajasthan’s Tonk-Sawai Madhopur, on a day as India celebrates Hanuman Jayanti.

Prime Minister Narendra Modi on Tuesday hit out at the Congress and said even listening to Hanuman Chalisa has become a crime under the party’s rule. The Prime Minister also said it was difficult to follow one’s faith under the party and accused it of hatching a deep conspiracy to snatch people’s wealth and distribute it among selected few people in the society. PM Modi was addressing an election rally in Rajasthan’s Tonk-Sawai Madhopur, on a day as India celebrates Hanuman Jayanti.

PM Modi said in a state like Rajasthan where people chant Ram-Ram, Congress banned Ram Navami. He reffered to the redistribution of wealth remarks he had made during a rally in Rajasthan’s Banswara on Sunday and said it has angered the Congress and INDI Alliance so much that they have started throwing abuses at Modi everywhere.

The Prime Minister said that Congress has written in their manifesto that they will survey the wealth. He said the Congress leadership had said in a speech that an X-ray of wealth will be done. He added when Modi exposed the secret then the hidden agenda came out and this has left the people trembling. PM Modi further added that the Congress party has played with the Constitution of the India.

He said when the Constitution was drafted, reservations based on religion were opposed, so that Scheduled Casts (SC), Scheduled Tribes (ST) and Other Backward Classes (OBC) could get protection. He said former Prime Minister Dr Manmohan Singh had said that Muslims have the first right to the country’s resources. The prime minister further added Congress’s ideology has always been of appeasement and vote bank politics. He said stones would still be pelted in Jammu and Kashmir, and enemies would still be cutting off the heads of India’s soldiers had Congress been in power.

-

Cricket news20 hours ago

Cricket news20 hours agoIPL 2024: Yashasvi Jaiswal hits brilliant century to help Rajasthan Royals beat Mumbai Indians by 9 wickets

-

2024 Lok Sabha Elections18 hours ago

2024 Lok Sabha Elections18 hours agoNCP (SP) leader Sharad Pawar says Prime Minister Narendra Modi is trying to create fear like Russian President Vladimir Putin

-

Entertainment18 hours ago

Entertainment18 hours agoMithun Chakraborty, Usha Uthup honoured with Padma Bhushan

-

Entertainment16 hours ago

Entertainment16 hours agoFan jumps on stage and hugs Atif Aslam during concert, video goes viral

-

2024 Lok Sabha Elections17 hours ago

2024 Lok Sabha Elections17 hours agoPrime Minister Narendra Modi says listening to Hanuman Chalisa under Congress rule is a crime

-

Entertainment13 hours ago

Entertainment13 hours agoManisha Koirala reveals reason for rejecting Dil To Pagal Hai, says regrets that decision

-

2024 Lok Sabha Elections12 hours ago

2024 Lok Sabha Elections12 hours agoPM Modi says Congress leaders consider themselves above Lord Ram

-

India News20 hours ago

India News20 hours agoArvind Kejriwal given insulin in Tihar jail after sugar levels touch 320